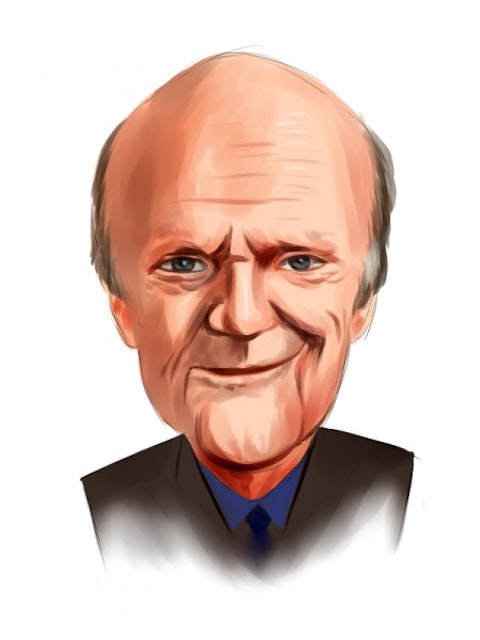

Positions in a number of prominent technology giants helped legendary investor Julian Robertson of Tiger Management outperform the market with the 45 long positions reported in his latest 13F filing that eclipse a market cap of $1 billion. The weighted average return of those 45 positions was 1.9% in the first quarter, outpacing the S&P 500 by around one percentage point.

Professional investors like Robertson, who has spawned a cadre of ‘Tiger Cubs’ (protégés who worked with him at Tiger Management before spreading out to open their own firms), spend considerable time and money conducting due diligence on each company they invest in, which makes them the perfect investors to emulate. However, we also know that the returns of hedge funds have not been good for several years, underperforming the market. We analyzed the historical stock picks of these investors and our research revealed that the small-cap picks of these funds performed far better than their large-cap picks, which is where most of their money is invested and why their performances as a whole have been poor. A portfolio of the 15 most popular small-cap stocks among funds outperformed the S&P 500 Total Return Index by 95 basis points per month between 1999 and 2012 in backtesting. The exceptional results of this strategy got even better in forward testing after the strategy went live at the end of August 2012. A portfolio consisting of 15 most popular small-cap stock picks among the funds we track has advanced by 132% and has beaten the market by more than 82 percentage points since then, and by 4.6 percentage points in the first quarter (see the details).

We start Robertson’s top picks with Netflix, Inc. (NASDAQ:NFLX), whose stock returned 21.98% during the first quarter, a rather surprising performance for a stock that was starting to pick up some bearish sentiment as one of the five stocks in which several funds disclosed holding ‘Put’ options. Around 16 investors disclosed ‘Put’ options underlying Netflix, Inc. (NASDAQ:NFLX) shares at the end of 2014, up from just 12 at the end of the third quarter. Luckily for Robertson, he was not one of them, instead opening a new position in the online streaming company during the fourth quarter, which consisted of 71,400 shares valued at $24.39 million, making it the sixth most valuable long position in his portfolio. Activist Carl Icahn also has a large position in Netflix, Inc. (NASDAQ:NFLX), as do the quantitative analysis funds D E Shaw and Renaissance Technologies.

Apple Inc. (NASDAQ:AAPL) was another company that hedge funds had a number of put options out on, though we concluded that those options were as a hedge, and not actual bearish sentiment towards the iPhone and Apple Watch-maker. Robertson was again wise to avoid doing so himself, instead having a large long position in Apple Inc. (NASDAQ:AAPL) that he increased massively during the fourth quarter, by 1,925%. That lifted it to 321,900 shares valued at $35.53 million, and elevated it to his fourth-largest long position. Apple Inc. (NASDAQ:AAPL) enjoyed another solid quarter to kick off 2015, up by 13.17% on the strength of record iPhone 6 sales and quarterly revenue, and the potential for Apple’s Watch going forward. Apple is also sitting on a hoard of cash, some of which Icahn (also a major investor of theirs) would like to see directed towards share buybacks and increased dividends, which Apple appears poised to do. Billionaires Ken Fisher and David Einhorn are also large shareholders of the Cupertino, California company.

In Amazon.com, Inc. (NASDAQ:AMZN) Robertson opened a large position of 160,000 shares underlying ‘Put’ options, which was valued at $49.66 million, making it the third-largest reported in his equity portfolio. However, Amazon.com, Inc. (NASDAQ:AMZN) defied some of its bearish critics this past quarter when it released an unexpectedly strong earnings report that sent shares soaring; they finished the quarter up by 19.90%. While not necessarily great news for Robertson or the other 18 funds which held ‘Put’ options on Amazon.com, Inc. (NASDAQ:AMZN)’s stock, it was good news for Lansdowne Partners, which had the largest long position, consisting of 2.73 million shares.

Facebook Inc (NASDAQ:FB) represents Robertson’s fifth-largest long position, consisting of 317,500 shares valued at $24.77 million. The social media giant gained a solid 5.38% during the first quarter, as it continued to show solid growth in mobile ad revenue. Robertson recently declared Facebook Inc (NASDAQ:FB) a better growth company than its rival Twitter Inc (NYSE:TWTR), though the latter’s stock did enjoy a very strong first quarter. Billionaires Stephen Mandel and Ken Griffin have two of the largest long positions in Facebook Inc (NASDAQ:FB) in our database.

Lastly is Google Inc (NASDAQ:GOOGL), in which Robertson holds 25,900 shares Class A and 40,600 shares Class C shares. The value of each increased by 4% during the quarter. As with Apple, Robertson sees Google Inc (NASDAQ:GOOGL) as having a product line (which includes its dominant search engine, its Android operating system, and its immensely popular video site YouTube) that gives it a growth potential for many years. Boykin Curry’s Eagle Capital Management is the most bullish investor on Google Inc (NASDAQ:GOOGL) in our database, with large positions in the Class A and Class C shares.

Disclosure: None