Anne Margaret Crow: I have a couple mainly related to acquisitions. So firstly, could you talk a little more about how you are actively integrating the acquisitions to remove that silo effect that you talked about? Following on from that, how — when should investors start to see the results of this integration or are there — is there evidence of that already with regards to cross-selling and the integration of the DeepCube technology into other existing systems that you have already? And then the third question is, looking at the cash pile that you have — and one alternative would be not to spend it on acquisitions, and then you’d have 14 years of cash at the current rate of cash burn, which, clearly, you’re not going to do. Could you give us any indication of roughly how much of that cash you’ve got earmarked for acquisitions? I think you’ve made it quite clear that valuations are more reasonable now. So you’ve got much more to choose from?

Yoav Stern: Okay, that’s great questions. As usual the human brain or at least my brain is limited. So we remember the last question, and we will start with the last question and then we’ll go backward. The cash that is earmarked for acquisitions in the next three to five years is between $600 million to $800 million. We have certain assumptions about that. We have some assumptions, based on the multiples today, of how much can it bring as revenue because multiples by now are going much lower than 2x revenue even. So it starts to become very, very interesting. And, yes, we’re not going to wait 14 years. We are hopefully not going to wait five years, because we will accelerate. Until now, we are ahead of our plan, when I had this five years model and program, I had it since two years ago and we are ahead of that plan.

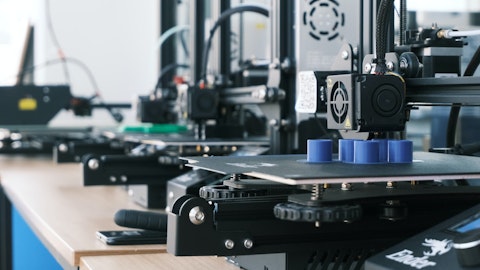

So that’s point number one. Point number two, the DC technology, we are looking at acquisitions, as I mentioned before, and the deep learning is a very, very advanced technology. It has one, if you want to call it disadvantage. It takes huge amount of data from the field, which means a machine that will fit our engine of deep learning needs to have a lot of data it manufactures. It can be data through all kinds of sensors. It can be data about temperature data, about vibration data, of course, visual data, thermal data. So we are measuring — if they don’t manufacture these data, then you will take longer time to implement the DeepCube into the machine. So we’re looking at acquisitions also based on how the machines are built. And if they are data rich, because if they are data rich, the effect of the deep learning as a self-learning technology that able to correct without human interference is much, much more — is maximized, actually.

Now, going back to the question before, you asked about how do we do this integration in order not to keep it in a silo format in order to results — or when we’ll see the results for this integration, I impressed. I remember all the questions. So the integration is an example. We acquired a year ago, no more than a year ago, actually exactly in November, the Additive Electronics Company in Switzerland. Since then, we converted all the North American sales into our go-to-market. And as a result their sales in North America almost doubled organically. And we already started the whole infrastructure. We’re going to build our next machine in Additive Manufacturing Electronics in Switzerland, not in Israel, because it’s better, frankly. They are better in building machines.

They are building machines for 20 something years, similar kinds of technologies. So we have started already to build machines in Switzerland, which originally were built in Israel. Third point, we are already applying our artificial intelligence technology to the machines that were built in Switzerland. And to develop — in this case, they didn’t have enough data. So we are developing the sensor array to generate enough data so we can apply the AI. Another example, is a company in the — that we acquired the Netherlands only in July. I think I mentioned it before. Since July, we already trained all our salespeople to go-to-market, which is much bigger than that company had to sell their company. Now, since it was in July, August, September, October, November, they already have revenue ahead of what they budgeted themselves.

But what you’ll see it is next year. I’m not talking about over it, which is of course, very easy. We have one finance department, we don’t have a whole array of finance and administration people in every company we buy, and we do, we move them around, so become very, very efficient. And our management team thinks about the following: We have 12 people in our senior and mid management team, five of those — first of all 10 of those are ex-CEOs, 10 of 12 are ex-CEOs. They joined us, I guess with the excitement of working with such an open ended and beautiful planned development and growth plan. But out of this, five were from acquisitions, which means a management team is of 12 is integrated with five which are ex founders, or ex general managers of the acquisitions we did.

So that’s closing up on your first question.

Yoav Stern: Okay, guys, it’s 50 minutes. I think this is — everybody has a day of work ahead of them. Unless there’s other questions, I want to thank you very, very much for participating. Thank you very much for your interest. And again, you have our emails, phone numbers, and you know how excited we are to speak with you so even if it’s offline. Looking forward to that. Thank you very, very much.

Operator: The conference has now concluded. Thank you for attending today’s presentation. You may now disconnect.

Follow Nano Dimension Ltd. (NASDAQ:NNDM)

Follow Nano Dimension Ltd. (NASDAQ:NNDM)

Receive real-time insider trading and news alerts