David S. Winter and David J. Millstone‘s 40 North Management is one of the 749 hedge funds in our database that filed a 13F for the June 30 SEC reporting period. It was an incredibly strong quarter for the basket of hedge funds tracked by Insider Monkey, as approximately 95% of them delivered positive returns with their long portfolio, according to our calculations. In this article, we’ll take a look at the third quarter returns and some of the noteworthy stock picks of 40 North Management during that period.

With a very concentrated public equity portfolio containing just 13 long positions, 40 North Management had over half of its portfolio’s value amassed in two stocks, Cadence Design Systems Inc (NASDAQ:CDNS) and Mattress Firm Holding Corp (NASDAQ:MFRM). Out of 11 positions in companies valued at $1 billion or more on June 30, 40 North Management’s holdings delivered weighted average returns of 23.4% during the third quarter, ranking it as one of the best performing funds in our system. Mattress Firm was the fund’s big performer, nearly doubling in value after it was acquired by Steinhoff.

It should be noted that our calculations may be different from the fund’s actual returns, as they do not factor in changes to positions during the quarter, or positions that don’t get reported on Form 13Fs, like short positions. In this article we’ll take a look at its positions in Cadence and three other stocks and see how they performed in the third quarter.

First up is Cadence Design Systems Inc (NASDAQ:CDNS), in which 40 North Management owned 11.43 million shares on June 30 after trimming its stake by 7% during the second quarter. Given that its equity portfolio had 37.74% exposure to the stock, it’s somewhat surprising that Cadence Design wasn’t leading the charge towards those impressive quarterly returns for the fund. The stock gained a solid but unspectacular 4.7% during the third quarter, while its year-to-date gains stand at just under 20%.

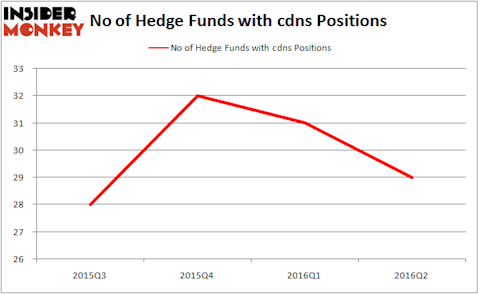

Hedge funds seemed to be perfectly timing their moves into and out of Cadence Design Systems, as ownership of the stock among the funds in our database jumped in the fourth-quarter of 2015, ahead of the stock’s strong first-half of 2016, while ownership declined in each of the first two quarters of this year. 40 North Management had the most valuable position in Cadence Design Systems Inc (NASDAQ:CDNS) on June 30, worth close to $277.7 million, while Panayotis Takis Sparaggis of Alkeon Capital Management held a $156.6 million position. Other hedge funds and institutional investors with similar optimism comprised Mariko Gordon’s Daruma Asset Management, Cliff Asness’ AQR Capital Management, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Follow Cadence Design Systems Inc (NASDAQ:CDNS)

Follow Cadence Design Systems Inc (NASDAQ:CDNS)

Receive real-time insider trading and news alerts

Let’s move on to Columbia Property Trust Inc (NYSE:CXP), which 40 North Management owned 1.84 million shares of at the end of June. What was once a holding valued at over $200 million has been slashed to less than $40 million in value over the past two quarters, as 40 North’s overall equity portfolio has also been cut in half (whether due to bearishness or redemptions is unknown). Columbia Property Trust Inc (NYSE:CXP) posted nearly identical gains as Cadence Design Systems during the quarter, at about 4.6%.

At the end of the second quarter, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a 33% increase quarter-over-quarter. 40 North Management also held the most valuable position in Columbia Property Trust Inc (NYSE:CXP) among those investors, while the second-most bullish fund manager was D E Shaw, with a $21 million position. Some other members of the smart money that held long positions on June 30 contained Israel Englander’s Millennium Management, Dmitry Balyasny’s Balyasny Asset Management, and Jim Simons’ Renaissance Technologies.

Follow Columbia Property Trust Inc. (NYSE:CXP)

Follow Columbia Property Trust Inc. (NYSE:CXP)

Receive real-time insider trading and news alerts

We’ll analyze two other stock picks held by 40 North Management as of June 30 on the next page.