Markforged Holding Corporation (NYSE:MKFG) Q4 2022 Earnings Call Transcript March 6, 2023

Operator: Greetings, and welcome to the Markforged’s Fourth Quarter 2022 Earnings Conference Call. As a reminder, this conference is being recorded. It is now my pleasure to introduce your host, Austin Bohlig, Director of Investor Relations. Thank you, Austin. You may begin.

Austin Bohlig: Good afternoon. I’m Austin Bohlig, Director of Investor Relations of Markforged Holding Corporation. Welcome to our fourth quarter and fiscal year 2022 results conference call. We will be discussing the results announced in our earnings press release issued after market close today. With me on the call is our President and CEO, Shai Terem; and our CFO, Mark Schwartz. Before we get started, I’d like to remind everyone that management will be making statements during this call that include estimates and other forward-looking statements, which are made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. Any statements contained in this call that are not statements of historical fact should be deemed to be forward-looking statements.

These statements represent management’s views as of today, March 6, 2023 and are subject to material risks and uncertainties that could cause actual results to differ materially. Markforged disclaims any intention or obligation, except as required by law, to update or revise forward-looking statements. Also, during the course of today’s call, we’ll refer to certain non-GAAP financial measures. There’s a reconciliation schedule showing the GAAP versus non-GAAP results currently available in our press release issued after market close today, which can also be found on our website, at investors.markforged.com. I’ll now turn the call over to Shai Terem, President and CEO of Markforged.

Shai Terem: Thank you, Austin, and thank you, everyone, for joining us on our Q4 2022 earnings call. We ended the year strong with a record quarterly revenues as demand for the Digital Forge continue to grow worldwide despite the challenging operating environment. Throughout 2022, we saw more and more manufacturers solve mission critical metal applications on their factory floor using combinations of our metal and advanced composite solutions. And with our effective cost controls, we met our earnings per share target keeping us on our path to profitability. The long term fundamentals of our business continue to be a powerful differentiator as we gain further momentum in our target markets. Additionally, supply chain disruption has been a catalyst for growth as manufacturers shortened their supply chains through industrial point of need production.

I couldn’t be more excited about our vision to make manufacturing more resilient and flexible by using the Digital Forge to address the $43 billion market opportunity available to us today. A great example of a customer harnessing the innovation of the Digital Forge is Texas based Dixie Iron Works. The user solution to achieve an edge in the globally competitive oil and gas industry. When Dixie needed to make an engineering change, their critical o-ring, their supplier quarter the price that would have made their products too expensive. Instead, they designed a better and less expensive version of the part using our X7 printer and since then expanded to a fleet of 6 Markforged X7 printers producing parts on-site in Texas around the clock. Based on their early success with Markforged, Dixie expanded even further with our Metal X solution.

And are now producing critical steel parts with our solution instead of using traditional CNCs. This is a great example of how onshoring industrial production at the point of need can be a competitive advantage for manufacturers. With that said, we still feel a wait-and-see mentality with our manufacturing customers who are concerned by the macroeconomic uncertainty. As such, we have yet to realize what we see as the full growth potential of our product lineup. While we are confident that once the world gets out of the cycle, this bottleneck will open up and our growth will accelerate, we have already taken the required actions to adjust our cost base and ensure we’re still in our path to profitability. Since the second quarter of 2022, we have taken nearly $20 million out of our cost structure after giving effect to the two acquisitions completed in 2022.

Notably, we reduced our costs while investing over $70 million in our innovation pipeline through M&A and R&D. And in 2023, we expect increased operational leverage resulting in a $30 million decline in our cash burn. While in the Americas, we are experiencing delayed purchased decisions as a result of near term macro uncertainty we executed on our growth strategy in both the EMEA and APAC regions in the fourth quarter of 2022, with revenues growing 36% in EMEA and 20% in APAC year-over-year. We anticipate that both of these regions will again achieve outside growth in 2023. In the Americas, we are taking actions to optimize our go-to-market model to accelerate the return to growth and anticipate the benefits of onshoring in the years to come.

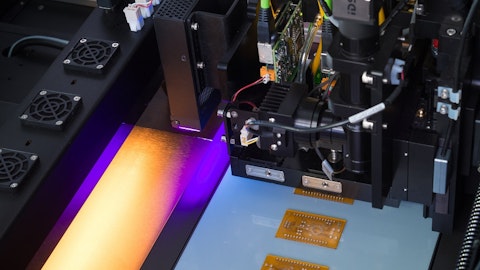

In 2022, we made a meaningful progress towards achieving profitable growth. We materially expanded our addressable market organically through the introduction of the FX20 and inorganically for acquisitions of Teton Simulation and Digital Metal. We are confident that in the next couple of years, we will see accelerated growth from our enhanced product offering and continue to build operational leverage via strong cost control until we get to profitability. In 2022, we began commercializing the FX20, our largest production ready composite solution for manufacturers requiring parts of industrial strength and high temperature resistance. As we mentioned previously, demand for the FX20 has exceeded our expectations. In fact, in its first year of general availability, we received multisystem orders for the FX20 from multiple customers.

