In this article, we discuss long-term returns of Scott Ferguson’s activist targets. If you want to see more stocks in this selection, check out Long Term Returns of Scott Ferguson’s 5 Activist Targets.

Scott Ferguson is a portfolio manager who has perfected the art of leveraging value-oriented strategies to reap substantial returns while investing. A protégé of renowned activist investor Bill Ackman, Ferguson has risen up the ranks to become one of the most respected value-oriented investors on Wall Street. The founder and managing partner at Sachem Head Capital specializes in investing in undervalued and underperforming companies.

Founded in 2012, Sachem Head Capital had about $3.9 billion in assets under management as of the beginning of 2023 and has been one of the best-performing hedge funds with a portfolio gain of 102.14%.

Ferguson has made a name for himself as an aggressive, active investor focused on pursuing strategic initiatives to unlock underlying value. The hedge fund manager often seeks board representation, influence, and operational improvements in companies he gets involved in. He is also on record calling for capital allocation changes and pushing for mergers and acquisitions if they have the potential to unlock hidden value.

Our Methodology

Ferguson has been engaged in various proxy battles with multiple companies’ boards, all in the effort of unlocking value. We have analyzed some of the biggest plays and strategies the activist investor pursued to unlock shareholder value.

Long-Term Returns of Scott Ferguson Activist Targets

13. CDK Global Inc (NASDAQ:CDK)

Activist Investment: 2014

Long Term Returns Since Ferguson’s Investment: 58%

S&P 500 Gain Since Ferguson’s Investment: 130%

CDK Global Inc. (NASDAQ:CDK) is a leading retail technology provider and software as service solutions. The company offers solutions that help dealers and auto manufacturers run their businesses more efficiently to drive profitability and create frictionless purchasing. In 2014, Sachem Head Capital took out a 7.88% stake in the company, insisting that the stock was undervalued and was an attractive investment.

The activist investor also reiterated it planned to hold discussions with the board of directors and stockholders on issues including governance and board composition. It also planned to discuss management operations capitalization and financial condition.

12. Zoetis Inc. (NYSE:ZTS)

Activist Investment: 2014

Long Term Returns Since Ferguson’s Investment: 64%

S&P 500 Gain Since Ferguson’s Investment: 16%

Zoetis Inc. (NYSE:ZTS) is a leading player in the drug manufacturing industry, specializing in discovering, manufacturing, and commercializing animal health medicines, vaccines, and diagnostic products. The company commercializes products across species, including livestock, cattle, swine, poultry, fish, sheep, etc.

In 2014, Sachem Head Capital teamed up with Pershing Square Capital Management, headed by Bill Ackman, to acquire an 8.5% stake in Zoetis. The investment came from the strong belief that the company had a strong product portfolio and a significant market opportunity but needed to cut costs and explore strategic alternatives.

Following the investment, the two activist investors nominated four directors for the company’s board. In addition, the company agreed to cut $500 million in operating costs and increased its share buyback authorization following mounting pressure from activist investors. Zoetis Inc. (NYSE:ZTS) also agreed to review its business portfolio.

In 2016, Zoetis confirmed it had achieved its cost-cutting targets ahead of schedule and would continue to invest in growth. Nevertheless, Zoetis Inc. (NYSE:ZTS) decided to retain its core business of livestock and animal health.

11. Autodesk, Inc. (NASDAQ:ADSK)

Activist Investment: 2015

Long Term Returns Since Ferguson’s Investment: 40%

S&P 500 Gain Since Ferguson’s Investment: 7.8%

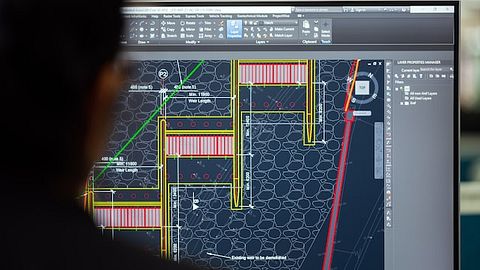

Autodesk, Inc. (NASDAQ:ADSK) is a company that provides 3D design, engineering, and entertainment technology solutions. The company is best known for offering AutoCAD Civil, a surveying design analysis and documentation solution for civil engineering. In 2015, the company was targeted by activist investor Ferguson, who acquired a 5.7% stake.

10. Whitbread plc (LSE:WTB.L)

Activist Investment: 2017

Long Term Returns Since Ferguson’s Investment: 3.2%

S&P 500 Gain Since Ferguson’s Investment: 96.3%

Whitbread is a British company that operates hotels and restaurants worldwide. It operates restaurants under the Brewers Fayre Beefeater, Cookhouse & Pub, and Bar+Block Steakhouse brands. The stock jumped the most in more than eight years after Sachem Head Capital took a 3.4% stake in the company.

