We recently compiled a list of the Jim Cramer’s Lightning Round: 8 Stocks to Watch. In this article, we are going to take a look at where Cameco Corporation (NYSE:CCJ) stands against Jim Cramer’s other stocks.

Jim Cramer, the host of Mad Money, recently shared his insights on several key topics. He discussed the recent turmoil in the pharmaceutical sector, which followed the news that President-elect Trump is considering Robert F. Kennedy Jr. for the position of Secretary of Health and Human Services.

Cramer pointed out that the pharmaceutical industry took a significant hit after the announcement, but he believes this may present solid buying opportunities. Cramer acknowledged that RFK Jr., whom he humorously referred to as “Bobby Jr. for some Sopranos flavor,” has a strong anti-big pharma stance, which could be a concern for the sector. However, Cramer emphasized:

“… There’s a whole federal bureaucracy at HHS and frankly, I don’t think Trump will let him wreck a pretty important sector of the stock market.”

READ ALSO Jim Cramer Is Focused on These 15 Stocks This Week and Jim Cramer Talked About These 11 Stocks Recently

Cramer further addressed the potential confirmation of RFK Jr. as Secretary of Health and Human Services. He suggested that while there is a debate about whether the Senate will provide confirmation for him, he believes RFK Jr. will likely be approved. However, Cramer remained less concerned about RFK Jr. causing significant damage to the pharmaceutical industry, noting that he doesn’t expect him to have much success in pushing his anti-vaccine or anti-pharma agenda. Moving on to broader market trends, Cramer commented:

“After the initial Trump rally euphoria in the wake of the election, we quickly transitioned to a Trump rally hangover last week with the averages getting clobbered.”

He highlighted that semiconductor stocks were among the hardest hit, partially due to the typical tech sector sell-off when bond yields rise, as they did last week. Cramer also expressed concern, saying:

“With the election results from earlier this month and the second Trump administration coming in about two months, I am very worried about companies that are hostage to the Chinese economy.”

Finally, Cramer turned his attention to autonomous vehicles, suggesting that while the Trump administration’s plans for self-driving cars may sound ambitious, they could be more difficult to execute in practice.

He pointed out that a variety of state and local governments would need to align on new regulations, and the notion that the federal government could allow self-driving cars nationwide with a simple executive order seemed “just plain fanciful.” Despite this, Cramer advocated for owning TSLA, not because of any regulatory changes under Trump, but because he believes in the vision and leadership of the company’s CEO, Elon Musk.

Our Methodology

For this article, we compiled a list of 8 stocks that were discussed by Jim Cramer during the episode of Mad Money on November 18 and listed the stocks in the order that Cramer mentioned them.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

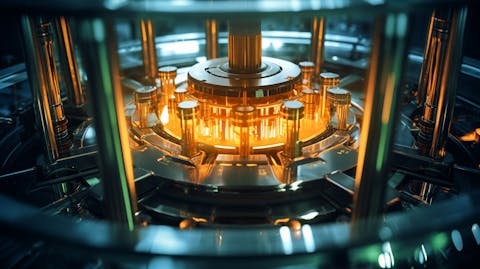

A close up of the reactor core, highlighting the complexity of the uranium power process.

Cameco Corporation (NYSE:CCJ)

Cramer mentioned that Cameco Corporation (NYSE:CCJ) is expensive and said:

“Look, all the uranium players are up. I think that they’re going to amount to very little in the end. This is not an expensive stock. I understand why you want to be in it, not versus the others, but it is an incredibly expensive stock versus the rest of the market. That’s what I care about. I am a kaching kaching when it comes to Cameco.”

Cameco (NYSE:CCJ) supplies uranium for electricity generation and offers nuclear fuel processing, reactor technology, and related services to commercial utilities and government agencies worldwide. As per CNBC, on November 20, according to Goldman Sachs, the company is well-positioned for growth, particularly in light of the increasing demand for nuclear power in the United States.

The company is expected to benefit from uranium prices, which are projected to rise due to a widening gap between supply and demand. Goldman Sachs raised its 12-month price target for the stock to $64 per share, highlighting the company’s potential as uranium prices climb. The stock has risen by approximately 33% so far this year.

Analyst Neil Mehta highlighted the company’s integrated business model across the nuclear fuel cycle, emphasizing its strengths in uranium mining, conversion, fabrication, and nuclear services through its stake in Westinghouse. Mehta also noted that Cameco is an appealing partner for Western utilities due to its limited geopolitical risks, with operations primarily based in Canada and the U.S., alongside a single site in Kazakhstan.

According to the firm, Cameco’s (NYSE:CCJ) contracts are supported by favorable uranium pricing, with current contracts seeing prices ranging from $70 to $130 per pound, with the midpoint around $100, which is higher than the current spot price of approximately $80 per pound. Additionally, Cameco’s 49% stake in Westinghouse, which is poised to play a key role in the construction of new power plants with its AP1000 reactor, presents further growth potential, as noted by Goldman Sachs.

Overall CCJ ranks 6th on Jim Cramer’s list of stocks to watch. While we acknowledge the potential of CCJ as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than CCJ but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock

Disclosure: None. This article is originally published at Insider Monkey.