In this article, we discuss the 8 best stock picks and portfolio performance of Michael Burry. If you want to skip our detailed analysis of these stocks, go directly to the Michael Burry Stock Portfolio Performance in 2021: 4 Best Picks.

Michael Burry, the legendary investor who rose to fame after predicting the financial crisis of 2007 and profiting from the collapse of the housing market — a feat that was later turned into a Hollywood film named The Big Short — had a very eventful 2021. The chief of Scion Asset Management was in the headlines as he paved the way for the GameStop short squeeze at the beginning of the year before swearing off meme stocks and predicting that the markets were about to crash and inflation was rising, long before other market experts picked up on the idea.

Burry Clashes With Elon Musk And Cathie Wood

Burry also made famous multi-million dollar bearish bets against Tesla, Inc. (NASDAQ:TSLA) and ARK Innovation ETF (NYSE:ARKK), famously sparring with Elon Musk, the owner of the former, and Cathie Wood, the investor whose hedge fund, ARK Investment Management, is behind the latter. In November, he surfaced on Twitter to remind his followers that Musk, who had been selling his Tesla, Inc. (NASDAQ:TSLA) stock as part of a plan to showcase his commitment to charity, just “liked” selling his stock because it was trading “too high”.

The tweets of the investor have since been deleted, but remain a part of public record through the news outlets that covered them when they were made. Earlier in August, Burry had also sparred with Wood. The hedge fund of the latter has a very bullish stance on Musk and Tesla, Inc. (NASDAQ:TSLA). Wood took Burry head-on when his bearish bets against ARK Innovation ETF (NYSE:ARKK) were made public, going on Twitter to say that Burry “did not understand the fundamentals creating explosive growth and opportunities in the innovation space”.

Burry Predicts Mother of All Crashes

As early as February 2021, when the post-pandemic economic recovery had yet to fully take-off, Burry took to Twitter to sound the alarm bells over a historic crash, noting that the markets were “dancing on a knife’s edge” as valuations soared and debt margins increased. A month later, Burry once again made an appearance on social media to compare the hype around growth stocks and Bitcoin to the housing bubble of 2007 and the dotcom bubble at the turn of the millennium. Burry had accurately predicted the collapse of both these bubbles.

The chief of Scion Asset Management went as far as to say that it was the “greatest speculative bubble” and would lead to the “mother of all crashes”. In November, he once again warned of “market speculation” and this time compared the situation to the crisis just before the onset of the Great Recession in 1920. Even though Burry has repeatedly dismissed the hype around cryptocurrencies, he has since clarified that he has not been betting against them. He has even said that he even owns some coins.

Burry Slashes Stock Positions

Just as inflation started creeping up in the United States, derailing a faster-than-expected economic recovery and leading to speculation around a rise in interest rates and an accompanying correction in growth stocks, Burry slashed his stock positions from more than 20 down to only 6. Between June and September, the portfolio value of Scion Asset Management decreased from $140 million to just $41 million. Market experts who closely follow Burry claim that this is a sign that he is preparing for a crash.

Some of the famous names that Burry sold in the third quarter include Alphabet Inc. (NASDAQ:GOOG), Meta Platforms, Inc. (NASDAQ:FB), and Discovery, Inc. (NASDAQ:DISCA), among others. During the third quarter, Scion Asset Management made new purchases in 3 stocks, additional purchases in none, sold out of 19, and reduced holdings in 2 stocks. Some of the top picks still in the portfolio include CoreCivic, Inc. (NYSE:CXW) and CVS Health Corporation (NYSE:CVS).

Our Methodology

The companies that featured in the Scion Asset Management portfolio in filings for the first, second, and third quarter of 2021 were selected and sorted based on the gains in share price in 2021. Scion has sold off some of these stakes in the third quarter but they have been included in the list as they remained in the Scion portfolio for the first half of 2021.

Data from around 900 elite hedge funds tracked by Insider Monkey was used to identify the number of hedge funds that hold stakes in each firm.

