Brian Drab: Okay. And then just can we talk a little bit more about gross margin and just with the goal here of trying to understand where the sources of improvement could come from the company was running at like 58% gross margin and then going into ’22 and then ’22 originally you’re expecting 56% in the supply chain, it’s the cost of the FX20. If you could kind of just bridge from that original 56% expectation for this year to the 48 level or 47 or 48 level we’re at now. How much is supply chain, how much FX20, et cetera?

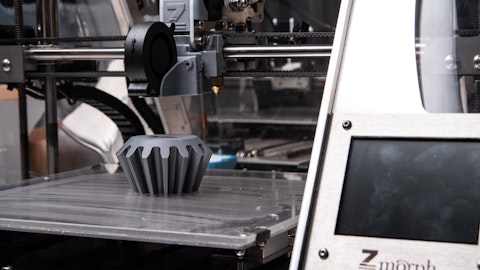

Shai Terem: Brian, this is Shai, thanks for the question. Look, I think as you can see on our product portfolio, we are moving upstream into more and more, I would say, heavy solution that can help our customers to do real industrial production in the point of need. And these solutions are heavier and they are more expensive. And the new product introduction from that perspective is a little bit more, heavier on our balance sheet. And from – it takes time until we get to the normalized cost of them. And so, the FX money is a little bit longer than we expected, but we already see the light. I think we took the right action there. And do you see that we are launching a new product now with the PX100, which is a very, very fast binder jetting solution for metal parts, can do up to 1,050 per hour, it’s also just over $0.5 million solution that we believe will have some impact during 2023.

But for both of them, we are already working behind the scenes to ensure that we go back as Mark suggested to the 65% plus gross margin in 2024.

Mark Schwartz: Hi, Brian, I’ll give you maybe more – two more concrete data points in support of Shai’s comments. So maybe to answer your question specifically, of that 8% delta between 56% and 48%, I think you can divide that almost equally between FX20 and a combination of supply chain and inflationary – pressures that we’re seeing. And in terms of 2023, yes, we expect cost improvements on the FX20. We are continuing to expect the global supply chain pressures will. But that there will still be some pressure and it will continue to act as a headwind even if it’s more modestly than previously. As an example Q1, we didn’t talk about this in our prepared remarks, but we’re expecting our margins to be flat to maybe slightly down in Q1 of this year due to lower revenues that we typically see in Q1.

As you know, seasonality in this business is significant. Q1 is often 20% to 25% below the previous Q4, but having said that, we expect this sort of to be the trough, and that our cost improvements will translate into improved gross margins sequentially throughout 2023 and then beyond.

Brian Drab: Okay, thanks both of you. That’s very helpful.

Mark Schwartz: Thanks, Brian.

Shai Terem: Thank you, Brian.

Operator: Thank you. Our next question is from Troy Jensen with Lake Street Capital Markets. Please proceed with your question.

Troy Jensen: Hi gentlemen, congrats on the good fourth quarter here?

Mark Schwartz: Thanks, Troy.

Shai Terem: Hi, Troy.

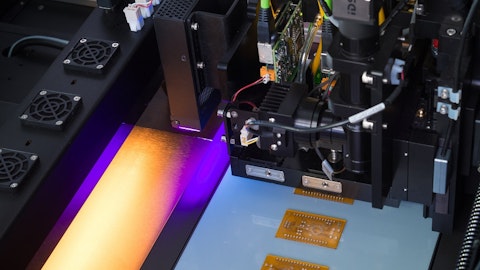

Troy Jensen: Hey Shai, I want to ask you a little bit about metals specifically. I mean, I always thought of you as the carbon reinforced fiber, company and the Mark Two – or the X7, but how successful has Metal X has been? I’m kind of want to tie this all into Digital Metal here, so channel sales, how effective is your channel at selling metal products? Can you talk about maybe the metals that are currently qualified on the Digital Metal platform also?