We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article, we look at what those funds think of Nektar Therapeutics (NASDAQ:NKTR) based on that data.

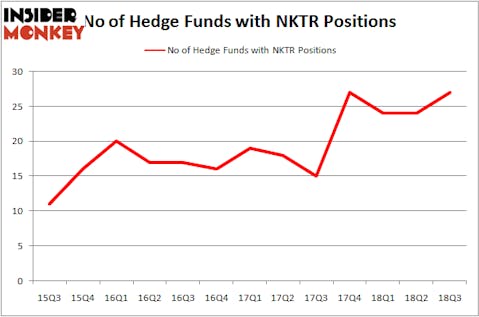

Nektar Therapeutics (NASDAQ:NKTR) has experienced an increase in hedge fund sentiment in recent months. NKTR was in 27 hedge funds’ portfolios at the end of the third quarter of 2018. There were 24 hedge funds in our database with NKTR holdings at the end of the previous quarter. Our calculations also showed that NKTR isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are numerous formulas stock traders have at their disposal to appraise their holdings. A couple of the most useful formulas are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the best picks of the elite money managers can outpace their index-focused peers by a healthy amount (see the details here).

We’re going to review the latest hedge fund action regarding Nektar Therapeutics (NASDAQ:NKTR).

What does the smart money think about Nektar Therapeutics (NASDAQ:NKTR)?

At Q3’s end, a total of 27 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards NKTR over the last 13 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

More specifically, Camber Capital Management was the largest shareholder of Nektar Therapeutics (NASDAQ:NKTR), with a stake worth $91.4 million reported as of the end of September. Trailing Camber Capital Management was Cormorant Asset Management, which amassed a stake valued at $83.5 million. Cormorant Asset Management, Bridger Management, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, specific money managers have jumped into Nektar Therapeutics (NASDAQ:NKTR) headfirst. EcoR1 Capital, managed by Oleg Nodelman, established the most outsized call position in Nektar Therapeutics (NASDAQ:NKTR). EcoR1 Capital had $19.8 million invested in the company at the end of the quarter. Ori Hershkovitz’s Nexthera Capital also made a $7.8 million investment in the stock during the quarter. The other funds with brand new NKTR positions are Jeffrey Talpins’s Element Capital Management, Israel Englander’s Millennium Management, and George Zweig, Shane Haas and Ravi Chander’s Signition LP.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Nektar Therapeutics (NASDAQ:NKTR) but similarly valued. We will take a look at Atmos Energy Corporation (NYSE:ATO), Tata Motors Limited (NYSE:TTM), Leidos Holdings Inc (NYSE:LDOS), and Packaging Corporation Of America (NYSE:PKG). All of these stocks’ market caps match NKTR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ATO | 15 | 168216 | -2 |

| TTM | 9 | 120349 | -3 |

| LDOS | 27 | 472777 | 0 |

| PKG | 26 | 315125 | 0 |

| Average | 19.25 | 269117 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $269 million. That figure was $418 million in NKTR’s case. Leidos Holdings Inc (NYSE:LDOS) is the most popular stock in this table. On the other hand Tata Motors Limited (NYSE:TTM) is the least popular one with only 9 bullish hedge fund positions. Nektar Therapeutics (NASDAQ:NKTR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard LDOS might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.