In this article we will take a look at whether hedge funds think NewMarket Corporation (NYSE:NEU) is a good investment right now. We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, unconventional data sources, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

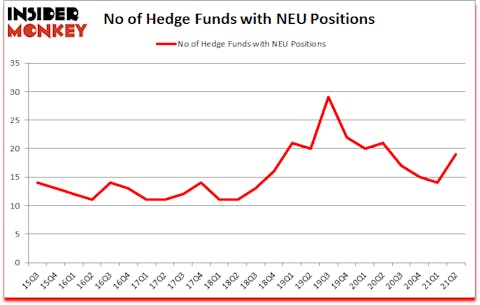

Is NewMarket Corporation (NYSE:NEU) worth your attention right now? Prominent investors were in a bullish mood. The number of bullish hedge fund bets moved up by 5 recently. NewMarket Corporation (NYSE:NEU) was in 19 hedge funds’ portfolios at the end of June. The all time high for this statistic is 29. Our calculations also showed that NEU isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 79 percentage points since March 2017 (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Jeffrey Bronchick of Cove Street Capital

Keeping this in mind we’re going to check out the latest hedge fund action regarding NewMarket Corporation (NYSE:NEU).

Do Hedge Funds Think NEU Is A Good Stock To Buy Now?

At the end of June, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 36% from the previous quarter. On the other hand, there were a total of 21 hedge funds with a bullish position in NEU a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the most valuable position in NewMarket Corporation (NYSE:NEU). AQR Capital Management has a $31.5 million position in the stock, comprising 0.1% of its 13F portfolio. On AQR Capital Management’s heels is Israel Englander of Millennium Management, with a $24.9 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other professional money managers with similar optimism include Renaissance Technologies, Jeffrey Bronchick’s Cove Street Capital and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital. In terms of the portfolio weights assigned to each position Cove Street Capital allocated the biggest weight to NewMarket Corporation (NYSE:NEU), around 1.96% of its 13F portfolio. Invenomic Capital Management is also relatively very bullish on the stock, dishing out 0.53 percent of its 13F equity portfolio to NEU.

Now, key money managers have jumped into NewMarket Corporation (NYSE:NEU) headfirst. Cove Street Capital, managed by Jeffrey Bronchick, created the most outsized position in NewMarket Corporation (NYSE:NEU). Cove Street Capital had $13.5 million invested in the company at the end of the quarter. Ali Motamed’s Invenomic Capital Management also made a $2.2 million investment in the stock during the quarter. The following funds were also among the new NEU investors: Paul Tudor Jones’s Tudor Investment Corp, Matthew Hulsizer’s PEAK6 Capital Management, and Peter Muller’s PDT Partners.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as NewMarket Corporation (NYSE:NEU) but similarly valued. These stocks are Atlas Corp. (NYSE:ATCO), Focus Financial Partners Inc. (NASDAQ:FOCS), Mantech International Corp (NASDAQ:MANT), WD-40 Company (NASDAQ:WDFC), Lexington Realty Trust (NYSE:LXP), NuVasive, Inc. (NASDAQ:NUVA), and Outfront Media Inc (NYSE:OUT). This group of stocks’ market caps resemble NEU’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ATCO | 18 | 1491399 | 6 |

| FOCS | 19 | 168334 | -4 |

| MANT | 12 | 22720 | -2 |

| WDFC | 17 | 150576 | 3 |

| LXP | 16 | 104285 | 4 |

| NUVA | 23 | 287292 | 3 |

| OUT | 31 | 701645 | -10 |

| Average | 19.4 | 418036 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.4 hedge funds with bullish positions and the average amount invested in these stocks was $418 million. That figure was $120 million in NEU’s case. Outfront Media Inc (NYSE:OUT) is the most popular stock in this table. On the other hand Mantech International Corp (NASDAQ:MANT) is the least popular one with only 12 bullish hedge fund positions. NewMarket Corporation (NYSE:NEU) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for NEU is 48.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and still beat the market by 1.6 percentage points. A small number of hedge funds were also right about betting on NEU as the stock returned 17.2% since the end of the second quarter (through 10/22) and outperformed the market by an even larger margin.

Follow Newmarket Corp (NYSE:NEU)

Follow Newmarket Corp (NYSE:NEU)

Receive real-time insider trading and news alerts

Suggested Articles:

- 12 Best Restaurant Stocks to Invest In

- 15 Largest Utility Companies In The World

- 10 Stocks to Buy to Profit from Post-COVID Economic Recovery

Disclosure: None. This article was originally published at Insider Monkey.