Kraft Foods Group Inc (NASDAQ:KRFT) has been on a tear since splitting from its global snacks business — Mondelez International. The stock is up nearly 25% since late 2012, even after a recent pullback. Clearly, investors are excited about the company’s prospects.

But, while Kraft Foods Group Inc (NASDAQ:KRFT) is a good business with a strong portfolio of consumer brands, three things about the stock should concern investors.

(1) High debt

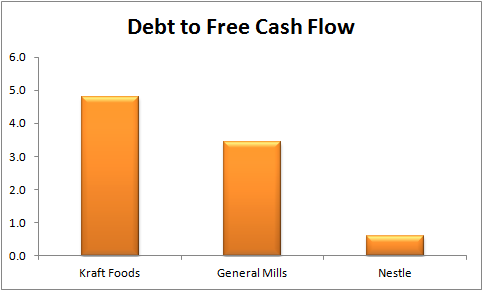

One of the reasons Warren Buffett recently reduced his stake in Kraft Foods Group Inc (NASDAQ:KRFT) may have to do with the company’s high debt load. The company’s long-term debt is nearly five times what it generated in free cash flow over the last four quarters. Meanwhile, General Mills, Inc. (NYSE:GIS) and Nestle (OTCBB:NSRGY) (NASDAQOTH: NSRGY) maintain lower debt-to-free cash flow ratios: 3.4 times and 0.6 times, respectively.

In general, investors should be concerned when a company’s debt-to-free cash flow ratio exceeds three; you want the company to be able to substantially reduce its debt burden in a short amount of time should extreme circumstances arise.

Kraft Foods Group Inc (NASDAQ:KRFT)’s high debt load is directly the result of the split with its global snacks segment — a typical feature of spin offs. Management never intended to run the company with so much debt, so the company is paying down debt as it comes due. This consumes valuable free cash flow; Kraft has to direct shareholder money toward paying down debt while Nestle returns cash to shareholders.

(2) Low margins

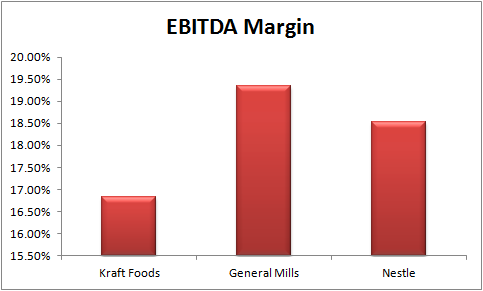

Kraft Foods Group Inc (NASDAQ:KRFT)’s EBITDA margin is consistently lower than those of its peers.

Granted, the difference between Kraft’s margin and General Mills, Inc. (NYSE:GIS)’ margin is only three percentage points, but the difference may be permanent. Kraft is undertaking cost-cutting initiatives to raise its margins in line with peers, but it is unclear exactly where costs can be trimmed; it appears that Kraft’s brands are simply less profitable than its peers, a condition likely to persist in the long run.

Although Kraft has strong food brands, like Jell-O, Maxwell House coffee, and Oscar Mayer hot dogs, Nestle’s brands fetch higher margins. Its Nescafe and other brands compete directly with Kraft’s products and command higher profits in many cases. This does not necessarily mean that Kraft is not the market leader in most of its categories, but that Nestle has found a more profitable price point/product cost trade-off.

General Mills, Inc. (NYSE:GIS) has an advantage over Kraft and Nestle due to its product mix; its breakfast cereals and some of its baking items fetch higher margins across the category. However, the degree of overlap between General Mills and Kraft is not nearly as high as that of Nestle and Kraft.

(3) Unattractive price

The final — and most important — concern is that of price. Kraft’s Enterprise Value to Free Cash Flow (EV/FCF) ratio is a little over 19. EV/FCF is an important metric to focus on for two reasons: it takes into consideration the amount of debt a company carries on its balance sheet (higher debt = higher EV) and it uses a truer measure of shareholder earnings for a mature company than accounting earnings give.

Essentially, Kraft’s stock offers a 5.2% free cash flow yield (1 divided by 19). Meanwhile, General Mills, Inc. (NYSE:GIS) offers a 6% yield and Nestle a 7% yield using the EV/FCF methodology. In other words, General Mills and Nestle sell for a more attractive price than Kraft after adjusting for net debt.