At around $18 per share, the world’s no. 1 PC vendor, Lenovo Group Limited (ADR) (OTCMKTS:LNVGY), is extremely cheap at the moment. It’s so cheap that you might consider going long, even after acknowledging that the PC world is shrinking. With a 15.3 times price-to-earnings multiple, increasing attempts to diversify its portfolio, an emerging server business and significant strides to capture new users with Android handsets, the new Lenovo will definitely be worth more than $18 per share. This article explains why.

The new Lenovo isn’t just about PCs

What most people fail to understand about Lenovo Group Limited (ADR) (OTCMKTS:LNVGY) is that the company isn’t just about PCs. We can’t deny the actual importance of the PC business as its main revenue driver (as it accounts for about 80% of its revenue base), but we should also acknowledge the importance that Lenovo is giving to smartphones, tablets and servers. Lenovo as a PC stock could have a fair valuation under a 15.4 times price-to-earnings ratio -for comparison, Dell Inc. (NASDAQ:DELL) has a price-to-earnings multiple of 12.8, while Morningstar places the average S&P 500 price-to-earnings multiple valuation at 17.2 times. A new Lenovo with a strong diversified business portfolio, however, is definitely too cheap at the current price-to-earnings multiple.

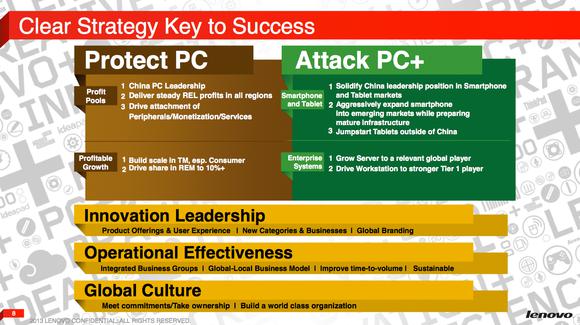

The company’s current business strategy is twofold. On one hand, Lenovo Group Limited (ADR) (OTCMKTS:LNVGY) aims to protect its PC business in consolidated markets and sell more, better PCs in emerging markets where demand can still grow more. On the other hand, Lenovo also benefits from the “shift to tablet and smartphones” global trend under its “Attack PC+” strategy.

Reference: Lenovo Investor Relations

The “Attack PC+” strategy involves replicating the same model and success factors that Lenovo Group Limited (ADR) (OTCMKTS:LNVGY) applied to become the no. 1 global PC vendor for 23 years in the smartphone and tablets arena. The only difference is that this time, it hopes to see more progress in less time. Just consider that Lenovo already managed to become the no. 2 most sold maker in the fierce Chinese mobile device market, behind only SAMSUNG ELECT LTD(F) (OTCMKTS:SSNLF). Globally speaking, Lenovo’s 2% market share is still far from what management is aiming for, but it is already equal to BlackBerry Ltd (NASDAQ:BBRY) and actually bigger than privately-owned HTC and Google Inc (NASDAQ:GOOG)‘s Motorola. Mobile shipments since the first quarter of 2012 have more than tripled!

Lenovo Group Limited (ADR) (OTCMKTS:LNVGY) decided to use the Android ecosystem instead of making its own, while BlackBerry Ltd (NASDAQ:BBRY) attempted to revamp its existing OS to maintain its identity. Lenovo kept its competitive advantages as a top manufacturer while leveraging on the already unbeatable Android system while BlackBerry’s sales floundered. Furthermore, cost-efficient Lenovo can benefit more from the commoditization trend of smartphones; most of BlackBerry’s models targeting the low-end segment are two to three years old.

There is one more scenario that could be interesting: a possible acquisition. Lenovo Group Limited (ADR) (OTCMKTS:LNVGY) expressed interest in BlackBerry Ltd (NASDAQ:BBRY) in the past, and now that shares are trading at half the price of their 52-week high the acquisition rumors will likely heat up again.

Source: Seeking Alpha Contributor Retracement

The PC industry isn’t dead, at least for Lenovo

So far we know Lenovo Group Limited (ADR) (OTCMKTS:LNVGY)’s attempts to enter the smartphone and tablets markets are quite promising. The best part, however, is that Lenovo’s cash cow the PC business is (amazingly) still growing despite an overall pessimistic PC usage trend. The record PC volume achieved last year of 52 million units shows this clearly. Furthermore, revenue is well-diversified geographically speaking, with strong positions in Japan and the U.S. The next task for Lenovo is to strengthen its position in emerging economies (Brazil and the Middle East/Africa) where PC penetration rates can still grow.

Reference: Lenovo Investor Relations