Artisan Partners, an investment management company, released its “Artisan Small Cap Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. In the third quarter, its Investor Class fund ARTSX returned -7.98%, Advisor Class fund APDSX posted a return of -7.96%, and Institutional Class fund APHSX returned -7.97%, compared to a return of -7.32% for the Russell 2000 Growth Index. From a sector perspective, allocation impacts drove the sector’s underperformance, while security selection was positive. From an allocation perspective, the portfolio was hurt by its lack of exposure to energy and overweight exposure to health care. In addition, please check the fund’s top five holdings to know its best picks in 2023.

Artisan Small Cap Fund highlighted stocks like MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) in the third quarter 2023 investor letter. Headquartered in Lowell, Massachusetts, MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) designs and manufactures analog semiconductor solutions. On November 30, 2023, MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) stock closed at $83.98 per share. One-month return of MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) was 11.91%, and its shares gained 22.12% of their value over the last 52 weeks. MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) has a market capitalization of $5.98 billion.

Artisan Small Cap Fund made the following comment about MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) in its Q3 2023 investor letter:

“Among our top contributors were Argenx, Guidewire Software and MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI). MACOM Technology Solutions designs and manufactures high-performance semiconductor products in the aerospace and defense, industrial, telecommunication and data center end markets. The company’s relatively new management team is taking steps to accelerate top-line growth and expand margins by addressing smaller, long-duration product cycle markets in which it can provide a differentiated offering, especially in compound semis (those made from two or more elements). The company also is a member of the US Department of Defense’s trusted foundry program, meaning it is a trusted manufacturer for US military and aerospace applications. In August, shares rallied after MACOM announced it was acquiring Wolfspeed’s radio frequency (RF) business. The RF business includes a portfolio of gallium nitride (GaN) on silicon carbide (SiC) products that serve a broad customer base of leading aerospace, defense, industrial and telecommunications customers. We view the acquisition as extremely accretive, which led us to increase our position.”

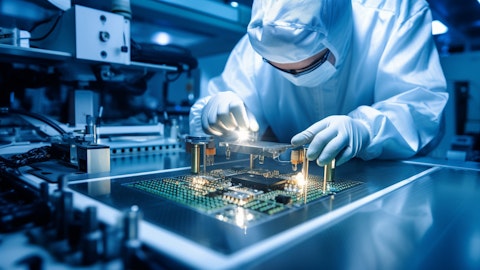

An aerial view of a semiconductor factory, with its intricate machinery and equipment.

MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 13 hedge fund portfolios held MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) at the end of third quarter which was 17 in the previous quarter.

We discussed MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) in another article and shared Aristotle Capital Small Cap Equity Strategy’ views on the company. In addition, please check out our hedge fund investor letters Q3 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 11 Best Long Term Growth Stocks To Invest In

- 12 Best Mineral Stocks To Buy Now

- 12 Best Seasonal Stocks To Buy Now

Disclosure: None. This article is originally published at Insider Monkey.