Over the summer, rising interest rates have been one of the most influential trends in the markets. In my view, that trend will continue, and as such, I have identified five stocks to avoid as the trend plays out.

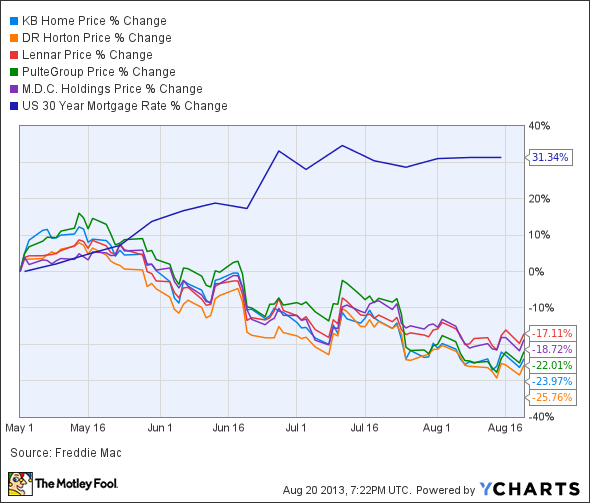

Just take a look at this graph of mortgage interest rates year to date. The leap in rates from May to August is just staggering.

US 30 Year Mortgage Rate data by YCharts.

Why are rates rising?

Rates are rising, simply put, because the market is anticipating an end to the quantitative easing, bond buying, and other monetary stimulus policies currently deployed by the Federal Reserve. The sudden spike we see beginning in late May is a result of statements made by Fed Chairman Ben Bernanke, widely interpreted to mean that the Fed would be ending its programs sooner rather than later.

Head for the hills

But if you take a step back, the fate of interest rates also has a big impact on another industry: homebuilders.

The relationship can be seen in the chart below, which compares the percentage change in mortgage rates year to date with the stock price performance of five homebuilders. You can see that in May, right at the moment 30-year interest rates begin to skyrocket, these stocks began a nose dive, moving down essentially in unison between 17% and 26%.

The reason is simple enough: The cost to purchase a home for most Americans is more than just the list price. It also includes the interest rate on the mortgage used to buy the house.

Back in May, the market rate for 30-year fixed mortgages was approximately 3.35%. The payment for a potential buyer, assuming a 30-year loan, comes to $441. That same loan at today’s rates — about 4.4% — would be $605. That is a 37% increase in monthly payment.

If rates continue to rise over the next 6 to 18 months, which most analysts think will happen, the impact on the affordability of housing will become even more significant.

Assume that same loan eventually comes with a 5.5% interest rate. That monthly payment would be $672. That’s a 52% increase in the monthly payment, driven only by changing interest rates. And 5.5% is still low by historical standards.

The takeaway

For consumers, this rise in the cost of a mortgage could deter many potential buyers. For many, it will make buying a new home too expensive and lead them to purchase an existing, less expensive home. The result is fewer buyers in the market for a new home.

For national homebuilders like KB Home (NYSE:KBH), D.R. Horton, Inc. (NYSE:DHI), Lennar Corporation (NYSE:LEN), PulteGroup, Inc. (NYSE:PHM), and M.D.C. Holdings, Inc. (NYSE:MDC), who produce new homes, rising rates is bad news for business.

Some value investors may claim that now is the time to buy, as the market has factored in the impact of rising rates already this summer. I disagree.

To me, these are five stocks to avoid. I think rates will continue to rise, and the full impact of this change has not yet worked its way into these stock’s prices. There’s still room for the stocks to sink, and I think the pain for shareholders will continue.

The article 5 Stocks to Sell Right Now originally appeared on Fool.com and is written by Jay Jenkins.

Fool contributor Jay Jenkins has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.