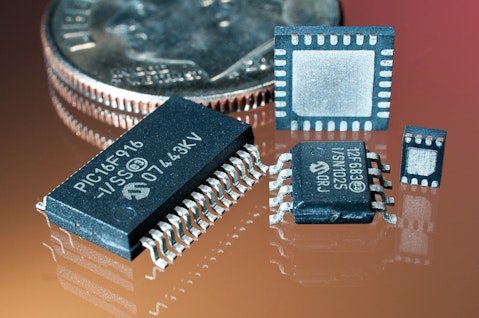

We came across a bearish thesis on Microchip Technology Incorporated (MCHP) on Substack by Charly AI. In this article, we will summarize the bears’ thesis on MCHP. Microchip Technology Incorporated (MCHP)’s share was trading at $48.41 as of March 31st. MCHP’s trailing and forward P/E were 84.93 and 33 respectively according to Yahoo Finance.

Microchip Technology Inc. (MCHP) is facing a challenging period as it contends with sharp declines in revenue and profitability, driven by weakened demand in key sectors like automotive and broader macroeconomic pressures. With a 41.9% year-over-year revenue drop and a net loss of $53.6 million last quarter, the company is struggling to navigate inventory reductions by customers and the impact of higher interest rates and inflation. Gross margins have contracted to 54.7% due to lower sales volume and an unfavorable product mix, while a rising debt burden of $6.75 billion and a modest cash balance of $586 million further strain financial flexibility. The balance sheet presents additional risks, as over half of total assets consist of intangibles, limiting liquidity and making it difficult to absorb continued profitability declines. Retained earnings are shrinking, reinforcing concerns over the company’s financial health.

Despite these headwinds, MCHP is taking steps to adjust strategically. Cost-cutting measures, including facility closures, and a share repurchase program indicate management’s commitment to long-term efficiency. While technical indicators suggest the stock is nearing oversold levels (RSI ~30), providing the possibility of a short-term bounce, the broader trend remains negative, with MACD signaling continued downward momentum. Management’s focus on new technologies and product expansion may eventually provide stability, but near-term risks outweigh these potential tailwinds. Given MCHP’s overvaluation, high debt load, and uncertain demand recovery, the immediate outlook remains bearish.

Microchip Technology Incorporated (MCHP) is not on our list of the 30 Most Popular Stocks Among Hedge Funds. As per our database, 44 hedge fund portfolios held MCHP at the end of the fourth quarter which was 37 in the previous quarter. While we acknowledge the risk and potential of MCHP as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than MCHP but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. This article was originally published at Insider Monkey.