Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track more than 700 prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile gigantic failures like hedge funds’ recent losses in Valeant. Let’s take a closer look at what the funds we track think about LyondellBasell Industries NV (NYSE:LYB) in this article.

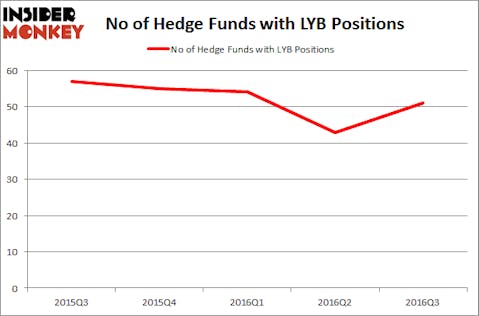

LyondellBasell Industries NV (NYSE:LYB) has experienced an increase in hedge fund sentiment recently. LYB was in 51 hedge funds’ portfolios at the end of the third quarter of 2016. There were 43 hedge funds in our database with LYB holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Boston Scientific Corporation (NYSE:BSX), PG&E Corporation (NYSE:PCG), and Prudential Financial Inc (NYSE:PRU) to gather more data points.

Follow Lyondellbasell Industries N.v. (NYSE:LYB)

Follow Lyondellbasell Industries N.v. (NYSE:LYB)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

hywards/Shutterstock.com

Now, we’re going to take a peek at the key action encompassing LyondellBasell Industries NV (NYSE:LYB).

What does the smart money think about LyondellBasell Industries NV (NYSE:LYB)?

At the end of the third quarter, a total of 51 of the hedge funds tracked by Insider Monkey were long this stock, a change of 19% from the previous quarter. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Soroban Capital Partners, managed by Eric W. Mandelblatt, holds the number one position in LyondellBasell Industries NV (NYSE:LYB). Soroban Capital Partners has a $445.2 million position in the stock, comprising 2.7% of its 13F portfolio. Coming in second is Viking Global, managed by Andreas Halvorsen, which holds a $319.4 million position; 1.4% of its 13F portfolio is allocated to the company. Some other professional money managers with similar optimism comprise Cliff Asness’ AQR Capital Management, and David Cohen and Harold Levy’s Iridian Asset Management.

With a general bullishness amongst the heavyweights, specific money managers were leading the bulls’ herd. As mentioned above, Soroban Capital Partners established the most outsized position in LyondellBasell Industries NV (NYSE:LYB). The other funds with brand new LYB positions are Dmitry Balyasny’s Balyasny Asset Management, and Benjamin A. Smith’s Laurion Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as LyondellBasell Industries NV (NYSE:LYB) but similarly valued. These stocks are Boston Scientific Corporation (NYSE:BSX), PG&E Corporation (NYSE:PCG), Prudential Financial Inc (NYSE:PRU), and Liberty Global PLC LiLAC Class C (NASDAQ:LILAK). This group of stocks’ market caps are closest to LYB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BSX | 46 | 1735257 | -1 |

| PCG | 23 | 1088480 | -3 |

| PRU | 28 | 520358 | -7 |

| LILAK | 43 | 941029 | -19 |

As you can see these stocks had an average of 35 hedge funds with bullish positions and the average amount invested in these stocks was $1.07 billion. That figure was $2.44 billion in LYB’s case. Boston Scientific Corporation (NYSE:BSX) is the most popular stock in this table. On the other hand PG&E Corporation (NYSE:PCG) is the least popular one with only 23 bullish hedge fund positions. Compared to these stocks LyondellBasell Industries NV (NYSE:LYB) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.