We came across a bullish thesis on KLA Corporation (KLAC) on Substack by Quality Equities. In this article, we will summarize the bulls’ thesis on KLAC. KLA Corporation (KLAC)’s share was trading at $757.47 as of Jan 17th. KLAC’s trailing and forward P/E were 34.62 and 25 respectively according to Yahoo Finance.

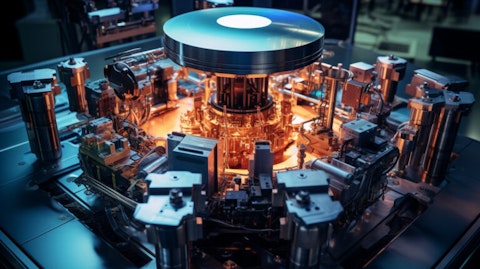

A one of a kind semiconductor process equipment machine with various parts and components.

KLA’s shares presented a compelling investment opportunity, which has since played out as the company benefitted from tailwinds in the semiconductor industry. Recently, KLA’s stock surged, reflecting investor optimism fueled by strong industry fundamentals and positive macro developments. Alongside other semiconductor giants like Applied Materials, Lam Research, and ASML, KLA has capitalized on the industry’s growth, with its stock rising 20.21% year-to-date in 2025, closing at $757.47. This surge was driven by a rally in semiconductor stocks following Taiwan Semiconductor Manufacturing Company’s (TSMC) strong earnings report, signaling robust demand for semiconductor equipment.

TSMC’s higher-than-expected capital expenditure forecast for 2025—ranging from $38 billion to $42 billion—presents a bullish growth catalyst for KLA. This increase, up from $29.8 billion in 2024, reflects growing investments in semiconductor manufacturing, benefiting KLA, which supplies process control and yield management equipment. As companies like TSMC, Samsung, and Intel ramp up spending, demand for KLA’s advanced inspection and metrology tools is expected to rise, particularly as AI-related chips drive tighter quality control requirements and increased wafer production.

The AI boom further strengthens KLA’s position in the market. As companies like NVIDIA and AMD design AI accelerators that require advanced semiconductor capabilities, KLA’s technology is becoming increasingly critical. Analysts have highlighted KLA’s exposure to AI-driven semiconductor growth, which positions the company for sustained revenue expansion. The company’s recent revenue guidance of $2.95 billion for the current quarter, exceeding analyst expectations, further confirms its strong growth prospects.

With TSMC’s capex boost, the ongoing AI revolution, and KLA’s leadership in process control, the company is well-positioned for long-term growth. Although macroeconomic risks and cyclical downturns remain, the increasing complexity of semiconductor production and the growing demand for high-performance chips suggest KLA will continue to thrive. Investors looking to capitalize on the AI and semiconductor equipment boom will find KLA an attractive investment, poised to benefit from rising industry investments and technological advancements.

KLA Corporation (KLAC) is not on our list of the 30 Most Popular Stocks Among Hedge Funds. As per our database, 61 hedge fund portfolios held KLAC at the end of the third quarter which was 55 in the previous quarter. While we acknowledge the risk and potential of KLAC as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than KLAC but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. This article was originally published at Insider Monkey.