Investors love companies with great products that command substantial shares of their overall markets. Few companies can rival the strength Anheuser-Busch InBev NV (ADR) (NYSE:BUD) has in the beer market. This industry titan has pulled back significantly from its highs and could be a source of major growth for those who buy it now.

Profiling the giant

A-B InBev is the largest brewer in the world. It has more than 200 brands of beers, and 14 provide sales of more than $1 billion; these include Budweiser, Bud Light, Stella Artois, Michelob Ultra, and Beck’s. It holds the No. 1 or No. 2 market position in 19 countries, including an incredible 47.6% share of the U.S. beer market.

On July 31, Anheuser-Busch InBev NV (ADR) (NYSE:BUD) reported second-quarter earnings. The results were mixed, but told a strong story overall:

1). Earnings per share of $0.93 versus estimates of $1.03

2). Net sales of $10.6 billion versus estimates of $10.45 billion

3). EDITDA of $3.895 billion versus estimates of $3.81 billion

Revenue grew 3.9% in the second quarter and 2.7% for the half-year of fiscal 2013. The company’s power brand, Budweiser, led this growth, with sales growing an incredible 6.3% globally. Volume declined slightly in 2013, mainly due to slowed sales in Brazil, but management does not see this as being an ongoing issue. The highlight for the quarter was the company’s better-than-expected EBITDA; this grew 5.8% in the quarter, primarily due to margin growth in North America, Mexico, Latin America, and the Asia-Pacific region. After the earnings release, the company received upgrades at four different firms.

Up, up, and away we go

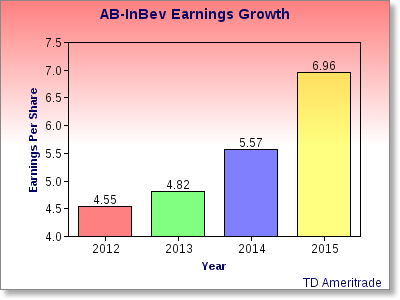

For the full year of fiscal 2013, analysts expect A-B InBev to earn $4.82 per share on revenue of $44 billion. This would represent a growth of 5.9% and 10.6%, respectively, compared to 2012. These are great numbers for our industry giant, but 2014 and 2015 are expected to be years of explosive growth.

Analysts predict earnings growth of 15.6% in 2014 and an incredible 25% in 2015. This can be credited to innovation and answering consumer demands, like the company’s addition of a cider beer in May and its strategic acquisition of Grupo Modelo.

Anheuser-Busch InBev NV (ADR) (NYSE:BUD)’s $20 billion acquisition of Grupo Modelo officially closed in the second quarter. This acquisition brings five of the world’s top six most valuable beer brands under one roof and gives the company major exposure in the Mexican beer market. A-B InBev recognizes Mexico as “the world’s fourth largest profit pool for beer,”making it one of the best acquisitions that could have been made and will immediately impact earnings. I believe acquisitions to increase its presence in the world’s markets will be an integral part of the company’s continued growth in the future.

Dividend champion

Anheuser-Busch InBev NV (ADR) (NYSE:BUD) currently pays an annual dividend of $2.22 per share, resulting in a yield of roughly 2.35%. It has raised its dividend every year since returning to the U.S. stock markets in 2009, and its healthy cash flow will allow this trend to continue.

Hop-ful competitors

Molson Coors Brewing Company (NYSE:TAP) and Boston Beer Co Inc (NYSE:SAM) are two of Anheuser-Busch InBev NV (ADR) (NYSE:BUD)’s most popular competitors.

| Company | AB-InBev | Molson Coors | Boston Beer |

|---|---|---|---|

| Market cap | $151.8 billion | $9.04 billion | $2.8 billion |

| Quarterly revenue | $10.6 billion | $1.18 billion | $58.9 million |

| Gross margin | 58% | 41.9% | 60.3% |

| Dividend yield | 2.35% | 2.60% | N/A |

| YTD performance | 6.2% | 13% | 58% |

Source: Yahoo Finance! and Investor Relations.

As you can see, Anheuser-Busch dominates in market cap and revenue, and has a very impressive margin. There is still plenty of room for the competition. Boston Beer Co Inc (NYSE:SAM) and its Samuel Adams brand has been growing rapidly in the United States over the last few years. This stock has well outperformed the others, but as I see it, it has run too far to consider an investment today. If Boston Beer were to pull back to around the $190 level, where it would be trading at 40 times earnings, I would consider it a value play; but until then, I would hold off.