The business

Investors usually refer to Mercadolibre Inc (NASDAQ:MELI) as the eBay Inc (NASDAQ:EBAY) of Latin America, and the comparison makes a lot of sense: eBay is a major shareholder in Mercado Libre – the U.S. link in Mercado Libre takes you directly to eBay Inc (NASDAQ:EBAY) – and both companies have similar business models.

Mercado Libre is the biggest ecommerce platform in Latin America and, just like eBay Inc (NASDAQ:EBAY); the company has been expanding into other areas like payments. Mercado Pago plays a similar role for Mercadolibre Inc (NASDAQ:MELI) to what PayPal does for eBay, a payment method which has been expanding beyond its own ecommerce platform to become an independent business opportunity on its own merits. Mercado Libre has also been growing in other areas like advertising, classifieds and technological solutions for its clients.

There is one big difference between Mercado Libre and eBay though, the Latin American company doesn´t face the same level of competitive pressure from Amazon.com, Inc. (NASDAQ:AMZN). Amazon.com, Inc. (NASDAQ:AMZN) is not only the market leader in the U.S. ecommerce industry; the company´s aggressively low prices and overall efficiency force other players to reduce their margins in order to compete against such a voracious and disruptive company.

Amazon.com, Inc. (NASDAQ:AMZN) is one considerable risk factor for Mercadolibre Inc (NASDAQ:MELI), the online retailer launched its Kindle store in Brazil in December, and it will most likely try to increase its presence in the region over the next years. Amazon won´t have it easy in Latin America though, it’s a complex market, and Mercado Libre has the home team advantage.

Latin America is not one big market like the U.S., but a region with different countries and currencies, there are also significant cross border tariffs and regulations which make international selling quite complicated. Amazon has benefited enormously form economies of scale and operating efficiencies in the U.S., but those factors would be hard to replicate in Latin America.

Even if Amazon can gradually increase its presence in Latin America over the next years, Mercado Libre has obtained a big advantage by being the first mover. Besides, the company knows the ins and outs of doing business in the region, so Amazon will have to go through considerable hurdles in order to effectively compete against Mercadolibre Inc (NASDAQ:MELI).

The opportunity

Mercadolibre Inc (NASDAQ:MELI) has consolidated its leadership position over the last years due to its strong brand recognition and the power of the network effect, meaning that the service becomes more valuable as it grows in users. Both buyers and sellers want to go to the platform which attracts more counterparties, this provides a self sustaining competitive advantage benefiting the company as it becomes at the same time more popular and more valuable to its users.

Source: Mercado Libre investor day presentation

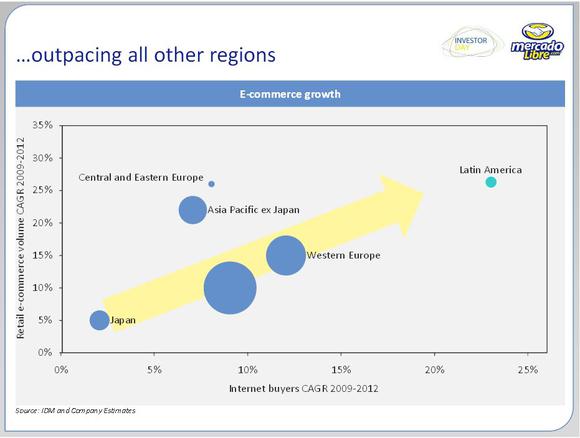

Latin America has outpaced all other regions when it comes to ecommerce growth over the last years, at least according to traditional measures like retail ecommerce volume and internet buyers.

Source: Mercado Libre investor day presentation

But the opportunity is far from over; the Latin America ecommerce industry still offers plenty of room for growth in the middle and long term. Only 1.5% of retail transactions are done online and just 10% of the population shops online. As internet penetration continues growing and people become increasingly familiar with ecommerce in general and Mercado Libre in particular, the company stands to benefit from strong secular growth drivers.

Source: Mercado Libre investor day presentation

Besides, the business model is quite attractive: since revenue grows much faster than operating expenses, this means that profit margins tend to increase as the company grows in sales. Revenue growth and margin expansion should be two powerful growth drivers for the company over the next years.

Economic volatility can create some important uncertainties for Mercadolibre Inc (NASDAQ:MELI) investors, especially when it comes to fluctuations in exchange rates which can have a big impact on the company´s financials. However, over the long term, investors are more than fairly compensated for the risks by gaining exposure quite an especial growth opportunity.

Bottom line

Online commerce is a high growth industry, especially in Latin America where we have barely seen the tip of the iceberg in terms of market penetration and long term growth prospects. Thanks to its rock solid leadership position in this market and its profitable business model, Mercado Libre provides investors with a fairly unique opportunity for growth.

The article Why You Need to Consider This Unique Growth Opportunity originally appeared on Fool.com and is written by Andrés Cardenal.

Andrés Cardenal owns shares of Mercado Libre and Amazon.com. The Motley Fool recommends Amazon.com, eBay, and MercadoLibre (NASDAQ:MELI). The Motley Fool owns shares of Amazon.com, eBay, and MercadoLibre. Andrés is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.