We recently published a list of Jim Cramer is Talking About These 10 Stocks. In this article, we are going to take a look at where Arm Holdings plc (NASDAQ:ARM) stands against other stocks Jim Cramer is talking about.

Jim Cramer in a latest program on CNBC said that the market is narrowing again as he sees gains getting concentrated in big tech stocks again amid bond movements.

“If the bond market doesn’t start behaving and calming down, and long-term interest rates don’t stop going up, we are gonna start losing the groups that led us higher for months and go back to our bad old ways with just a couple of magnificent ones.”

Jim Cramer said that this trend was more or less expected as market assumptions following the 50bps rate cut by the Federal Reserve proved to be wrong down the road.

But then that darn double cut—we saw something that hasn’t happened since 1995. We saw loan rates go higher, not lower. It was a total buzzkill, and we’re beginning to feel it with earnings.

Cramer then talked about a latest earnings report from a notable homebuilder that showed soft results, indicating a weaker consumer. Cramer then summarized his thesis again on why he sees the overall market trajectory in what he called a “suboptimal situation.”

“If interest rates don’t stop rising quickly—they can go up slowly, but this quick rise means we’ll go right back to the same old story. Only a few big tech stocks were winning, while many more were losing. In other words, we’re on the verge of what I can describe as an extremely suboptimal situation if the bond market doesn’t settle down.”

READ ALSO: 7 Best Stocks to Buy For Long-Term and 8 Cheap Jim Cramer Stocks to Invest In

Our Methodology

For this article we watched several latest programs of Jim Cramer on CNBC and picked 10 stocks he’s talking about. With each company we have mentioned its hedge fund sentiment. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

ARM Holdings plc (NASDAQ:ARM)

Number of Hedge Fund Investors: 38

A caller recently asked Jim Cramer about ARM Holdings Plc (NASDAQ:ARM).

Cramer said “yes, ARM’s good” and recommended the investor to buy the stock.

Cramer said that ARM Holdings Plc (NASDAQ:ARM) has a “tremendous” relationship with Softbank’s Masayoshi Son.

“I think that the support there is gonna make it so he got a lot of runaway. I like him.”

William Blair analyst Sebastian Naji recently started covering Arm Holdings PLC – ADR (NASDAQ:ARM) with an Outperform rating.

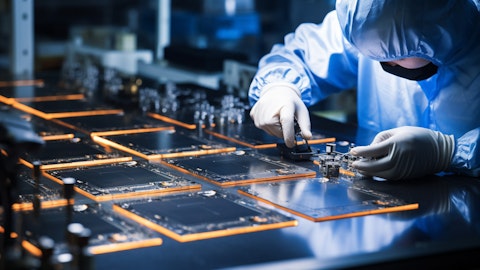

The analyst said the chipmaker is seen as a “critical vendor” of computing intellectual property with “best-in-class” financials. He said the company generates revenue from over 29B chips sold in the mobile, automotive, IoT, and data center markets.

“Arm’s royalty/licensing revenue model drives best-in-class profitability— R&D is the largest expense, 35% of total revenue in fiscal 2024. With expanding royalty rates helping drive better operating leverage (long-term target of 60% non-GAAP operating margin), we see room for sustained EPS and free cash flow growth,” the analyst said.

Arm Holdings PLC – ADR (NASDAQ:ARM) has unveiled its latest processor design, v9, which features significant upgrades like enhanced encryption and vector processing. These improvements have allowed ARM to double its take-rate compared to the previous v8 design, which is expected to boost royalty revenue over the next few years, according to analyst Naji.

The company, led by Rene Haas, is also seeing growth from its mobile CSS and data center Neoverse subsystems, driving new licensing activity. Arm Holdings PLC – ADR (NASDAQ:ARM) is gaining traction in the data center market, traditionally dominated by Intel. With hyperscalers like Amazon, Google, Microsoft, and Meta developing their own chips and Nvidia leading the AI accelerator space, Arm Holdings PLC – ADR (NASDAQ:ARM) is positioned to benefit from this growing sector. Naji estimates ARM’s data center business could account for 15% of its royalty revenue by 2025.

Overall, ARM ranks 8th on our list of stocks Jim Cramer is talking about. While we acknowledge the potential of ARM, our conviction lies in the belief that under the radar AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than ARM but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. This article is originally published at Insider Monkey.