Hotel giant Marriott International, Inc. (NYSE:MAR) has been a great stock to own over the past year, generating a near-18% return. The company has grown in the midst of a tepid U.S. economic recovery and even weathered the European crisis relatively well. At the end of 2012, Marriott represented 24% of all new room construction in North America. The company’s loyalty programs are incredibly effective and are driving revenue at new hotel concepts. But with fears of U.S. sequestration, management remains cautious. Here is what you need to know about Marriott’s earnings and outlook for the rest of 2013.

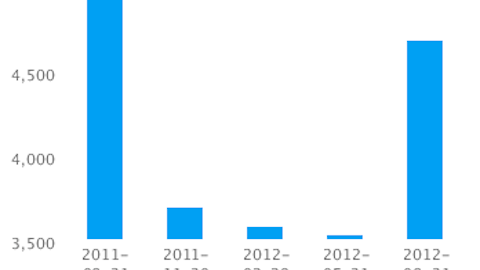

It’s safe to say that Marriott had a good year. For the fourth quarter of 2012, the company earned $0.56 per share, a penny above estimates and a solid $0.10 more than 2011’s earnings. For the full year, Marriott hauled in $1.64 versus $1.31 in the year prior, with top-line earnings of $11.8 billion — $800 million more than in 2011. Keep in mind, this was the company’s performance in a year in which European financial disaster was a common theory along with substantial Middle East instability and a dramatic slowdown in GDP growth among Asian countries. Put that all together with a recovering but not booming U.S. economy, and it’s pretty impressive that Marriott was able to increase earnings by 25%.

Base management and franchise fees were up 7 points in the quarter, driven by growth in the all-important metric for hotels — revenue per available room (RevPAR). The company was able to achieve such healthy bottom-line growth with the help of its impressive 40% operating margin. In the year-ago quarter, the operating margin was 33%.

Across the board, Marriott’s performance looked healthy. In the company’s conference call, management was appropriately enthused.

Good talk

Arne Sorenson, the company’s CEO, was eager to mention Marriott’s recently minted Autograph brand. The company added 24 Autograph hotels in the United States over the last three years, and has 40 hotels worldwide under the Autograph name. The brand is tailored toward Marriott loyalty program members — and it’s working. Forty-five percent of Autograph guests are Rewards guests.

A couple of years ago, the company initiated a strategy to incentivize sales personnel to work outside their territory — typically known as cross-selling. This has been a big boost for the company’s smaller properties, and in 2012 resulted in $250 million in additional revenue for the company.

The company is taking advantage of the idea that the first to recover in a mending economy are the wealthy businessy types: Marriott currently has over 50,000 luxury rooms around the globe under various brands. It is also investing $900 million in its latest high-luxe concept, Edition, which will open hotels in London, New York, and Miami in the coming months.

RevPAR across the various business segments jumped from between the high fours to just under 10%. This means the company is raising rates and having no trouble booking the more expensive rooms.

It’s rather clear by now that Marriott has been doing very well navigating the uncertain global macroeconomic environment — especially in an extremely sensitive industry. But what about the future?

Guidance

Marriott management is expecting RevPAR growth to be between 4% and 7% for 2013. From the look of things, and judging by what management focused on during the conference call, the numbers will likely be higher in the range. The 4% reflects the company’s uncertainty regarding the U.S. sequestration issue. Sorenson went as far as to mention during an interview on CNBC Wednesday that the sequester “will not be good for our business.” Now, I don’t want to sell short the ineptitude of our government, but judging by the last few major economic deadlines, Congress should be able to pull a rabbit out of the hat at the 11th hour and kick the can down the road for the billionth time. Therefore, I do not expect too much disruption in Marriott’s business.

Worldwide, Marriott is planning on opening between 30,000 and 35,000 new rooms — half of which will be in the United States. This bodes well for the company (barring sequestration) going forward, given the increases in RevPAR and improving environments.

Valuation

Marriott has already had a strong rise in stock price over the last 12 months, but can it go higher? On a trailing basis, P/E is very rich at 25 times earnings. Forward earnings aren’t cheap either at 16.5. The company is very well run and, as mentioned, destined to grow. Its EV/EBITDA is 11.29 on trailing-12-month EBITDA. For comparison, Host Hotels and Resorts Inc (NYSE:HST) trades at 13.4 times forward earnings and has an EV/EBITDA of 16.27. Chief competitor Hyatt Hotels Corporation (NYSE:H) is much more expensive at 37.94 times forward earnings but with an EV/EBITDA of just 13.95. The company’s price-to-sales is 1.72 versus Marriott’s 4.86.

Marriott’s valuation seems to be average to a bit richer than its competitors’. Hyatt looks more attractive on a sales basis, and the company put out a strong earnings release recently. In my opinion, however, all of these companies are trading a bit rich for my taste and investors should wait for a dip if they want to own a piece of these businesses.

The article Marriott Continues to Dominate, but Valuation Is Rich originally appeared on Fool.com and is written by Michael B. Lewis.

Fool contributor Michael B. Lewis has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.