We continue to ramp FX20 capacity to meet the expected levels of demand in 2023. But while demand was robust, we were short of our FX20 cost target. This shortfall resulted in a decrease of our gross margins in Q4. We expect cost improvements in Q1 and throughout 2023 and intend to reach our production cost target in the next year. We successfully executed on our M&A strategy in 2022 acquiring two companies with products that we expect to expand our addressable market opportunity in 2023 and beyond. The first, Tetan Simulation enabled manufacturers to have a greater confidence that their part will meet certain specification in mission critical applications, removing a key barrier to additive manufacturing adoption. We integrated the technology into the Digital Forge for a feature known as Simulation and rolled out a free beta to all of our customers in Q4.

The response from our customers has been positive with thousands of trial registrants to date and part simulated in our software prior to production. We expect to offer simulation as a component of a tiered SaaS subscription offering that we plan to launch in Q2 this year. Our second acquisition, Digital Metal closing Q3 2022 and expands our addressable market into high throughput production of precise and use metal parts, a key long term growth strategy. In Q1 2023, we plan to launch the TX100, which doubles the speed compared to the previous model up to 1,000 CC per hour and build size up to 10 liters to ensure high volume production of end use metal parts for lower cost per part. Initial customer reaction has been positive and we expect this line to contribute to our revenue growth in 2023 and beyond.

A great example of our digital metal solution is open new markets for Markforged comes from our customer Distalmotion, a Swiss based medical device company that manufactures cutting edge robotic surgical systems. Serial production parts from our metal binder jetting solution are used in real life medical procedures. This is a great example of how our solution gives manufacturers the flexibility in their supply chains that is needed to make life changing break for us. Manufacturing has changed. We are at the inflection point as manufacturers use our Digital Forge to deliver more resilient and flexible solutions for the manufacturing shore. Supported by our robust balance sheet and strong innovation pipeline, we continue to execute on our strategy towards profitable growth and feel confident in our business fundamentals.

With that, I now turn the call over to Mark Schwartz, our CFO, who will offer more details on our financial performance and guidance for the remainder of the year.

Mark Schwartz: Thanks, Shai. Let’s turn to our financial results for the fourth quarter and the full year of 2022, as well as our guidance for fiscal year 2023. Please note that my comments reflect our non-GAAP results and outlook. For your reference, our earnings press release, issued earlier this afternoon and posted to our Investor Relations website includes our GAAP to non-GAAP reconciliation to assist with my commentary. For the fourth quarter 2022, revenue increased 11% to $29.7 million compared with revenue of $26.6 million for the fourth quarter 2021. Gross profit for the fourth quarter 2022 was $14.1 million compared to $15.3 million in the fourth quarter of 2021. As a result, we achieved a 47.5% gross profit margin for the fourth quarter 2022 compared to 57.6% for the fourth quarter of 2021.

Operating expenses in the fourth quarter 2022 were $29.4 million compared to $26.3 million for the fourth quarter 2021. Research and development expenses in the fourth quarter 2022 increased to $10.7 million compared with $8.8 million in the fourth quarter 2021. Net loss for the fourth quarter 2022 was $13.3 million or $0.07 per share based on our weighted average shares outstanding for the quarter of 194.3 million shares. For the fiscal year 2022, our revenue increased 11% to $101 million compared with revenue of $91.2 million for the full year 2021. We experienced growth across hardware, consumables and services with the EMEA and APAC regions growing 18% and 41% respectively for the year as compared to fiscal year 2021. For fiscal year 2022, gross profit was $51.3 million compared to $53.4 million for fiscal year 2021 reflecting a 50.8% gross profit margin in 2022 compared to 58.5% in the prior year.

We believe, we will sustain our strong gross margins as a result of our cost control and our focus on serving the demanding markets for machinery and automation, maintenance, repair and operations and mission critical part production. For fiscal year 2022, our operating expenses were $114.3 million. Our research and development expenses were $37.8 million in 2022, compared with $27.5 million in 2021 as we ramped up our R&D teams consistent with our commitment to accelerate new product time to market. We remain committed to our strategy of increasing our addressable market through product innovation with every software development, system release or additional material, thus increasing the value of our Digital Forge platform to our customers.

