Copyright: gdolgikh / 123RF Stock Photo

- Health: While the research on the health consequences of eating meat continues, it has become part of conventional wisdom that meat-based diets (and red meat in particular) are associated with a greater risk of cardiovascular disease and cancer. This link provides a fairly balanced account of whether this belief is true, but for better or worse, it has led some meat eaters to cut back and sometimes top consuming meat.

- Environment: As climate change and environmental concerns rise to the top of concerns for some, they are feeling the pressure to shift away from meat, in general, and beef, in particular, because of its environmental footprint. I am not an environmental scold, but I don’t think that there is any debate that meat-based diets puts a greater pressure on the environment

- Taste: Until recently, shifting away from a meat-based diet also meant giving up the taste and texture of meat, since most meat substitutes did not come close. As companies like Beyond Meat and Impossible Foods are showing, plant-based alternatives are getting better at mimicking real meat, and for those who are attached to the texture and taste of meat, that is making a difference in their diet decisions.

Follow Beyond Meat Inc. (NASDAQ:BYND)

Follow Beyond Meat Inc. (NASDAQ:BYND)

Receive real-time insider trading and news alerts

- The meatless meat market is still small, relative to the overall meat market: In 2018, the meatless meat market had sales of $1-$5 billion, depending on how broadly you define meatless markets and the geographies that you look at. Defined as meatless meats, i.e., the products that Beyond Meat and Impossible Foods offer, it is closer to the lower end of the range, but inclusive of other meat alternatives (tofu, tempeh etc.) is at the upper end. No matter which end of the range you go with, it is small relative to the overall meat market that is in excess of $250 billion, just in the US, and closer to a trillion, if you expand it globally, in 2018. In fact, while the meat market has seen slow growth in the US and Europe, with a shift from beef to chicken, the global meat market has been growing, as increasing affluence in Asia, in general, and China, in particular, has increased meat consumption, Depending on your perspective on Beyond Meats, that can be bad news or good news, since it can be taken by detractors as a sign that the overall market for meatless meats is not very big and by optimists that there is plenty of room to grow.

- It is still a niche market: Meatless meat products have made their deepest inroads in urban and affluent populations and its allure is greatest with former meat-eaters rather than lifelong vegetarians, who don’t crave either the taste or texture of meat. The plus is that this market has significant buying power, but the minus is that urban, well-to-do millennials can eat only so much.

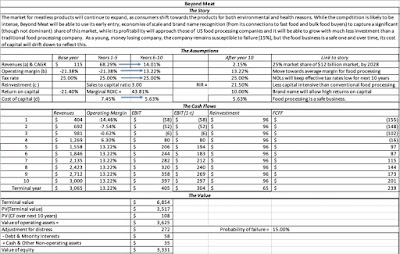

- Total market for meatless meats will grow significantly: I see the total market for meatless meats growing from just over $1 billion in 2018 to $12 billion by 2028. While that is less than the $35 billion that Beyond Meat’s back-of-the-envelope estimate delivers, it is closer to the upper end of the range of forecasts that you have for this market.

- With Beyond Meat capturing a significant market share: As the market grows, the number of players will increase, but I see Beyond Meats capturing a 25% market share of this market, building on its early entry into the market and brand name recognition, partly from its fast food connections.

- While delivering operating profits similar to the large US food processing companies: Over the next five years, I see pre-tax operating margins improving towards the 13.22% that US food processing business delivered in 2018, built largely on economies of scale and pricing power.

- And reinvesting a lot less, in delivering that growth: While Beyond Meat generates about a dollar in revenue per dollar in invested capital right now, I will assume that it will be able to use technology as its ally to invest more efficiently in the future. Specifically, I will assume that the company will generate $3 in revenue for every dollar in invested capital, about double what the typical US food processing company is able to generate.

|

| Download spreadsheet |

- Industry structure: A growing market may not translate into high value businesses, if it is crowded and intensely competitive. That market will deliver high revenue growth, but with low or no profitability, and no pathway to sustainable profits and value added. In contrast, a growing market where there are significant barriers to entry and a few big winners can result in high-value companies with large market share and unscalable moats.

- Winners and Losers: Assuming that there is potential for value creation in a market, investors have to pick the companies that are most likely to win in that market. That is difficult to do, when you are looking at young companies in a young market, but there is no way around making that judgment. In a post from 2015, I argued that in big (or potentially big) markets, you can expect companies to be collectively over valued early in the game.

Disclosure: None