I believe Microsoft Corporation (NASDAQ:MSFT) is getting closer to finally being recognized by Mr. Market, which will lead to capital appreciation that should have come a long time ago. I already know that this may not be a very popular belief, as I have already received many negative comments regarding my bullishness and bullish writings on Microsoft in the past.

While I agree with many bears that Microsoft may be a broken stock as of now, I strongly disagree that it will remain one permanently. Before I dive deeper into my reasoning why, let’s examine a few other “broken stocks” of the past.

A sideways trading medical giant…

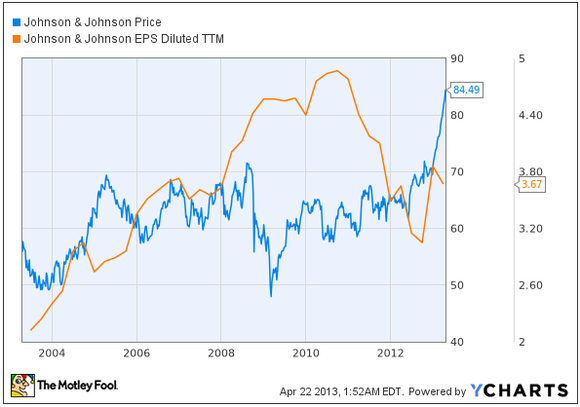

Like Microsoft Corporation (NASDAQ:MSFT), Johnson & Johnson (NYSE:JNJ) once traded sideways and range-bound:

Notice something? While the stock price stayed in a relatively tight range for close to a decade (barring the financial crisis), its earnings went steadily upwards. The company’s price didn’t catch up until recently, in the latter part of 2012. Please note that the drop-off in EPS in 2012 was largely due to $1.24 per share in non-recurring items — which if backed out — would give the company a normalized EPS of $5.10, which keeps its uptrend in earnings constant.

In other words, Johnson & Johnson constantly increased earnings and still is, but it took a while for Mr. Market to notice the broken nature of this blue chip medical stock. Johnson & Johnson (NYSE:JNJ)’s annual EPS estimate going forward is $5.42, which gives the company a forward P/E of around 15.

Wal-Mart Stores, Inc. (NYSE:WMT) disease?

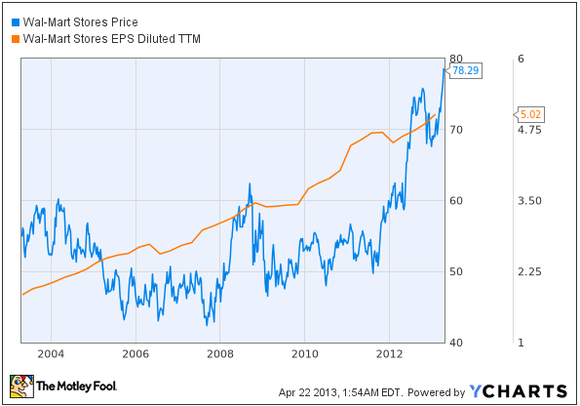

Another offender of trading sideways, producing hardly any value capital appreciation wise, was Wal-Mart.

Wal-Mart did nothing price-wise for investors for a decade, despite solid, increasing earnings. The company even had a disease named after it by Forbes contributor Adam Hartung, who pointed out that the company was obsessed about execution and did little to move the needle for shareholders.

Like Johnson & Johnson, the company’s earnings power was eventually recognized by the market in 2012, however, and finally corresponded by breaking out in a higher share price. Wal-Mart Stores, Inc. (NYSE:WMT) is also expected to continue to increase earnings at a good pace, with an annual EPS estimate of $5.34 going forward.

So how does this relate to Microsoft?

Like Johnson & Johnson and Wal-Mart, Microsoft has done nothing (unless bought solely for its dividend) for investors for over a decade. Its price has remained range-bound, but earnings have shot straight up, if you consider normalized earnings. Like Johnson & Johnson (NYSE:JNJ), Microsoft’s true earnings power was depressed by a one-time write-off. Microsoft Corporation (NASDAQ:MSFT)’s was related to a bad acquisition in the past that was swung to a more recent quarter.

Tony Bradley of PCWorld, for instance, thinks that Windows 8 sales may be the reason for the decline in PCs, but more so because Windows 8 is changing the definition of the PC. How do you classify a Surface, which is a blend between a tablet (not counted as a PC) and laptop (which counts as a PC in most estimates)? There are many other Windows 8 hybrid devices on the market produced by Microsoft’s OEM partners as well.

People tend to forget Windows 8 was designed to get Microsoft Corporation (NASDAQ:MSFT) into the world of touchscreens and mobile, and isn’t focused only on old-school PCs. According to CNN Money, Windows sales surged 23% in their most recent quarter. Microsoft’s annual EPS estimate going forward is $2.75.

So will Microsoft finally breakout?

Maybe, maybe not. It should, if judged by its earnings. But there is also the whole “the market can stay irrational longer than you can stay solvent” thing. It took a decade for Johnson & Johnson (NYSE:JNJ) and Wal-Mart Stores, Inc. (NYSE:WMT) to achieve their rightful place in the sun, and that is a long time to wait.

Some things Microsoft Corporation (NASDAQ:MSFT) does have going for it, however, is its dividend paying well over 3%, which will give you some help being patient should you choose to invest. The company is also aggressively buying back shares and reducing its float as well. The stock will still need catalysts to break out.

Its impressive earnings in the midst of the worst drop off in PC shipments since 1994 helped the stock pop a little, but not exactly in the same straight upward way as a Johnson & Johnson (NYSE:JNJ) or a Wal-Mart Stores, Inc. (NYSE:WMT) style break-out.

The stock may need further catalysts to genuinely and sustainably break-out, which could include a series of nice quarters now that the market has begun paying more attention. Current CEO Steve Ballmer getting the boot would also likely jump start the broken stock, but with earnings shooting up consistently and Windows 8 doing better than initially thought, he will probably keep his job as long as this trend stays the same.

The bottom line

Microsoft seems to be one of the “safest” (if there is such a thing) blue-chips you can buy now. The software giant is one of only four companies left with a triple A debt rating. The company has posted impressive and resilient earnings consistently for a decade, which, if you believe in the whole Buffett/Ben Graham style philosophy of “the market is a voting machine in the short-term and a weighing machine in the long-run” should pay off.

It’s just a matter of when, but as the company continues to increase earnings under the guise of a flat share-price, the share price is getting heavier and heavier and Mr. Market will eventually feel the heaviness and correspond. Worst case scenario investing in Microsoft Corporation (NASDAQ:MSFT) now? You get a high-yielding dividend payment while waiting and not much downside risk. Sounds like a good deal to me.

The article Why Microsoft May Be Ready to Finally Breakout originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.