We recently compiled a list of the 14 AI News You Should Pay Attention To. In this article, we are going to take a look at where Intel Corporation (NASDAQ:INTC) stands against the other AI stocks you should pay attention to.

A lot has been made of the recent efforts by the United States government to tighten chip exports to China. This coordinated effort, just before Donald Trump takes office, includes stricter license restrictions on US chip firms doing business with China, added scrutiny on those that assemble their hardware in China, and an appeal to allies in Europe and Asia to follow suit. These efforts have only served to further bolster the semiconductor index in China, which leaped to a record high on November 11 amid reports that a recent US order to halt TSM chip supplies to China would accelerate efforts in Beijing to set up advanced chip manufacturing companies in the Asian country.

Read more about these developments by accessing 10 Best AI Data Center Stocks and 10 Buzzing AI Stocks According to Goldman Sachs.

Chinese brokerage Cinda Securities, in a note published on the China chip situation on November 10, has said that in the medium and long term it will force the reorganization of the supply chain, increase the demand for domestic advanced process production capacity, and promote technological breakthroughs in upstream semiconductor equipment and materials. Many Chinese firms are reliant on TSM chips – 11% of TSM revenue is linked to China – and analysts expect these firms to undergo short-term pain from the US measures, but back them to emerge stronger in the long term due to improvement of domestic chip manufacturing.

Read more about these developments by accessing 30 Most Important AI Stocks According to BlackRock and Beyond the Tech Giants: 35 Non-Tech AI Opportunities.

For this article, we selected AI stocks by combing through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds. Why are we interested in the stocks that hedge funds pile into?

The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

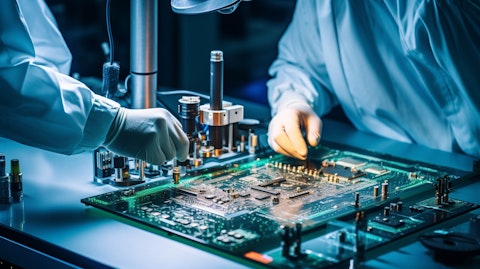

A technician soldering components for a semiconductor board.

Intel Corporation (NASDAQ:INTC)

Market Capitalization: $110 Billion

Intel Corporation (NASDAQ:INTC) markets key technologies for smart devices. Intel is one of the companies expected to receive billions in government funding through the CHIPS Act. The change of personnel in the White House has led to some concerns around the rebranding of the Act. Needham analysts Charles Shi and Ross Cole addressed these concerns through an investor note on November 11, noting that discussions with experts had led the advisory to believe that the Trump administration may not repeal the CHIPS Act, but will largely rebrand the bill and maintain the original essence of it. The analysts expect policy continuity of the CHIPS Act, which will be a positive for Semicap. Intel is likely to receive $20 billion in funding through the Act, per reports.

Overall INTC ranks 11th on our list of the AI stocks you should pay attention to. While we acknowledge the potential of INTC as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than INTC but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. This article is originally published at Insider Monkey.