For the fiscal year 2022, our net loss was $60.1 million or $0.32 per share based on our weighted average shares outstanding of 189.7 million shares. Now onto our guidance, we anticipate fiscal year 2023 revenues to be within the range of $101 million to $110 million. As we cannot predict the macro environment, this guidance assumes a continuation of the existing global economic uncertainties and challenges. As I mentioned before, we expect our strong gross margins to be sustainable with fiscal year 2023 non-GAAP gross margin expected to be in the range of 47% to 49%. The expense disciplines we exert over our operating expenses will continue to show leverage in 2023. We expect operating expenses to decline as a percentage of our revenue including the impact of the two acquisitions we completed in 2022, resulting in a non-GAAP operating loss in the range of $55 million to $58 million for the full year.

Finally, we expect non-GAAP EPS results for the full year to be a loss in the range of $0.27 to $0.29 per share. As Shai mentioned earlier in his remarks, Since the second quarter of 2022, we have removed approximately $20 million of our cost structure after giving effect to the two acquisitions completed in 2022. However, our cost controls are not simply the result of realizing cost synergies through M&A. We rationalize our operating expenses through a rigorous prioritization of innovation and customer facing activities, first regularly realigning our teams to these priorities from moats operational leverage and a focus on our most important initiatives. Further in 2023, we expect to reduce our annual cash burn, excluding any potential M&A activities by $32 million or 39% to approximately $50 million.

This will be realized through added gross profit from higher revenues, inventory reductions, working capital improvements and increased yields on our cash and equivalents and short-term instruments. We expect to end 2023, with a balance of approximately $120 million in cash and equivalents and short-term investments. We invested heavily in 2021 and 2022, to create an infrastructure that supports our long-term innovation and go-to-market objectives for profitable growth. We continue to believe our plans are achievable particularly given the strength of our innovation roadmap, our product portfolio and disciplined cost controls. We are excited for the future. That concludes our prepared remarks today. Operator, please open up the call for questions.

See also 13 High Growth Pharma Stocks that are Profitable and 10 High Growth Micro-cap Stocks to Buy .

Q&A Session

Follow Markforged Holding Corp (NYSE:MKFG)

Follow Markforged Holding Corp (NYSE:MKFG)

Receive real-time insider trading and news alerts

Operator: Thank you. Our first question is from Greg Palm with Craig Hallum Capital Group. Please proceed with your question.

Greg Palm: Yes. Good afternoon, everybody. Thanks for taking the questions here. I guess just starting off with the actual quarter, the geographic disparity was quite large. I’m just curious if you can go a little bit more detail on what you saw across the various geographies, specifically in EMEA, which was the real standout?

Shai Terem: Sure. So as we shared, Greg, in the U.S. we still see the sensitivity to the SMO inflation recession. But other than that in EMEA, I think once — I think manufacturing there clear view that we would actually manufacture during the winter and energy prices went down. Our customers came back into work. We also had some good changes there on the leadership, which also helped. And I think we saw a very good growth there across the entire product portfolio. APAC, I think it’s usually a year after what we’ve seen in the rest of the world. And I think for them, it’s still a business as usual. Maybe slight, I would say, decreasing the growth there in Australia. But all in all, I think very good growth worldwide.

Mark Schwartz: I’ll add to that a little bit, Greg, and thanks for the question. EMEA and APAC were unplanned internally for us anyway in Q4. And we anticipate both of these regions will again achieve good growth in 2023. Specifically in APAC, we’re seeing success in factory automation and in automotive. I think in EMEA, it’s more or less across the board. We see it in defense and automation in automotive, et cetera.

Greg Palm: That’s helpful. And I’m curious specific to the FX20, this somewhat ties back into the geographic question, but can you just comment on where you’re seeing the most interest whether that be geographically whether that’s by end market or vertical? And I guess in terms of new versus existing customers, do you have any sense of maybe the breakdown of shipments last year?

Shai Terem: Yes, we still see very strong demand for the FX20. I would say even better than expected. And I think because it’s a very unique product that has some capabilities which are differentiated, we still see strong demand even in the U.S. route, with sometimes multisystem orders. Yes, we feel a big believer that this is just the beginning with FX win and especially as we continue to add more materials into it.

Greg Palm: And just to be clear in terms of the multi system orders that you alluded to, were those initial multi-unit orders or were those follow-ons?

Shai Terem: Follow-ons. So that’s why we are a little bit positively surprised because it’s mainly going into aerospace applications, we expected the certification process to be longer, but we see some cases that it was proven fairly fast. And moved into higher level production even within the first year. So this is why we’re a little bit positive with the price here.

Greg Palm: Okay. Makes sense. I will leave it there. Best of luck. Thanks.

Mark Schwartz: Thanks, Greg.

Shai Terem: Thank you, Greg.

Operator: Thank you. Our next question is from Shannon Cross with Credit Suisse. Please proceed with your question.

Ashley Lessen: Hi. This is Ashley Lessen on for Shannon today. Mark, could you discuss how much conservatism is baked into your revenue guide? Are you sort of assuming what you saw in fourth quarter will maybe play out and improve? Are you expecting a lengthening of sales cycles before things get better? And then I have a follow-up.