Stelliam Investment Management, managed by Ross Margolies, recently filed a 13F, in which it disclosed its equity portfolio for the second quarter of 2014. According to the filing with the U.S. Securities and Exchange Commission, the value of the fund’s portfolio was $3.7 billion. The fund started more than 10 new positions and added shares to over 30 holdings during the quarter. Micron Technology, Inc. (NASDAQ:MU), Delta Air Lines, Inc. (NYSE:DAL) and Intel Corporation (NASDAQ:INTC) are represented as the top three largest holdings of the fund for the second quarter. Let’s discuss each of these holdings.

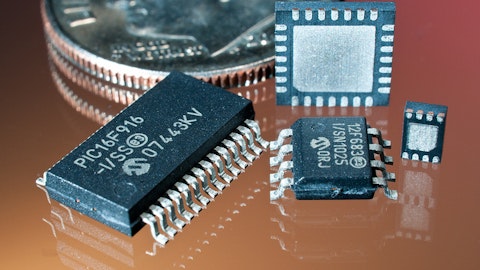

On the top position is Micron Technology, Inc. (NASDAQ:MU), in which Stelliam Investment Management upped its stake by 8% to 4.46 million shares from 4.16 million shares reported previously. The holding is valued at $146.9 million. Micron Technology, Inc. (NASDAQ:MU) is engaged in making of advanced semiconductor systems, and has a market cap of $3.92 billion. Other funds betting big on the company include Baupost Group, led by Seth Klarman, which owns 51.66 million shares, and Greenlight Capital, managed by David Einhorn, which holds 40.34 million shares of the company.

Delta Air Lines, Inc. (NYSE:DAL) occupies second position. Stelliam Investment Management holds 3.79 million shares, worth $146.7 million. The position represents an 11% increase from 3.44 million shares held previously. Recently, Joseph DeNardi, an analyst with Stifel Nicolaus, said that Delta Air Lines, Inc. (NYSE:DAL) is leading the pack of soaring airline stocks. If airline stocks were a gaggle of geese flying in formation through the summer sky, then Delta Air Lines, Inc. (NYSE:DAL) would be their leader, guiding them to their destination, according to DeNardi.

Delta Air Lines, Inc. (NYSE:DAL) has undertaken several initiatives over the past few years that have greatly improved their operations. They’re in the process of retiring some of their smaller jets, replacing them with larger, higher-margin ones.

Other largest shareholders of the company include Lansdowne Partners, managed by Alex Snow, which holds 26.59 million shares, and Crispin Odey’s Odey Asset Management Group, which owns 7.91 million shares of the company.

Intel Corporation (NASDAQ:INTC) came in at third position, where the fund reported owning 4.61 million shares, representing an increase from 3.97 million shares. The value of the stake is $142.5 million shares. Intel Corporation (NASDAQ:INTC) seems not happy with antitrust regulators’ decision. Intel Corporation (NASDAQ:INTC) has been fined €1.06 bln ($1.4 bln) for breaching the antitrust law in 2009. The world’s biggest chip-maker requested EU’s top court to review the decision against its bid to eradicate the fine, Bloomberg reported.

Intel Corporation (NASDAQ:INTC) struggles with declining PC sales and slow progress in mobile. In order to change the game, it hired Mr. Amir Faintuch, Senior Executive at QUALCOMM Inc. (NASDAQ:QCOM). Rumors predict Intel Corporation (NASDAQ:INTC) is going to strengthen its position in the mobile and internet-connected gadgets’ markets, although this move is particularly peculiar because the computer chipmaker company is known for its insular culture.

Disclosure: none