Only behind Johnson & Johnson (NYSE:JNJ) and well above Unilever plc (ADR) (NYSE:UL) in my performance chart, The Procter & Gamble Company (NYSE:PG) is among the best performing stocks in its industry. The latest earnings call for its fourth quarter of fiscal 2013 just came out, and it’s a good time to analyze the future growth and profitability prospects of Procter & Gamble.

While the firm has one of the strongest global brands ever created, it is struggling to keep a top line that grows faster than 1%-2% per year. As competition increases and customers become more price sensitive, is The Procter & Gamble Company (NYSE:PG) going to be able to keep its position as the leading global household and personal-care firm over the next few years?

Understanding P&G’s problems

First of all, we need to acknowledge that the size The Procter & Gamble Company (NYSE:PG) has achieved is enormous, and it is a well-known fact elephant firms struggle to at least keep growth rates constant. The upside is that P&G enjoys all the benefits that economies of scale can deliver. The downside is that the annual P&G’s growth rate for the past five years has barely surpassed 1%. Cash flow coming from core operations achieved its highest level in 2010, and since then, it has decreased. In a nutshell, organic growth isn’t happening.

Source: Procter & Gamble Co. Annual Reports

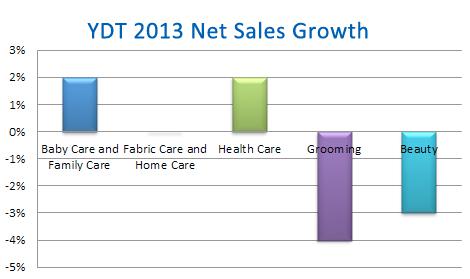

Among the worst performing businesses in terms of revenue growth, we find the Grooming and Beauty segments. In the latest earnings call, management mentioned hair care (Pantene) and skin care remain in decline. So far, it seems that the way the company is dealing with its growth issues is by spending more budget on brand promotion and marketing. And although this may stop sales from declining further in the long run, it may not be as sustainable in the long run as product innovation.

Source: Procter & Gamble’s Q1 2013 Report & Saibus Research

Finally, The Procter & Gamble Company (NYSE:PG) has also had a profitability issue for the past four years, due to competitive pricing.The good thing is that the latest figures, after CEO Lafley’s return, are early signs of a recovery. P&G reported an annual profit of $11.3 billion, a 5% increase that managed to beat Street expectations. There’s a $10 billion cost-saving plan on its way to reduce head count, which could help EPS grow even further. As for the short-run, Lafley has promised core earnings per share growth of 5% – 7% for this year.

Can this elephant dance again?

The Procter & Gamble Company (NYSE:PG) needs more organic growth to avoid disappointing investors. The good news is that the come-back of CEO Lafley could become a positive catalyst for revenue. Lafley ran P&G for 10 years since 2000 and did a superb job, making key acquisitions (Gillete) and almost tripling EPS in his time as a CEO.

Also the fact that The Procter & Gamble Company (NYSE:PG) is still able to deliver meaningful growth in emerging markets is an opportunity that needs to be further exploited. Latin America and Asia still represent a small proportion of total revenue.

Of course, the drug business also has plenty of upsides. First of all, it adds diversification to its business portfolio. The Pharmaceutical business and the Medical Devices and Diagnostics business combined already represents 79% of total revenues. Drugs like Zytiga and Incivo have become massive growth drivers; Zytiga alone saw its sales jump 70% year over year. And although the stock is trading near its 52-week high, some other drugs like diabetes drug Invokana or Hepatitis drug Simeprevir (which is expected to receive FDA approval in the fourth quarter of this fiscal year) could become a positive revenue catalysts for the next quarter, taking the stock price to even higher levels. The Procter & Gamble Company (NYSE:PG) doesn’t have this kind of exposure.

Coming back to emerging markets, if The Procter & Gamble Company (NYSE:PG) wants to increase its market share, it will have to steal it from Unilever plc (ADR) (NYSE:UL). In terms of total sales mix, Unilever is far more exposed to emerging markets than P&G and sells better in many key markets, like Brazil, where despite P&G undercutting its prices by more than 30% (Morningstar), it has continued to maintain more than 70% of the personal and home care category. This shows how strong Unilever’s brand has become in emerging economies, where the company is an early mover; it has more than 50 years of experience in Brazil, China, Indonesia and India.

Unilever plc (ADR) (NYSE:UL)’s success in emerging markets, where it has recorded double-digit growth in sales for the past 6 quarters (for comparison, in the past quarter, sales in developed markets slipped 1.6%) shows that the current focus The Procter & Gamble Company (NYSE:PG)is taking may be late, but late is better than never. In the latest quarter of 2012, its organic sales from China grew by 9%, Russia by 18% and Brazil by 17%. This suggests that P&G is still far away from reaching the geographical mix Unilever enjoys, but progress is certainly being made on that direction.