Monsanto Company (NYSE:MON) exemplifies the increasing population, expanding food demand, and growing food production story. The company’s main segment, corn seed, continues to capitalize on this megatrend by providing higher yielding hybrids to farmers. Growth in their soybean platforms, while flat recently, will rise through increased licensing and the introduction of new higher yielding products. Additionally, the company’s strong balance sheet provides stability, opportunities for reinvestment, and growing shareholder returns.

Corn

Monsanto Company (NYSE:MON) has doubled the price of its corn seeds over the past ten years through the introduction of higher yielding hybrids. To the farmer, a relatively small increase in seed costs is easily outweighed by the increased profits from the higher crop yield. As the share of newly introduced hybrids increases in Monsanto Company (NYSE:MON)’s portfolio mix so too does the net selling price. Because of this mix benefit, the company is improving its price by 5-10% per year.

Source: MON_Second Quarter 2013 Earnings.pdf

Monsanto Company (NYSE:MON) is also increasing its volumes by introducing higher yielding hybrids. Farmers are not only willing to pay more but the company captures a higher market and acreage share by offering higher yields. Monsanto Company (NYSE:MON) has doubled its seed volume since 2006 by offering higher value seeds.

In April, Monsanto Company (NYSE:MON) announced an agreement with The Dow Chemical Company (NYSE:DOW) to cross-license corn technologies. Monsanto will license a The Dow Chemical Company (NYSE:DOW) herbicide trait and Dow will have access to Monsanto’s upcoming, third generation rootworm tech. Financial terms were not disclosed. For Monsanto, the agreement will bring an additional mode of action to their corn platform that will benefit their farmer customers’ yields. For Dow the agreement is the first licensing of their Enlist trait in corn. The agricultural science segment at Dow is growing and currently represents about 9% of sales. About 2% of total sales come specifically from seed and trait technologies.

Soy

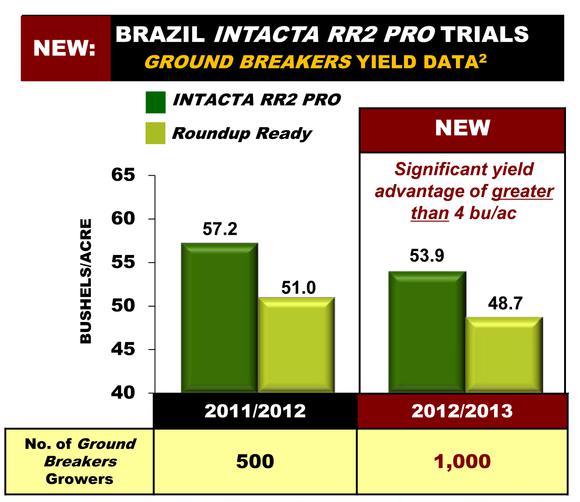

Monsanto has a multi-billion dollar opportunity in soybeans over the next five years. First, trials of its new Intacta RR2 Pro in Brazil show a significant yield increase over Roundup Ready. The trials indicate a greater than 4 bushel per acre increase and yield the farmer an additional $80 per acre (including other platform savings). Large scale, open-minded Brazilian farmers are early adopters and Intacta RR2 Pro is a 100 million acre opportunity for Monsanto.

Source: MON_Q2F13_Earnings.pdf

Licensing is also proving growth opportunities in soy. In March, Monsanto announced an agreement to provide, DuPont Fabros Technology, Inc. (NYSE:DFT) with soybean trait technology. The deal is broken down into two parts. First, DuPont Fabros Technology, Inc. (NYSE:DFT) will make four annual payments from 2014-2017 that total $802 million. Then, from 2018 until 2023, DuPont will pay royalties on a per unit basis for Genuity Roundup Ready 2 technology. The royalty payments are subject to minimums and should total at least $950 million. Like Dow, DuPont’s agriculture segment is growing and represents a larger piece of its revenue pie at 28%. DuPont focuses on both seeds and agricultural chemicals.

Conclusions

As seen above, Monsanto’s revenue growth history is solid and future growth prospects remain strong. Additionally, operating expenses are growing slower than sales, creating positive earnings leverage. Last, the company enjoys a strong cash to debt position. The cash position provides essential research and development opportunities along with stability in the cyclical agriculture business.

Evidence of the strength of the balance sheet can be seen when compared to agriculture sector mainstay Potash Corp./Saskatchewan (USA) (NYSE:POT) (see chart below). But it is not just the noted cash difference, Potash Corp./Saskatchewan (USA) (NYSE:POT) has five of its seven major debt issues due between 2014 and 2020. It will be interesting to see at what rates this debt will reissue.

| Monsanto | PotashCorp | |

| Total Cash | 4.7B | 585M |

| Total Debt | 2.2B | 4.1B |

Monsanto’s dividend is growing and sustainable because of their balance sheet. The company is aggressively increasing its share repurchases. Taking the aforementioned growth and increasing shareholder friendliness, Monsanto can be bought on a pull back under $100.

Source: finance.yahoo.com

The article Monsanto’s Growing Yields originally appeared on Fool.com.

John Miller has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. John is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.