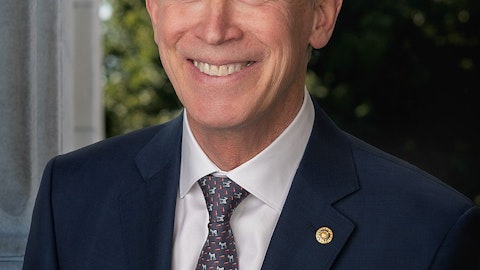

Michael Burry of Scion Asset Management

Michael Burry Stock Portfolio Performance in 2021: Best Picks

8. Lockheed Martin Corporation (NYSE:LMT)

Number of Hedge Fund Holders: 51

Gain in Share Price in 2021: 3%

Lockheed Martin Corporation (NYSE:LMT) operates as an aerospace and defense firm. On January 10, Wells Fargo analyst Matthew Akers maintained an Equal Weight rating on Lockheed Martin Corporation (NYSE:LMT) stock and raised the price target to $379 from $340, underlining that new programs that were transitioning to production would cut the risks to legacy rotorcraft platforms marketed by the firm. The analyst highlighted the Future Vertical Lift program as a “big opportunity” for Lockheed Martin Corporation (NYSE:LMT).

Lockheed Martin Corporation (NYSE:LMT) has won the backing of major hedge funds in the past few months. Among the hedge funds being tracked by Insider Monkey, New York-based firm Millennium Management is a leading shareholder in Lockheed Martin Corporation (NYSE:LMT) with 561,512 shares worth more than $193 million.

The company is a new holding in the portfolio of Scion Asset Management. At the end of September, the fund owned 30,000 shares of Lockheed Martin Corporation (NYSE:LMT) worth $10.3 million, representing close to 25% of the portfolio. Several other hedge funds also hold bullish positions in the company. At the end of the third quarter of 2021, 51 hedge funds in the database of Insider Monkey held stakes worth $1.2 billion in Lockheed Martin Corporation (NYSE:LMT).

Just like Tesla, Inc. (NASDAQ:TSLA), Alphabet Inc. (NASDAQ:GOOG), Meta Platforms, Inc. (NASDAQ:FB), Discovery, Inc. (NASDAQ:DISCA) and CVS Health Corporation (NYSE:CVS), Lockheed Martin Corporation (NYSE:LMT) is one of the stocks on the radar of elite investors.

In its Q4 2020 investor letter, RiverPark Advisors, LLC, an asset management firm, highlighted a few stocks and Lockheed Martin Corporation (NYSE:LMT) was one of them. Here is what the fund said:

“Despite better-than-expected third quarter results, LMT shares were weak for the quarter as defense spending is expected to be flat for the coming year. With a record $150 billion backlog and almost 30% of its revenue coming from building F-35 aircraft with deliveries forecast to reach 180 per year in 4-5 years (3Q’s revenue upside was from the F-35), we believe LMT should grow at a higher rate than overall defense budget growth and Street expectations over the next several years. Further, strategic acquisitions (LMT acquired AJRD for $4 billion in late December), debt pay down, a 3% dividend yield, and continued share buybacks from $6 billion per year of free cash flow should lead to even greater shareholder returns.”

7. The Kraft Heinz Company (NASDAQ:KHC)

Number of Hedge Fund Holders: 33

Gain in Share Price in 2021: 5%

The Kraft Heinz Company (NASDAQ:KHC) makes and sells food and beverage products. It has been a favorite hedge fund stock for years. Among the hedge funds being tracked by Insider Monkey, Nebraska-based investment firm Berkshire Hathaway is a leading shareholder in The Kraft Heinz Company (NASDAQ:KHC) with 325 million shares worth more than $12 billion.

Scion opened a new position in The Kraft Heinz Company (NASDAQ:KHC) during the fourth quarter of 2020, buying nearly 600,000 shares at an average price of $32.46 per share. Burry then added to that stake in the first and second quarter of 2021, increasing it by 99% and 21% respectively. During the third quarter, this position was sold off entirely.

