The slowdown in stock market has also adversely affected leading healthcare companies’ stocks. But many still think investing in healthcare giants such as Johnson & Johnson (NYSE:JNJ) is the right move. Let’s take a closer look at this company and break down its main strong points, opportunities, and risks.

J&J continues to grow

Johnson & Johnson has done well in the first quarter of 2013: The company’s revenues grew by more than 8.5%. In comparison, other leading healthcare companies such as Eli Lilly & Co. (NYSE:LLY) and The Procter & Gamble Company (NYSE:PG) haven’t done as well: Revenues of Eli Lilly remained flat in the first quarter of 2013; Procter & Gamble’s net sales increased by only 2% (year-over-year). On the other hand, Johnson & Johnson (NYSE:JNJ)’s operating margin declined by 15.5%. The sharp drop in profit margin is related to the one time beneficial adjustments that were recorded in the first quarter of 2012. After controlling for this one-time accounting provision, the company’s profitability declined by only 4.4%. Johnson & Johnson’s profit margin used to be much higher than that of Procter & Gamble and Eli Lilly in most of 2012. In the past couple of quarters, however, J&J’s profit margin slipped while other companies’ profit margin rose. In the chart below are the developments in adjusted profit margins of the above-mentioned companies (adjusted for one-time accounting expenses such as goodwill).

As seen, the profitability of Johnson & Johnson (NYSE:JNJ) is in the middle of the pack among these healthcare and consumer goods companies.

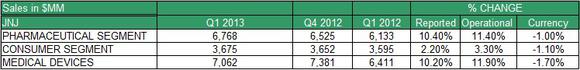

As indicated in the table below, among the three major business segments J&J operates, both the medical devices and pharmaceutical segments have sharply increased in the first quarter of 2013. The company’s consumer goods segment rose by only 3.3%.

For the consumer segment, the high competition and slow progress of the U.S economy is likely to impede this segment’s growth.

Despite the rise revenues across all three segments, the fluctuations in the currencies have adversely affected revenues. The high movement in the forex markets could keep pulling down the growth rate in revenues in the coming quarters.

What about future growth?

J&J is well diversified and reaches many business segments as presented in the table above. The consumer segment depends on the future progress of the global economy mainly the U.S, which accounts for nearly a third of Johnson & Johnson (NYSE:JNJ)’s revenues in this segment. If the U.S economy’s growth slows down; it could impede growth in consumer sales. Alas, this segment has the lowest profit margin and accounts for the lowest share of J&J’s total revenues.

The main concerns will revolve the pharmaceutical and medical devices segments. In regards to the pharmaceutical segment, the company is likely to maintain its growth in this segment. The company’s progress in the treatment of Hepatitis C is keeping analysts optimistic regarding J&J maintaining its growth in sales in the future.

Dividend and buyback

Johnson & Johnson (NYSE:JNJ) repurchased more than $10 billion of shares in 2012. The company also paid back nearly $3.6 billion of its debt. J&J wasn’t the only one: Both P&G and Eli Lilly repurchased their own stock in the past year. P&G repurchased its stock and at the same time expanded its debt. Considering the low interest rates the company has to pay, and considering the high dividend yield the company pays, this maneuver could save the company millions in dividend payments.

This year, however, J&J issued $1.1 billion worth of stocks. If the company will continue to issue stocks, it will lower the company’s earnings per share ratio, which is something worth noticing.

In terms of dividend, the above companies offer reasonable yields that range from 3.08% for P&G to 3.77% for Eli Lilly. J&J is, again, in the middle of the pack at nearly 3.1%. This is another key advantage for holding these stocks.

Financial stability

The company’s financial situation remains stable as it continues to maintain a very low debt-to-equity ratio that reached in the first quarter of 2013 only 0.23. In comparison, P&G’s ratio is 0.48; Eli Lilly’s, 0.36. The low financial risk of J&J is another advantage for holding this company.

The bottom line

The company’s financial stability, reasonable dividend yield and steady growth make J&J an interesting investment. If the stock market will continue to dwindle and in the process will drag along with it Johnson & Johnson (NYSE:JNJ), this could only benefit investors who consider purchasing this profitable and sustainable company. Nonetheless, currency risks, decline in profitability and slowdown in consumer segment growth could impede this company’s progress in the near future.

Lior Cohen has no position in any stocks mentioned. The Motley Fool recommends Johnson & Johnson and Procter & Gamble. The Motley Fool owns shares of Johnson & Johnson.

The article Is This Healthcare Company a Strong Investment? originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.