Carillon Tower Advisers, an investment management company, released its “Carillon Eagle Mid Cap Growth Fund” fourth quarter 2024 investor letter. A copy of the letter can be downloaded here. Mid-cap stocks experienced mixed results in the fourth quarter after reporting positive gains in the previous quarter. The Russell Midcap Growth Index (up 8.14%) outperformed the Russell Midcap Value Index (fell 1.75%) during the quarter. Mid-cap stocks posted solid returns in 2024 similar to 2023. In addition, you can check the fund’s top 5 holdings to determine its best picks for 2024.

Carillon Eagle Mid Cap Growth Fund highlighted stocks like Monolithic Power Systems, Inc. (NASDAQ:MPWR), in the fourth quarter 2024 investor letter. Monolithic Power Systems, Inc. (NASDAQ:MPWR) is a semiconductor-based power electronics solutions provider. The one-month return of Monolithic Power Systems, Inc. (NASDAQ:MPWR) was 4.37%, and its shares gained 2.46% of their value over the last 52 weeks. On January 28, 2024, Monolithic Power Systems, Inc. (NASDAQ:MPWR) stock closed at $617.57 per share with a market capitalization of $30.125 billion.

Carillon Eagle Mid Cap Growth Fund stated the following regarding Monolithic Power Systems, Inc. (NASDAQ:MPWR) in its Q4 2024 investor letter:

“Monolithic Power Systems, Inc. (NASDAQ:MPWR) provides semiconductors for power management. The company delivered results ahead of expectations for the quarter, driven by strength in AI-related data center applications, but said that it expects to share the market with other competitors over time. The company is well-diversified across end markets, including communications, computers, automotive, and industrial segments. We suspect that investors may be overestimating potential share loss in the AI segment, and that the other segments could rebound in 2025 after a relatively weaker year.”

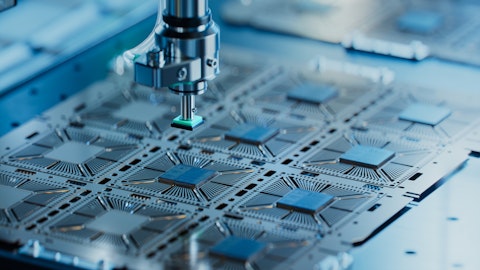

An engineer examining a DC to DC integrated circuit board, looking for any flaws.

Monolithic Power Systems, Inc. (NASDAQ:MPWR) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 38 hedge fund portfolios held Monolithic Power Systems, Inc. (NASDAQ:MPWR) at the end of the third quarter which was 35 in the previous quarter. In the third quarter, Monolithic Power Systems, Inc. (NASDAQ:MPWR) generated $620.1 million in revenues, 22% higher than the second quarter of 2024. While we acknowledge the potential of Monolithic Power Systems, Inc. (NASDAQ:MPWR) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Monolithic Power Systems, Inc. (NASDAQ:MPWR) and shared the list of high growth semiconductor stocks that are profitable heading into 2025. In addition, please check out our hedge fund investor letters Q3 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.