Fertilizer companies are split into two main camps, the nitrogen names such as Terra Nitrogen Company, L.P. (NYSE:TNH) and Agrium Inc. (NYSE:AGU) , which are reporting record earnings thanks to continually depressed natural gas prices. Then there are the potash names, such as

Fertilizer names that rely on natural gas have been reaching record high valuations as the price of natural gas falls. The cost of natural gas can account for up to 80% of the production cost of nitrogen-based fertilizer.

Where to invest?

Based on the current market, a nitrogen-producing stock would be your best bet. In addition, nitrogen fertilizer has to be constantly re-spread, unlike potash, which can be mixed into the soil and left for an extended period. Thus, buyers will tend to buy more nitrogen-based fertilizer.

In the chart below, we’ve listed the difference in company structures because master limited partnerships must distribute 90% of their income to partners. They also come with their own set of tax issues compared to regular stocks.

| Company | Company structure | Nitrogen/potash based | Market Cap | 5-yr EPS Growth | P/E | Yield |

| Terra Nitrogen | Master Limited Partnership | Nitrogen | $4.4B | 44% | 14.6 | 6% |

| CF Industries (NYSE:CF) | Incorporated Company | Nitrogen + Potash | $13B | 105% | 7.5 | 0.8% |

| Agrium | Incorporated Company | Nitrogen | $16B | 97% | 12 | 0.9% |

| CVR Partners | Master Limited Partnership | Nitrogen | $2B | 55% | 13.6 | 3% |

| PotashCorp | Incorporated Company | Potash | $35B | 17% | 17 | 2.8% |

| Mosaic | Incorporated Company | Potash | $25B | 36% | 14 | 1.7% |

| Average | 59% | 13 | 2.5% |

Out of these six producers, I am going to look at three closely.

Terra Nitrogen Company, L.P. (NYSE:TNH) is the highest-yielding, thanks to its master limited partnership structure. The company has produced below-average EPS growth for the past five years, and is a nitrogen focused producer.

CF Industries has achieved the best EPS growth over the past five years. The company produces fertilizer from both and nitrogen and potash, and currently has the lowest P/E ratio in the group.

Agrium Inc. (USA) (NYSE:AGU) has achieved the second-highest EPS growth over the past five years. The company is the second cheapest in the group by P/E ratio, and is another nitrogen-based producer.

Margins

The three companies I am looking at are all nitrogen-based producers. One of the reasons they have been so successful over the past five years is because of their profit margins and highly cash-generative nature.

Terra Nitrogen Company, L.P. (NYSE:TNH) has achieved the best profit margins over the past few years. The gradual decline in the price of natural gas since 2009 has meant that net margins have grown every year consistently since 2009.

As the smallest of the three, Terra Nitrogen Company, L.P. (NYSE:TNH) has the lowest costs, translating directly into larger profits. In comparison, Agrium Inc. (USA) (NYSE:AGU), the largest of the three, has the lowest net profit margin, due to higher admin and sales costs.

| TNH | ||||||

| $US Millions | 2009 | 2010 | 2011 | Q1 2012 | Q2 2012 | Q3 2012 |

| Revenue | 508 | 565 | 799 | 197 | 196 | 181 |

| Gross profit | 178 | 231 | 556 | 152 | 159 | 139 |

| Margin | 35.00% | 40.90% | 69.63% | 77.20% | 81.40% | 76.90% |

| Net Profit | 144 | 200 | 505 | 124 | 153 | 131 |

| Margin | 28.40% | 35.40% | 63.28% | 63.10% | 78.40% | 72.10% |

The table shows the profit margins that Terra Nitrogen Company, L.P. (NYSE:TNH) is managing to achieve, partly thanks to its relatively small size and partly thanks to low natural gas prices. Terra’s margins have steadily increased since 2009 as the price of natural gas fell. Indeed, these high gross margins have flowed through onto the company’s net margin making Terra by far the most efficient company of the group.

| AGRIUM | ||||||

| $US Millions | 2009 | 2010 | 2011 | Q1 2012 | Q2 2012 | Q3 2012 |

| Revenue | 10,411 | 10,836 | 15245 | 3,634 | 6,907 | 2,949 |

| Gross profit | 2,250 | 2,942 | 4654 | 892 | 2,002 | 920 |

| Margin | 21.60% | 27.10% | 30.88% | 24.60% | 29.00% | 31.20% |

| Net Profit | 416 | 735 | 1348 | 155 | 869 | 128 |

| Margin | 4.00% | 6.80% | 8.20% | 4.30% | 12.60% | 4.40% |

Agrium Inc. (USA) (NYSE:AGU), unlike Terra produces a wide variety of fertilizer products. Unfortunately, this has translated into lower gross and net margins for the business. In addition, due to Agrium Inc. (USA) (NYSE:AGU)’s size, the company has higher management costs, which reduce net margins even more.

