Diamond Hill Capital, an investment management company, released its “Long-Short Fund” third-quarter 2023 investor letter. A copy of the same can be downloaded here. The positive returns of the portfolio outperformed the Russell 1000 Index and the blended benchmark (60% Russell 1000 Index/40% Bloomberg US Treasury Bills 1-3 Month Index), both of which were negative in Q3. The short book trailed the index, providing a relative tailwind to performance. Long financial holdings were another source of relative strength. On the other hand, the fund’s long industrials and healthcare holdings were sources of relative weakness in Q3. In addition, you may look at the fund’s top 5 holdings to learn about its best picks in 2023.

Diamond Hill Long-Short Fund highlighted stocks like Johnson Controls International plc (NYSE:JCI) in the third quarter 2023 investor letter. Headquartered in Cork, Ireland, Johnson Controls International plc (NYSE:JCI) engages in engineering, manufacturing, commissioning, and retrofitting building products and systems. On December 20, 2023, Johnson Controls International plc (NYSE:JCI) stock closed at $54.71 per share. One-month return of Johnson Controls International plc (NYSE:JCI) was 3.77%, and its shares lost 14.69% of their value over the last 52 weeks. Johnson Controls International plc (NYSE:JCI) has a market capitalization of $37.22 billion.

Diamond Hill Long-Short Fund made the following comment about Johnson Controls International plc (NYSE:JCI) in its Q3 2023 investor letter:

“Other bottom contributors included our long positions in Alaska Air Group, Target Corporation and Johnson Controls International plc (NYSE:JCI). Diversified technology and industrial company JCI announced late in Q3 it was impacted by a cyberattack — which contributed to downward pressure on the share price. While we believe the cyberattack was unfortunate, it is also not uncommon and should minimally impact JCI’s long-term prospects. We maintain our conviction in the company’s position relative to the trend toward smart buildings and expect it to continue shifting to high-margin services — and we believe these possibilities are not reflected in the current valuation, which trades at a steep discount to peers’.”

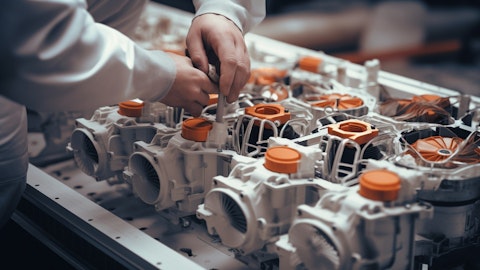

An engineer inspecting a HVAC system, revealing the complexity of the products.

Johnson Controls International plc (NYSE:JCI) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 43 hedge fund portfolios held Johnson Controls International plc (NYSE:JCI) at the end of third quarter which was 39 in the previous quarter.

We discussed Johnson Controls International plc (NYSE:JCI) in another article and shared the list of best infrastructure stocks to buy. In addition, please check out our hedge fund investor letters Q3 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 20 Best Serial Killer Documentaries on Netflix and Other Streaming Services

- 16 Most Promising QQQ Stocks According to Hedge Funds

- Analysts on Wall Street Lower Ratings for These 10 Stocks

Disclosure: None. This article is originally published at Insider Monkey.