In its Q4 2020 investor letter, Berkshire Hathaway highlighted a few stocks and The Kraft Heinz Company (NASDAQ:KHC) was one of them. Here is what the firm said:

“We exclude our The Kraft Heinz Company (NASDAQ:KHC) holding — 325,442,152 shares — (In the list of 15 common stock investments that at yearend were our largest in market value) because Berkshire is part of a control group and therefore must account for that investment using the “equity” method. On its balance sheet, Berkshire carries the Kraft Heinz holding at a GAAP figure of $13.3 billion, an amount that represents Berkshire’s share of the audited net worth of Kraft Heinz on December 31, 2020.

Berkshire and its subsidiaries hold investments in certain businesses that are accounted for pursuant to the equity method. Currently, the most significant of these is our investment in the common stock of The Kraft Heinz Company (“Kraft Heinz”). The Kraft Heinz Company (NASDAQ:KHC) is one of the world’s largest manufacturers and marketers of food and beverage products, including condiments and sauces, cheese and dairy, meals, meats, refreshment beverages, coffee and other grocery products. Berkshire currently owns 325,442,152 shares of Kraft Heinz common stock representing 26.6% of the outstanding shares.

We recorded equity method earnings from our investment in Kraft Heinz of $95 million in 2020, $493 million in 2019 and losses of approximately $2.7 billion in 2018. Equity method earnings (losses) included the effects of goodwill and identifiable intangible asset impairment charges recorded by Kraft Heinz. Our share of such charges was approximately $850 million in 2020, $450 million in 2019 and $3.7 billion in 2018. We received dividends from Kraft Heinz of $521 million in each of 2020 and 2019 and $814 million in 2018, which we recorded as reductions in our carrying value.

Shares of The Kraft Heinz Company (NASDAQ:KHC) common stock are publicly-traded and the fair value of our investment was approximately $11.3 billion at December 31, 2020 and $10.5 billion at December 31, 2019. The carrying value of our investment was approximately $13.3 billion at December 31, 2020 and $13.8 billion at December 31, 2019. As of December 31, 2020, the carrying value of our investment exceeded the fair value based on the quoted market price by $2.0 billion (15% of carrying value). In light of this fact, we evaluated our investment in Kraft Heinz for impairment. We utilize no bright-line tests in such evaluations. Based on the available facts and information regarding the operating results of Kraft Heinz, our ability and intent to hold the investment until recovery, the relative amount of the decline and the length of time that fair value was less than carrying value, we concluded that recognition of an impairment loss in earnings was not required. However, we will continue to monitor this investment and it is possible that an impairment loss will be recorded in earnings in a future period based on changes in facts and circumstances or intentions.”

6. NOW Inc. (NYSE:DNOW)

Number of Hedge Fund Holders: 18

Gain in Share Price in 2021: 18%

NOW Inc. (NYSE:DNOW) distributes energy and industrial products for petroleum refining. Several elite hedge funds are bullish on the company as a new fiscal year begins. Among the hedge funds being tracked by Insider Monkey, New York-based investment firm Renaissance Technologies is a leading shareholder in NOW Inc. (NYSE: DNOW) with 5.3 million shares worth more than $40 million.

In early November, Stephens analyst Tommy Moll upgraded NOW Inc. (NYSE:DNOW) stock to Overweight from Equal Weight with a price target of $12, underlining that the company was “showing commitment to protect gross margins”. The analyst noted that a focus on higher margin manufacturers and end markets was driving this improvement for NOW Inc. (NYSE:DNOW) that looked “set to continue in 2022”.

