But just overall on the – you call the hydraulics, Grant, on the revenue outlook for 2024, what else would you add?

Grant Fitz: Yes. I mean, I think we talked about it a little bit earlier. But the big question mark of what’s going to happen with RV and Marine is still out there, a lot of different views on that. I think we’re going to tend to probably be a little bit conservative that it’s going to stay kind of in that trial that we’re in right now for at least the first part of next year. But overall, again, I’ll use the term hydraulics. The fundamentals of the business are really a really quite strong and compelling within Myers. I think we’ve got good cost structure. We’re trying to be become more variable in our costs, so that we can ebb and flow with the market trends. But overall, Myers does have a history over the last few years and having both organic and inorganic growth, and I think we’re going to continue to stay very focused on driving organic growth as part of our strategies

Michael McGaugh: Yes. Christian, just affirm that up a little bit. The big growth spots for us are going to be auto aftermarket, I talked about that. E-commerce, we actually are getting a lot of traction there. That continues to be a bright spot, and we’re resourcing it accordingly. And then the military artillery shell casings. As you may recall, we sold those casings to militaries around the world, but not the United States. And that business was actually doing well. In fact, it had doubled over the last two or three years. Now that we’re qualified and we can supply the U.S. and those orders have shown up, the purchase orders. Given the conflict in the Ukraine, the conflict in the Middle East, we continue to get some volume projections that are quite significant. How and when those materialize? We don’t know. But I feel very confident in the trend that the military and artillery shell casings and the rearmament is going to be good for our company.

Christian Zyla: Great, thank you for that. And then last question for me. Can you – just sticking with auto aftermarket. Can you just talk about the margin improvement that we’re seeing in distribution? Is that largely a function of those costs initiatives that you guys are talking about? Or is that some kind of price flow through that we should be thinking about? And just where do you see the ceilings for the margin in that segment, given your optimism on the auto aftermarket repair and tire repair talents? Thank you guys so much.

Grant Fitz: Yes. Sorry, Christian. It’s really a mix of both price and cost improvement. Jim Gurnee, who’s been put in as the new leader, Mike talked about that last quarter. He is really a person who has some significant go-to-market expertise. And so, he’s basically has looked at how do we best optimize the cost structure of our business while still getting – generating good sales opportunities within probably a little bit more of a focus on some of the larger corporate accounts as we see some real opportunities there. Part of what he’s brought is also the discipline on pricing. So value-based pricing is something that we’ve seen. And then, additionally, just on the cost side, we have worked significantly and just working down the cost within the business and getting ourselves in a good position from a competitive basis.

So, I would see the margin overall. We’re targeting to get to the low double digits within that business. And that’s going to probably take a little bit of time to work up to that. But I think certainly Q3 is a good indication of how you can start to see that EBITDA growth in spite of the revenue decline that we had through the quarter.

Christian Zyla: Great. Thanks so much.

Operator: Thank you, Steve. We will now take our next question from William Dezellem from Tieton Capital Management. William, your line is now open. Please go ahead.

William Dezellem: Thank you. Relative to the artillery casing business, are you displacing an incumbent or is the military simply expanding suppliers?

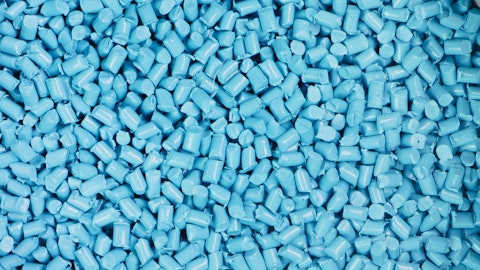

Michael McGaugh: William, this is Mike. It’s the latter. There’s just so much demand. There’s so much demand. And so, we are evaluating capital investment to meet that demand. And we’re trying to ensure that we balance our capital investments with our ramp and the demands that put upon us. So it’s not – you’re replacing metal and wood. Those are entrenched incumbents, but our product is lighter and stronger and easier to recycle and easier to return from the battlefield. It’s preferred by the user. What we found is the conflicts have been a catalyst to drive to a new material. Obviously, wood and metal are still dominant and still the leaders in that space, but injection molding, plastic and the model that we have that’s been working effectively with other militaries outside the U.S. have been good proof points. And we found a receptive audience, mostly, that’s driven just because of the significant demand level.

Grant Fitz: The other thing I would add, William, just with that is, that is an engineered product that’s – it’s not the easiest to meet the standards that the military has. And so, we’ve been working with the military on that. And it’s taken some time over the last years to just get up to the point where we are now a supplier. And I think it’s just been a great testament to the team that we do now have secured orders coming in and are really working on getting ready to start to fulfill some of that demand.

William Dezellem: Thank you both. And taking that one step further, are you finding that the incumbent wood and metal suppliers are also creating plastic options? Or are you the sole source for low weight plastic alternatives?

Michael McGaugh: Yes. Thank you. The metal and wood, guys, to my knowledge, are not creating a plastic part. William, this is a situation. We are actually reasonably good at – I’ll call it moderately difficult technologies for plastic parts. Big, complicated parts, that’s where we excel. Quite frankly, that’s where we like to be because your competitive intensity is lower. Your barriers-to-entry are higher. We always talk about branded products with a moderate level of technology difficulty and engineering difficulty. And that’s really our sweet spot. This fits in it. It’s quite a difficult part to manufacture. We’ve been making these for about a decade. For other militaries, we continue to improve with each year and each cycle in terms of durability and design.

And as a result, that’s allowed us to get the qualification with the US. But that’s part of the reason why I don’t mind talking about it in a public forum like this. It’s a difficult part to make. And we actually do a pretty good job at it. So, I feel that those sales will be durable for our company.

William Dezellem: Okay. One additional follow-up, diving in just to touch deeper. If in fact the wood and metal guys do not move to plastic and plastic is going to be lighter weight and therefore more desirable. Does this ultimately create a very large opportunity for you all? Or would you expect at some point there will be competition that will come in?

Michael McGaugh: Yes, I think any sort of environment, if this becomes such a significant opportunity, inevitably more competition will flow in. And hey, that’s a good thing. It makes us better. I think competition is always a good thing. For the short-term and short to intermediate term, I feel good about our position. I still think old technologies and old habits die hard. And if metal and wood are the incumbents and they’re a fully suitable product, you could argue that this is a very significant opportunity for Myers. But at this point, I want to take it one step at a time. William, one thing to point is that’s really a lot of our business. We sell a premium product at a premium price that has a greater payback for our customers, but it’s a more durable or sustainable product.