Steven Hedlund: And Mig, I would just add that there’s long cycle portions of our business and they’re short-cycle portions of our business. And the long cycle that we have visibility to, we’re pretty confident and comfortable in. The short cycle is choppy. There are a lot of puts and takes, right? As you note, the yellow equipment guys are likely going to take down production. We saw that starting to happen in the first quarter. We expect that to continue to happen in the second quarter. The expectation that Gabe outlined earlier, already incorporates that continued softness in that sector. We see challenges in Europe. The macroeconomic conditions there are not very favorable for us at the moment. But we see some encouraging signs in the Americas, particularly when you look at the general industry consumable portion of our business, which is probably our best canary in the coal mine, it’s holding steady, and we see improving sentiment, and we’re expecting that sentiment to translate into higher activity and higher orders in the second half of the year.

Again, we don’t have a lot of orders on the books for consumables for the second half. So those are still to come, but we’re optimistic. But beyond that, we can’t really control the end market conditions. We can control our strategy and our execution. We’re very happy with our performance to date, very confident in our strategy and confidence in the team, and we’re just going to keep driving our agenda forward.

Operator: Your next question comes from the line of Steve Barger with KeyBanc Capital Markets.

Steve Barger: In the slides about RedViking, you mentioned new capabilities with the MES software. Can you talk about the need, if any, for software interoperability across your portfolio? And then longer term, what do you expect recurring revenue from software and service will be as a percentage of the automation business?

Steven Hedlund: Yes, Steve. So if you think about an automation cell or a collection of automation cells, there’s a lot of information we can take out of that system in terms of production throughput and part genealogy so we can trace which sell at which shift a given part was made and the like. That information is all available in the cell, and we have access to it. But getting that from the cell into the customer’s ERP system is a challenge for a lot of customers. So they want the visibility and the traceability of that data, but they want it to be integrated and systems are already running not a separate system. And that’s really with the MES software at RedViking positions us better to be able to do. As far as the percentage of the business that software I don’t have a good figure for you on that, and I think it’s probably a little bit down in the weeds, right?

Because we do have a lot of recurring revenue as it is with existing automation cells that are not software related. So we have a lot of work we do where we come in and reprogram robots for the customers. We upgrade and update the equipment that’s in the cell to help keep it operating at its peak performance. We’ve got a fairly good service business. So the idea of chasing after revenue and an automation system is not something that’s new to us.

Steve Barger: Is that — can you give us some kind of gauge of that percentage? If you’re at $1 billion run rate, is that recurring revenue 10%, 20%?

Steven Hedlund: Yes, I’d say on the order of magnitude in the 5% to 10% range.

Steve Barger: Okay. And then to your point about getting information out of the cell. Everybody loves an AI story. Here’s your chance. Are you using AI or machine learning as a tool for automation sales or for improving test and train for the systems you’re installing?

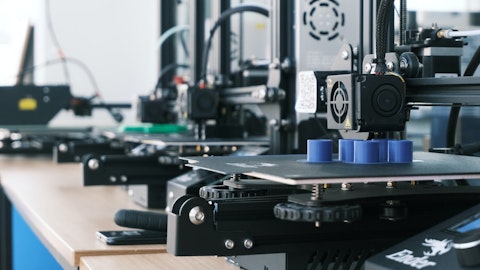

Steven Hedlund: We’re doing a lot, Steve, with additive in our — sorry, AI in our additive business around how do we print parts closer to near or net shape. And we’ve got a lot of research activities that we’re doing to try to answer what is a fundamental question most customers have, did I just make a good weld, right, without having to go through destructive testing or x-raying or the like, how do we have greater confidence that the weld I just made is good. And with a wide variety of different process parameters that affect the quality of it, it’s a nontrivial task. So there’s a lot of effort going into trying to improve our ability to make a predictive score, if you will, for the weld. So there’s a lot of activity around AI in the business. And I can’t really comment on whether the MES system RedViking has an AI-enabled component to it or not. It’s just too early for me to tell, and I’ll remind everybody, I’m a [indiscernible] major not an engineer. So…

Steve Barger: And I guess just one quick follow-up. The last 2 automation acquisitions had a heavier AGV exposure. Are there more opportunities outside of core welding that you are really focused on? And should we see more AGV acquisitions? I’m just trying to get a sense of how this business is going to evolve into what is obviously a growing TAM.

Steven Hedlund: Yes. See, I think the simplest way to think about it is we help customers fabricate and assemble things, right? So we’re heavily rooted in our history of metal cutting and welding and then using the capabilities we’ve developed to hold position, rotate, manipulate those parts, while they’re being welded or cutted — welded or cut, the challenges I mentioned earlier about people moving things through their factory in and out of cells. That’s really the happy hunting ground for us. So we’ll continue to look for opportunities to add value to customer and to make money by doing that in places where we’re helping people make things. Now whether the making process involve vending tube or deburring or grinding or welding or cutting, we’re relatively agnostic on that part.