Burry first bought a stake in NOW Inc. (NYSE:DNOW) in the fourth quarter of 2020. At the time, the legendary investor bought 1.5 million shares of NOW Inc. (NYSE:DNOW) at an average price of $5.63 per share. He then proceeded to reduce that position by almost half in the first quarter of 2021 and sold it off completely during the second quarter. In the third quarter, Scion bought a stake in NOW Inc. (NYSE:DNOW) again. This stake is worth more than $1.1 million and consists of 150,000 shares.

Along with Tesla, Inc. (NASDAQ:TSLA), ARK Innovation ETF (NYSE:ARKK), Alphabet Inc. (NASDAQ:GOOG), Meta Platforms, Inc. (NASDAQ:FB), Discovery, Inc. (NASDAQ:DISCA), CoreCivic, Inc. (NYSE:CXW) and CVS Health Corporation (NYSE:CVS), NOW Inc. (NYSE:DNOW) is one of the stocks that hedge funds are buying.

In its Q3 2020 investor letter, Palm Valley Capital, an asset management firm, highlighted a few stocks and NOW Inc. (NYSE:DNOW) was one of them. Here is what the fund said:

“NOW is a 2014 spinoff from National Oilwell Varco and has a 150-year legacy as a distributor to the oil and gas and industrial markets. Through a vast network of 245 locations, NOW’s 300,000 SKU product offering addresses all segments of the energy value chain, from upstream E&Ps to midstream infrastructure to downstream refining, in addition to industrial end markets including chemicals, mining, utilities, and manufacturing. When energy companies reduce activity, NOW suffers. However, it has streamlined its business since the last oil and gas downturn and expects reduced operating losses this round. As of June 30th, NOW had $269 million of cash and no debt ($497 million market cap), although if demand recovers as we expect, some cash will be reinvested in working capital. The stock is currently selling for 66% of tangible book value.

Pason and NOW represent our fourth and fifth investments in the energy sector. The active rig count in the U.S. is at all-time lows. When considering our timing, we concluded, if not now, when? Our largest energy holding is Helmerich & Payne, the nation’s largest drilling contractor. It’s selling for half of book value. We believe the financial strength of our holdings is far above the typical energy company. Even so, we have kept our exposure to the energy sector in check given our concerns about the overall economy.”

5. Meta Platforms, Inc. (NASDAQ:FB)

Number of Hedge Fund Holders: 248

Gain in Share Price in 2021: 25%

Meta Platforms, Inc. (NASDAQ:FB) develops and markets products that enable people to connect. It is one of the most popular stocks among hedge funds. At the end of the third quarter of 2021, 248 hedge funds in the database of Insider Monkey held stakes worth $38 billion in Meta Platforms, Inc. (NASDAQ:FB).

Meta Platforms, Inc. (NASDAQ:FB) has featured in the Scion portfolio since early 2020. Burry opened a new position in Meta Platforms, Inc. (NASDAQ:FB) in the first quarter of 2021 after selling off the previous stake in late 2020. He added to the stake by 71% during the second quarter of 2021, buying nearly a million shares at an average price of $320 per share before selling off the position entirely during the third quarter.

In its Q1 2021 investor letter, ClearBridge Investments, an asset management firm, highlighted a few stocks and Meta Platforms, Inc. (NASDAQ:FB) was one of them. Here is what the fund said:

“We continued to keep our learnings from 2020 in mind during the quarter as we sought to increase the up capture of the portfolio. We also made adjustments to the portfolio’s top 10 holdings to increase the participation of select stocks, including Facebook, while trimming our weighting to stable names, which now represent 47% of the portfolio. Our repositioning has been encouraging so far with the portfolio performing better on up days in the market while maintaining good down capture during more turbulent sessions.”

Click to continue reading and see Michael Burry Stock Portfolio Performance in 2021: 4 Best Picks.

Suggested Articles:

- 10 Best Bank and Finance Stocks to Buy According to Mario Gabelli

- 10 Best Diversified Stocks to Invest In

- 10 Best SPACs to Invest In According to Reddit

Disclosure. None. Michael Burry Stock Portfolio Performance in 2021: 8 Best Picks is originally published on Insider Monkey.