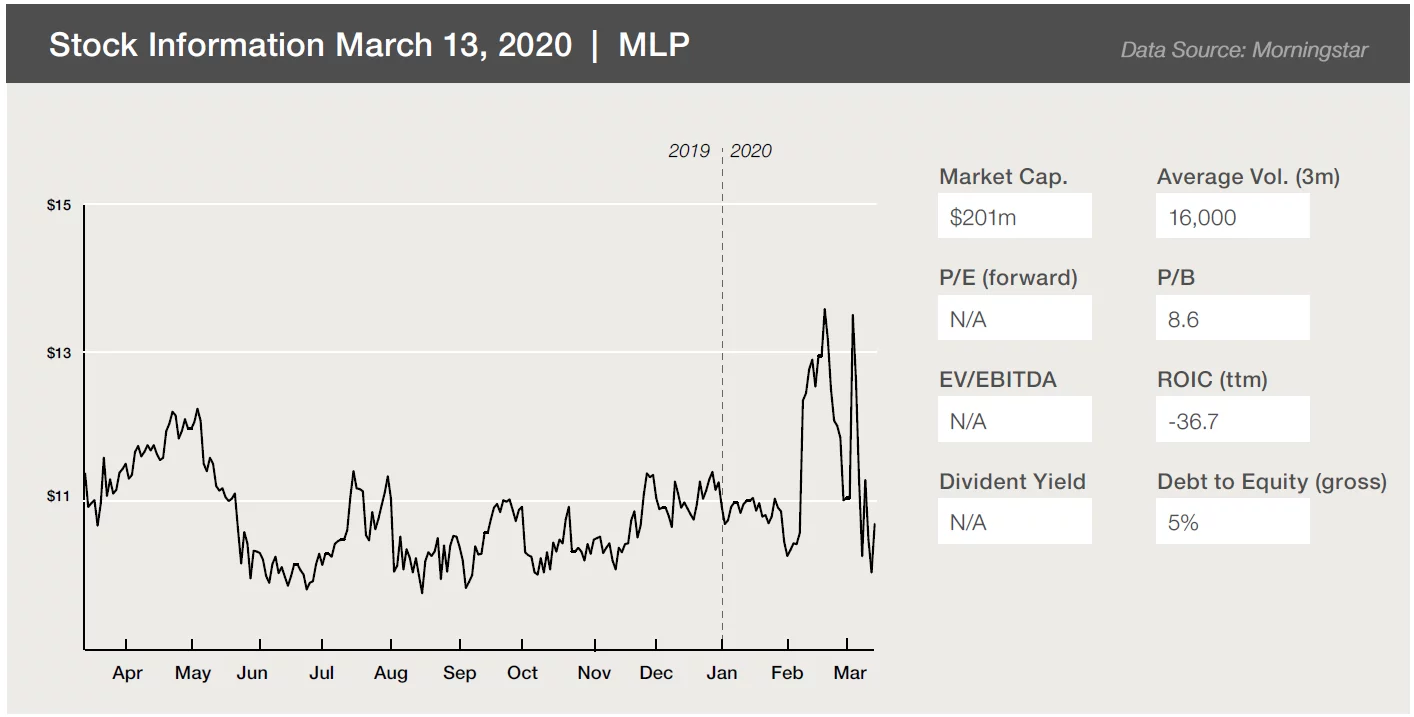

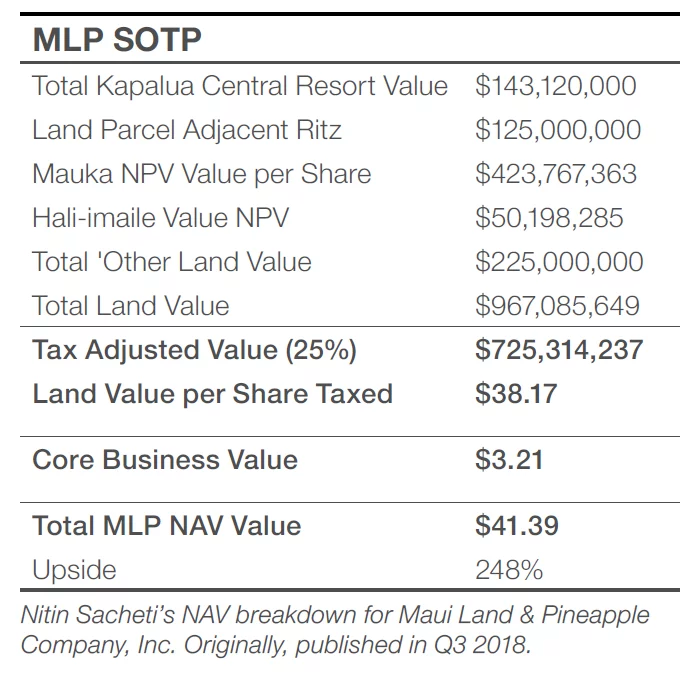

In the Q3 2018 issue of Hidden Value Stocks, Nitin Sacheti of Papyrus Capital presented one of his favorite stock ideas at the time, Maui Land & Pineapple Company, Inc. (NYSE:MLP).

