2. Nvidia Corp (NASDAQ:NVDA)

Number of Hedge Fund Investors: 179

Jim Cramer in a latest program analyzed Nvidia Corp (NASDAQ:NVDA)’s charts and referred to the comments and analysis by Jessica Inskip of Stock Brokers.

According to Cramer, Inskip thinks if Nvidia Corp (NASDAQ:NVDA) could cross $140.76, it could reach a whopping $177.

“If it can break out above $140.76, how high can it go? We will use Fibonacci numbers. She thinks it can go—it’s almost embarrassing to say. She thinks it goes to $177. It would be by far the world’s largest company unless Apple could keep lockstep with it. I don’t even have the ability to show you where it is,” Cramer said.

Cramer also shared his take on this analysis:

“The charts interpreted by Jessica look pretty darn good for the S&P, NASDAQ, and NVIDIA. We have a bull market, but if it’s going to keep running, we need to see meaningful participation. That’s why she thinks NVIDIA is the most important in the market. If it can make a higher high, she thinks that’s the whole ballgame. As for me, I never bet against the fabulous Jensen Huang.”

Nvidia’s declines after the Q2 results were more or less expected amid Blackwell delay reports confirmed by management. However, the delays were mainly due to a change in Blackwell GPU mask. That does not affect the main functional logic or design of the chip, according to analysts. While Blackwell has been delayed for a few months, it does not change the core growth thesis for Nvidia.

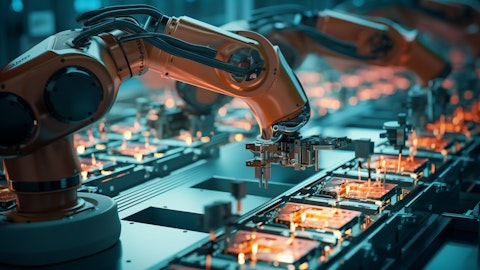

Nvidia is set to see huge growth on the back of the data center boom amid the AI wave.

At Nvidia’s GPU Technology Conference in March 2024, CEO Jensen Huang estimated annual spending on data center infrastructure at about $250 billion. Over the next decade, this could total between $1 trillion and $2 trillion, depending on how long this level of investment continues. During the same Q&A session, Bank of America’s Vivek Arya echoed this estimate, suggesting the total addressable market would fall in the $1-2 trillion range, particularly as countries invest in their own AI infrastructure. By the end of the decade, spending could be at the high end of that range.

Of course, Nvidia won’t dominate the entire $2 trillion opportunity, as it faces competition from companies like AMD and internally developed AI accelerators from Google, Amazon, and even Apple. Some analysts believe Nvidia’s data center market share between 2025 to 2029 will be over $950 billion—less than half of the total market—but still enough to make it the leader in the sector.

Baron Opportunity Fund stated the following regarding NVIDIA Corporation (NASDAQ:NVDA) in its Q3 2024 investor letter:

“Given the stellar returns of their stocks over the last couple of years, particularly NVIDIA Corporation, and the weights they grew to in the portfolio, we trimmed NVIDIA and Microsoft Corporation during the period. As we articulated above, our views regarding AI and the leadership of these two companies have not changed. On an absolute basis, NVIDIA and Microsoft remain the top two positions in the portfolio – as of this writing NVIDIA is our largest position and Microsoft is second – and both remain material overweights versus the Benchmark.”