Fairfax Financial recently filed its 3Q 13F with the SEC, which reveals the holdings of hedge funds and other notable investors. Prem Watsa is the founder of Fairfax and also holds an MBA from the University of Western Ontario. Fairfax has managed to increase its book value almost 25% annually since 1985. In Fairfax’s recent 13F filing, Watsa showed a broad interest in various industries, while one major theme was Fairfax’s selloff of a couple big banks during the quarter.

Johnson & Johnson (NYSE:JNJ) remained Fairfax’s top holding at the end of 3Q. Johnson & Johnson makes up over 20% of the firm’s 13F holdings. The global pharma company expects solid revenue growth, up 8% in 2013 from 2012. In part, Johnson & Johnson’s recent acquisition of Synthes will assist with its global reach and add around $0.15 to EPS in 2013. We like Johnson & Johnson’s prospects, and believe investors are over-discounting next year’s earnings—where Johnson & Johnson currently trades at 23x trailing earnings, but only 13x forward earnings .

Research In Motion Ltd (NYSE:RIMM) saw quite the increase in Watsa’s portfolio during 3Q, a boost of over 90% from 2Q, in terms of total shares invested. Research In Motion now makes up almost 20% of the firm’s holdings. RIMM remains down almost 20% year to date despite strong price performance of late on the hopes that the phone maker’s newest mobile operating system, Blackberry 10, can save the company. We remain cautious however, and note that the upcoming holiday season will likely see the iPhone 5 continue to take market share from the Blackberry line. The Blackberry maker’s P/E of 6x suggests it is very cheap, but it very well could be a value trap.

Resolute Forest Products Inc (NYSE:RFP) was only a minor increase for Fairfax during 3Q, by about 3%; the stock now sits as Fairfax’s fourth largest 13F holding. Resolute is a global forest products company that offers newsprint, commercial printing papers and wood products. We believe there are better investments in the forest and paper industry given Resolute trades at 40x earnings and has an expected five-year EPS CAGR of 5%. Major paper competitor Domtar trades at only 13x earnings. Check out our other thoughts on whether you should buy this little-known paper company.

U.S. Bancorp (NYSE:USB) is Fairfax’s fifth largest holding and saw a 30% decline in share ownership from 2Q. U.S. Bancorp is the fifth largest U.S. bank by assets, with net interest income expected to rise 6% in 2012. U.S. Bancorp has some of the best credit quality and best loan growth in the industry. Another notable decrease for Fairfax was Wells Fargo & Company (NYSE:WFC) – of about 40% – now making up the 9th spot in the fund’s 13F. Wells Fargo expects much less net interest income growth in 2012 of only 1%, but the bank’s mortgage loan segment has been carrying its financials. Loan growth over the next year is expected to fall however, as low rates continue to pressure Wells Fargo’s net interest margin.

Both U.S. Bancorp and Wells Fargo trade at the high end of the industry on a P/B basis, at 2.9x and 1.2x, respectively. They both also trade close to $33 a share, but Wells’s book value is much more in line at $27, while U.S. Bancorp’s recent book value has been valued close to $18. We believe these banks are a couple of the best bets in the industry, but feel they may have seen too much of a run-up lately – making their valuation unattractive. Wells Fargo remains one of the top ten financial stocks owned by hedge funds.

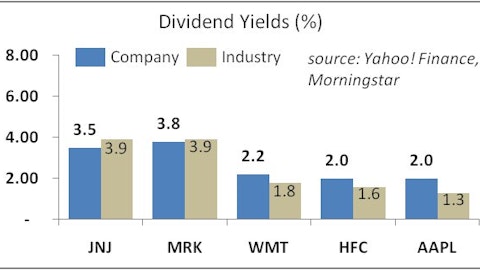

Johnson & Johnson is a solid dividend-paying pharma company that trades with a 3.5% yield. We would rather wait on the sidelines and not follow Fairfax into a turnaround bet on RIMM, or on the paper company Resolute. We also see the downsizing of the big bank stocks as worth noting, given their valuation relative to other financials. Check out all of Fairfax’s top holdings.