It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The S&P 500 Index gained 7.6% in the 12 month-period that ended November 21, while less than 49% of its stocks beat the benchmark. In contrast, the 30 most popular mid-cap stocks among the top hedge fund investors tracked by the Insider Monkey team returned 18% over the same period, which provides evidence that these money managers do have great stock picking abilities. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Enterprise Products Partners L.P. (NYSE:EPD).

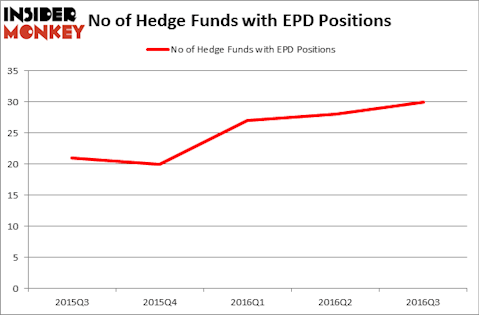

Is Enterprise Products Partners L.P. (NYSE:EPD) a cheap stock to buy now? Hedge funds are getting more optimistic. The number of long hedge fund bets advanced by 2 in recent months. EPD was in 30 hedge funds’ portfolios at the end of September. There were 28 hedge funds in our database with EPD holdings at the end of the previous quarter. At the end of this article we will also compare EPD to other stocks including China Life Insurance Company Ltd. (ADR) (NYSE:LFC), The Chubb Corporation (NYSE:CB), and NextEra Energy, Inc. (NYSE:NEE) to get a better sense of its popularity.

Follow Enterprise Products Partners L.p. (NYSE:EPD)

Follow Enterprise Products Partners L.p. (NYSE:EPD)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

QiuJu Song/Shutterstock.com

What does the smart money think about Enterprise Products Partners L.P. (NYSE:EPD)?

At the end of the third quarter, a total of 30 of the hedge funds tracked by Insider Monkey were bullish on this stock, a gain of 7% from one quarter earlier, the third straight quarter with positive hedge fund sentiment towards the stock. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Zimmer Partners, managed by Stuart J. Zimmer, holds the biggest position in Enterprise Products Partners L.P. (NYSE:EPD). Zimmer Partners has a $98.7 million position in the stock, comprising 2.6% of its 13F portfolio. Sitting at the No. 2 spot is Balyasny Asset Management, managed by Dmitry Balyasny, which holds a $60.8 million position. Remaining hedge funds and institutional investors with similar optimism encompass Charles Davidson’s Wexford Capital, Jim Simons’ Renaissance Technologies, and Israel Englander’s Millennium Management.

As one would reasonably expect, some big names were breaking ground themselves. Renaissance Technologies, initiated the biggest position in Enterprise Products Partners L.P. (NYSE:EPD). Renaissance Technologies had $47.5 million invested in the company at the end of the quarter. Leighton Welch’s Welch Capital Partners also initiated a $9.4 million position during the quarter. The other funds with new positions in the stock are Paul Marshall and Ian Wace’s Marshall Wace LLP, Ken Griffin’s Citadel Investment Group, and Jeff Lignelli’s Incline Global Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Enterprise Products Partners L.P. (NYSE:EPD) but similarly valued. These stocks are China Life Insurance Company Ltd. (ADR) (NYSE:LFC), The Chubb Corporation (NYSE:CB), NextEra Energy, Inc. (NYSE:NEE), and American International Group Inc (NYSE:AIG). This group of stocks’ market values match EPD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LFC | 12 | 47740 | 1 |

| CB | 33 | 1276402 | -4 |

| NEE | 35 | 997374 | 3 |

| AIG | 82 | 6994716 | -3 |

As you can see these stocks had an average of 40 hedge funds with bullish positions and the average amount invested in these stocks was $2.33 billion. That figure was $523 million in EPD’s case. American International Group Inc (NYSE:AIG) is the most popular stock in this table. On the other hand China Life Insurance Company Ltd. (ADR) (NYSE:LFC) is the least popular one with only 12 bullish hedge fund positions. Enterprise Products Partners L.P. (NYSE:EPD) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard AIG might be a better candidate to consider for a long position.

Disclosure: None