Tomorrow afternoon, when the Federal Reserve announces the results of stress tests related to the Dodd-Frank Act, one thing important to every big bank CEO will be on the line: Reputation. For any of the largest U.S. banks, reputation of its brand and balance sheet quality impact borrowing costs and operational success.

The last 12 months have been somewhat of a rollercoaster ride for Jamie Dimon and the reputation of JPMorgan Chase & Co. (NYSE:JPM). In March 2012, while still holding the title of “Obama’s favorite banker,” Dimon successfully guided the bank through the Federal Reserve’s annual stress tests. In typical Dimon-fashion, the charismatic CEO announced the bank’s intention to raise its dividend and initiate $15 billion of share buy-backs before the institution had been given official approval from the Fed. Some saw this as miscommunication; others saw Dimon marching to the beat of his own drum.

After escaping the 2008-2009 financial crisis with one of the strongest balance sheet compared to its troubled peers Bank of America Corp (NYSE:BAC) and Citigroup Inc. (NYSE:C) , investors were not surprised JPMorgan Chase & Co. (NYSE:JPM)’s assets fared well in the Fed’s hypothetically adverse economic scenario, a simulation of a sharp rise in unemployment and 20% decline in housing prices. A very similar scenario was used in this year’s tests, including 4% GDP contraction, +12% unemployment, and +20% drop in home prices. However, the major surprise came in May of 2012, when Dimon held an emergency call to disclose losses of around $2 billion in the firm’s central investing unit which ultimately ballooned to over $6 billion. Investors began to question Dimon’s competence.

Battling back

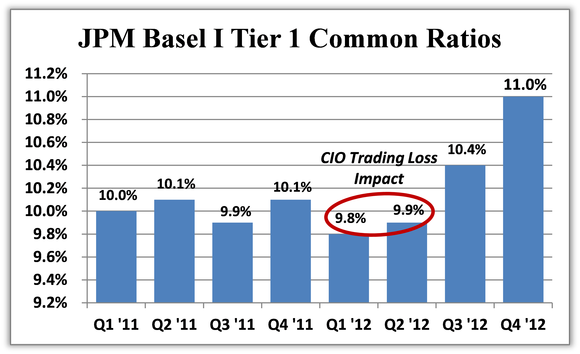

Despite the embarrassing loss and ongoing inquiries from Congress, few expect tomorrow’s results to highlight any deficiencies in Dimon’s “fortress balance sheet.” Continual improvement across wholesale and credit card loan portfolios has allowed JPMorgan Chase & Co. (NYSE:JPM), along with its peers, to consistently improve capital ratios throughout the year.

The results set to be released tomorrow are based on how the institution would fare under the adverse scenario based on its current capital deployment plan. While investors will surely use these stress tests results as a proxy for a relatively consistent snapshot-comparison across banks, forward-looking shareholders will undoubtedly be placing a greater emphasis on the Fed’s release of the Comprehensive Capital Analysis and Review (CCAR) results next Thursday, the 14th. Banks’ submissions for the CCAR incorporated planned strategies to return capital to shareholders. As a forward-looking mechanism, the market responds to future strategy changes. Following Dimon’s declaration of increases in dividend payouts and share repurchases in March 2012, shares of JPMorgan Chase & Co. (NYSE:JPM) climbed higher.

Comparing the two above graphs, the market has shown the tendency to value the bank in line with its capital strength. When capital ratios have weakened, share price has followed suit.

Back and ready for more

Although events in 2012 undoubtedly damaged the reputation of both Dimon and his management team, they have attacked the situation proactively and realigned the bank to continue marching toward higher capital ratios in preparation for tomorrow results, and more importantly, next Thursday’s CCAR results. After his compensation and ego took a hit, Jamie Dimon is surely eager to show the investment community that his bank is ready to return more capital to shareholders, and that he is still the most competent CEO on Wall Street.

The article Will This Bank’s Reputation Take Another Hit? originally appeared on Fool.com and is written by David Hanson.

David Hanson has no position in any stocks mentioned. The Motley Fool owns shares of Bank of America, Citigroup, and JPMorgan Chase.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.