Over the last few years, investors have piled into high-quality dividend stocks in search of yield. With bonds paying abysmal yields, dividend stocks became an attractive alternative. This popularity pushed prices up and yields down, and many dividend stocks became overvalued. Although many believe that high-quality dividend stocks are safe, the price which you pay matters greatly.

Now, with treasury yields rising, many dividend stocks have been hit hard, falling considerably in price over a short period of time. A disaster? On the contrary, this is an opportunity. When I was assembling my Ultimate Dividend Growth Portfolio, which you can track here, I was forced to exclude many standard dividend stocks because their prices were just too high. But with prices coming down, these stocks may become attractive again.

A standard dividend stock

Johnson & Johnson (NYSE:JNJ), the diversified health care giant, is a common holding in countless retirement portfolios. A long history, steady growth on all fronts, and consistent dividend increases round out this behemoth of a company. Since the beginning of 2013, the stock has been on a tear:

After reaching a high of about $89, the stock has fallen back to $84 in just a few days. Is $84 per share cheap enough? Or does the price need to fall further to justify a position in Johnson & Johnson (NYSE:JNJ)?

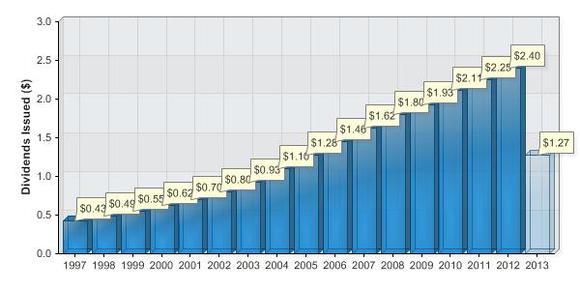

Johnson & Johnson (NYSE:JNJ) hiked its quarterly dividend by 8.2% in May, and this new payment puts the current projected yield at 3.13%. At the high of $89 per share, the yield was a lower 2.97%, so the yield is a little more attractive now. Since 1997, it has increased its dividend at an annualized rate of about 12.1%.

This rate has slowed, as the annualized rate of growth since 2008 is closer to 10% and the most recent hike was only 8.2%. So, it’s unlikely that dividend growth going forward will match the last decade.

Since dividends are paid out of the free cash flow, it makes sense to see how the payout ratio with respect to the FCF has changed over the years. In 2003, the payout ratio was just 33.5%. By 2012, the payout ratio had risen to 54.2%, and the recently hiked dividend pushes that number close to 60%. What this means is that much of the dividend growth of the last decade was a result of an expanding payout ratio.

The next decade, then, will feature far slower dividend growth than the previous one. Earnings growth will be the main driver, so I don’t expect the dividend to grow much faster than 8% per year. Based on this assumption, what’s the maximum you should pay for a share of Johnson & Johnson (NYSE:JNJ)?

If the dividend grows by 8% per year for the next decade, the most you should pay is a little under $81 per share. So the stock needs to fall at least another 4% or so before it becomes a fairly valued dividend stock. I’d like to see it fall into the 70’s before considering it for The Ultimate Dividend Growth Portfolio, as there are still plenty of dividend stocks which are cheap in comparison. But in terms of the company itself, you can’t do much better than Johnson & Johnson (NYSE:JNJ).

A similar story

Another standard dividend stock, The Procter & Gamble Company (NYSE:PG), is in a similar boat as Johnson & Johnson (NYSE:JNJ). The stock has a yield of 3.13% after a recent 7% dividend hike, well below the historical dividend growth rate. The annualized dividend growth rate over the past decade was 11.2%, and 10.2% over the past five years. The payout ratio with respect to free cash flow has risen from 31.% in 2003 to 67.5% in 2012.

The Procter & Gamble Company (NYSE:PG) has been undergoing a restructuring, cutting costs and improving operations, which has led to thousands of layoffs. Earlier this month, CEO Bob MacDonald suddenly retired, and the company brought previous CEO A.G. Lafley back as his successor. Changing CEO’s in the middle of a restructuring effort doesn’t seem like a great idea, but there was pressure from some investors to speed up the restructuring process.

The high payout ratio is a big red flag. At least in the short-term, dividend growth will likely be slower than earnings growth in order to get the payout ratio back to reasonable levels. I don’t expect dividend growth much faster than 7% annually over the next decade for P&G, and that might be overly optimistic. This assumption puts the fair value at about $68 per share, about 11.6% below the current market price.

P&G has already fallen from around $82, but it needs to fall a lot more before it offers any value to a dividend investor. The stock would need to be in the low 60’s before I’d consider it for The Ultimate Dividend Growth Portfolio, and even then I’d be reluctant.

A wide moat full of Coke

Almost any list of dividend stocks inevitably contains The Coca-Cola Company (NYSE:KO). With 50 years of consecutive dividend increases and a brand which is well known in the entirety of the civilized world, The Coca-Cola Company (NYSE:KO) is a fantastic company.

Unfortunately, the dividend isn’t quite big enough. A yield of 2.80% is above average, but not as high as many of the best dividend stocks. Dividend growth over the last decade was 9.8% annualized, about the same as the most recent dividend hike last year. The payout ratio with respect to free cash flow has grown from 46% to 59% in that time, which should be a cause for concern. This is partially due to an increase in capital expenditures over the last few years, and the payout ratio with respect to net income in 2012 was lower at 52%.

Realistically, 9% annual dividend growth over the next decade seems reasonable. At that rate, the stock would be fairly valued at about $37 per share, 9% below the current price. The stock has already fallen from a little over $42 per share, so if the price gets into the mid-30’s, things will get interesting. But right now, it is still too expensive.

The bottom line

Many dividend stocks which have been overvalued for some time are falling back to earth, and an opportunity may arise to buy them at a discount. It’s a good idea to keep a watchlist of high-quality dividend stocks which you’d like to buy and the price which you’d be willing to pay. Johnson & Johnson (NYSE:JNJ) needs to fall to $81 per share, The Procter & Gamble Company (NYSE:PG) to $68 per share, and The Coca-Cola Company (NYSE:KO) to $37 per share for the stocks to be fairly valued based on my assumptions. At the right price, these stocks would make good additions to a dividend portfolio.

The article A Dividend Watchlist for the Pullback originally appeared on Fool.com and is written by Timothy Green.

Timothy Green has no position in any stocks mentioned. The Motley Fool recommends Coca-Cola, Johnson & Johnson, and Procter & Gamble. The Motley Fool owns shares of Johnson & Johnson. Timothy is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.