With Sachem Head Capital, speculation was rife that the company would be forced to pursue strategic alternatives to unlock shareholders’ value. Top on the list was the sale of Costa Coffee and the leaseback of assets.

The company would bow to pressure and announced that it would pursue the spinoff of its Costa Coffee unit in 2018, therefore providing investors with investments in two distinct businesses. The breakup of the Costa Coffee unit from the hotels and restaurant business was seen as one of the best options for boosting the value of the individual businesses.

9. 2U, Inc. (NASDAQ:TWOU)

Activist Investment: 2019

Long Term Returns Since Ferguson’s Investment: -65%

S&P 500 Gain Since Ferguson’s Investment: -4.24%

2U, Inc. (NASDAQ:TWOU) is an online education platform that operates through Degree Programs and Alternative Credential segments. It provides colleges and universities with technology and services that allow them to offer degree programs online. Sachem Head Capital started building a position in the education software provider in 2019.

With the investment, the activist investor started pushing the company to explore strategic alternatives, including a complete sale. The hedge fund insisted that the company, which helps universities launch online master’s degree programs, would be a perfect takeover target of private equity firms or other education technology companies.

Despite facing governance issues, Sachem Head believed the company was a top provider in the space with a high-quality portfolio of academic partners, including Yale University. The activist investor exited its position in 2U, Inc. (NASDAQ:TWOU) in 2020.

8. Instructure Holdings, Inc. (NYSE:INST)

Activist Investment: 2019

Long Term Returns Since Ferguson’s Investment: 22.5%

S&P 500 Gain Since Ferguson’s Investment: 20%

Instructure Holdings, Inc. (NYSE:INST) is an education software company specializing in delivering dynamic learning experiences to students across the globe. It operates as an education technology company focused on elevating student success. The company was the subject of activist investor pressure in 2019 after Ferguson, through Sachem Head Capital, confirmed a 7% stake in the company and confirmed plans to push for strategic alternatives, including the sale of the business.

The activist investor hedge fund, which had been accumulating stakes in the company, pushed for a full sale process seen as the only way of unlocking value at the time. The hedge fund believed Instructure Holdings, Inc. (NYSE:INST) could generate interest among private equity and publicly traded companies.

The company behind the Canvas learning management software, which is widely used by schools and colleges, went private in 2020 after a $2 billion deal with Thoma Bravo, a private equity firm.

7. Eagle Materials Inc. (NYSE:EXP)

Activist Investment: 2019

Long Term Returns Since Ferguson’s Investment: 173%

S&P 500 Gain Since Ferguson’s Investment: 72%

Eagle Materials Inc. (NYSE:EXP) is a leading manufacturer of basic construction materials used for residential, commercial infrastructure, and energy applications. It operates under four segments: of Cement Concrete Gypsum Wallboard and Recycled Paperboard. Sachem Head Capital took a 9% stake in the company in 2019 and consequently nominated two directors to the board.

6. Olin Corporation (NYSE:OLN)

Activist Investment: 2020

Long Term Returns Since Ferguson’s Investment: 292%

S&P 500 Gain Since Ferguson’s Investment: 78.81%

Olin Corporation (NYSE:OLN) is a company engaged in the manufacturing and distributing chemical products and ammunition. Its chemical products include chlorine, caustic soda epoxy, hydrochloric acid, and bleach. Activist investment firm Sachem Head Capital started building positions in the company in 2020 and outlined plans to nominate four directors. In regulatory filings, it revealed owning 14.95 million shares or a 9.4% stake in the company.

In addition, Ferguson said they are focused on engaging management and shareholders on issues related to business management, operations, assets capitalization, and financial condition. The activist investor also planned to explore strategic plans and board composition. Ferguson got a seat on the board and engineered the appointment of a new CEO, Scott Sutton, who helped turn around Olin Corporation (NYSE:OLN)’s fortunes.

Ferguson resigned from the board at the end of 2022, insisting he had served with a talented management team and navigated COVID successfully. He touted his tenure on the board as a great success with remarkable turnaround and creating extraordinary value for shareholders.

Click to continue reading and see Long Term Returns of Scott Ferguson’s 5 Activist Targets.

Suggested articles:

- 12 States With The Largest Refining Capacity

- Goldman Sachs Defense Stocks: Top 10 Stock Picks

- 15 Countries That Produce the Most E-waste in the World

Disclosure: None. Long-Term Returns of Scott Ferguson Activist Targets is originally published on Insider Monkey.