| CF | ||||||

| $US Millions | 2009 | 2010 | 2011 | Q1 2012 | Q2 2012 | Q3 2012 |

| Revenue | 2,608 | 3,965 | 6098 | 1,528 | 1,736 | 1,359 |

| Gross profit | 1,028 | 1,618 | 3420 | 913 | 1,130 | 791 |

| Margin | 39.40% | 40.80% | 55.90% | 59.70% | 65.10% | 58.20% |

| Net Profit | 449 | 441 | 1761 | 432 | 678 | 458 |

| Margin | 17.20% | 11.10% | 28.73% | 28.30% | 39.10% | 33.70% |

CF Industries is a potash- and nitrogen-based producer, which gives the company the best of both worlds and perhaps the most flexibility and security. In addition, Terra Nitrogen is an indirect, wholly owned subsidiary of CF Industries, so CF gains some of Terra’s strong cash flow.

As the table shows, CF produces gross margins of around 60%, up from 40% in 2009 thanks to natural gas prices. Unlike Agrium Inc. (USA) (NYSE:AGU), CF manages to translate the majority of its gross profit into net profit, making the company look highly cash generative.

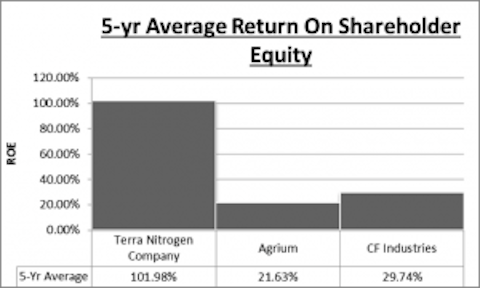

Return on Shareholder Equity

Return on shareholder equity is a good measure of how profitable a company is, and how good the management is at improving the balance sheet. Return on shareholder equity also highlights how efficient the company is, and what kind of return on investment shareholders can expect.

Terra Nitrogen is by far the best here. The company’s cash-producing operations have allowed the management to build its net cash balance, while still spending on capital expenditures.

However, over the past five years, both Agrium and CF have managed to produce a ROE of about 4% per year. Indeed, Mosaic and PotashCorp — the potash producers who have underperformed with other valuation metrics — produced an average ROE of 5.5% for the same period. Although these nitrogen producers have grown more quickly, they have not been able to utilize their free cash as well as the potash producers.

Cash Flows

Cash flow statements for fiscal 2012

| $US Millions | Terra Nitrogen | CF Industries | Agrium |

| Operating Cash Flow | 425 | 1953 | 1112 |

| Investing Cash Flow | -22 | -220 | -925 |

| Dividends | -422 | -77 | -42 |

| Issuance/(Reduction) of Debt, Net | 0 | -13 | 387 |

| Change in Capital Stock | 0 | -489.3 | 8 |

| Net Change in Cash | -20 | 1014 | 514 |

| Net Cash/Debt | 160 | -610 | -1000 |

Terra Nitrogen once again has the winning cash flow. As I have already mentioned, the company is a limited partnership, therefore it returns the majority (90%) of its profit to shareholders through dividends or cash distributions. Terra Nitrogen is the only business in this analysis that has a net cash balance.

That said, CF industries has a solid cash flow and is returning cash to shareholders through both dividends and stock buybacks. Even so, CF still has cash to spare, and a net change in cash of $1 billion over 2012 has allowed the company to work on reducing net debt.

Agrium is at the back of the group once again. The company is using the majority of its operating cash flow on investing, and as a result, it’s having to issue debt to remain cash flow-positive. In addition, the company pays the smallest dividend (by dollar volume) in the group.

Conclusion

Overall, the best fertilizer company appears to be Terra Nitrogen, despite being the smallest. Terra has the best margins, has produced the best return on equity and has plenty of free cash, which is has to return to shareholders or re-invested due to its partnership structure.

However, I am hesitant about Terra’s size, and the fact that the company only has one manufacturing facility.

CF industries came out as the next best company in this group, and it’s a major shareholder of Terra Nitrogen. So, on that basis, I believe CF industries could be the best company of this group, both for economies of scale and its holding in Terra Nitrogen.

The article Long Term Investing in Fertilizer originally appeared on Fool.com and is written by Rupert Hargreaves

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.