Maui Land & Pineapple began life as a pineapple plantation over 100 years ago and subsequently built up a large landbank. However, the previous management team levered the business up significantly before the financial crisis. As a result, the partnership had to spend the next eight years rebuilding its balance sheet.

Now that the restructuring is complete, Maui Land & Pineapple is focusing on the development, and sale of its incredibly valuable land.

alexkich/Shutterstock.com

In his original thesis, Nitin explained that, based on recent land sales, the ultimate value of Maui Land & Pineapple Company’s land bank could be worth as much as $41 per share, offering a potential upside of 250% at the time.

Since this report was first published, Maui Land & Pineapple Company’s shares have struggled, but after recently agreeing on the sale of a substantial block of land for a price of around $1 million per acre, Nitin believes that this could be about to change.

What’s changed since your original report on the company, which was published in August 2017?

Since my report published in August 2018, the company has announced the sale of 46 acres in their Kapalua Central Resort project for $44 million, with an anticipated Q2/Q3 2020 closing date.

Has the deal altered your original investment case for the company at all?

We had anticipated that the company would either: (1) enter into a development JV for Central Resort or (2) sell the land.

The sale is at a lower price than our expected value of development, but timing is sooner, so it means more cash today. That is more valuable than cash flow over time (on which we put a multiple).

After the sale, the company now has 850 acres of comparable land left to sell. At a sale price of $1 million per acre, this land could be worth up to $850 million.

Do you think that’s a realistic breakdown of the company’s asset value?

I think the Central Resort land is slightly inferior to the rest of the 850 acres. The rest of the property is located in Kapalua, which is closer to the beach. As such, I’d say the rest of the 850 acres is at least worth $1 million an acre. This also does not put any value on MLP’s 10,800 acres of agricultural land and 9,000 acres of conservation land.

We put $20,000/acre on the agricultural land since they can sell/develop it over time (though it’s far inferior to the 900 acres in Kapalua). We put almost no value on the conservation land since this will stay protected. That adds just about another $200 million in value, on top of 850 acres plus cash. This all needs to be taxed at about 25%.

Is the company planning more land sales?

There are another 50 acres just north of Central Resort for which we believe the company has already received offers. We think they can sell this for another $50 million in the near term.

Management has also offloaded the Kapalua Water Company and Kapalua Waste Treatment Company. Can you explain why these deals were necessary for the business?

Selling the water utilities was necessary to improve the plant. The buyer, Hawaii Water Services, is much larger with a lower cost of capital. This will help fund improvements to the facility, which are needed to support so much additional development on Maui Land & Pineapple’s property.

They also have the knowhow to improve the facility. One thing we really like about Maui Land & Pineapple’s management is that they know what they are good at, and are not willing to undertake extensive development projects where they have little expertise.

We believe this speaks to how well they will allocate the $44 million coming in from the recent land sale along with future cash flow from additional land sales.

On that topic, what do you believe management is planning to do with the cash from these asset sales?

I believe management will distribute the cash to shareholders while holding some in reserve for buybacks, taxes, and nominal costs for the development of other projects.

The stock has gone nowhere over the past 12 months. What makes you think this is about to change?

The most considerable pushback on this stock has always been that they would never sell assets, and it would sit as a land bank for many years.

Clearly, the sale of the Central Resort land shows us that they are beginning to sell large pieces of the business to benefit shareholders. That means unlocking value in the stock. The stock has already started moving as investors start to appreciate this (aside from more recent COVID-19 related volatility).

What’s your view of Steve Case, the majority shareholder? Is he working to unlock value?

Steve Case’s father was the attorney for the original land trust. No one would know the assets better than the attorney for the trust. He told his son to buy it, so we know Mr. Case sees value in the asset and is clearly helping drive monetization.

You initially place a SOTP value of $41.39 per share. Has your evaluation of the business changed since the first interview?

I’d say my value of the business still holds at just above $40, but I do believe the substantial Kapalua Central Resort monetization will help the stock get there sooner rather than later!

Are there any developments that could invalidate your thesis and cause you to sell the position?

I think the risks are the same as the original writeup, somewhat mitigated by the asset sale (lower risk of Maui Land & Pineapple developing on their own). There are no new risks to the name that did not exist in 2018.

Disclosure: Papyrus Capital is long MLP, the author of this piece has no position