The financial regulations require hedge funds and wealthy investors that exceeded the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on September 30th. We at Insider Monkey have made an extensive database of nearly 750 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded James Hardie Industries plc (NYSE:JHX) based on those filings.

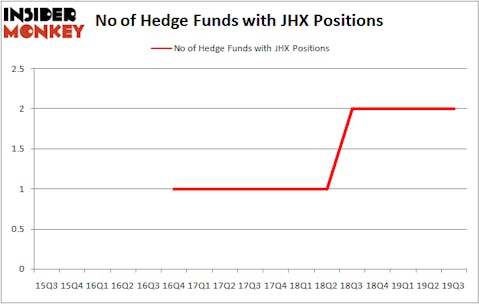

James Hardie Industries plc (NYSE:JHX) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 2 hedge funds’ portfolios at the end of the third quarter of 2019. At the end of this article we will also compare JHX to other stocks including BRF SA (NYSE:BRFS), Bio-Techne Corporation (NASDAQ:TECH), and Peloton Interactive, Inc. (NASDAQ:PTON) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most traders, hedge funds are perceived as slow, old investment tools of years past. While there are greater than 8000 funds trading at present, Our experts look at the top tier of this group, about 750 funds. These hedge fund managers control the majority of the hedge fund industry’s total asset base, and by tracking their inimitable investments, Insider Monkey has formulated several investment strategies that have historically beaten the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

David E. Shaw of D.E. Shaw

We’re going to take a glance at the latest hedge fund action regarding James Hardie Industries plc (NYSE:JHX).

How have hedgies been trading James Hardie Industries plc (NYSE:JHX)?

Heading into the fourth quarter of 2019, a total of 2 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the previous quarter. On the other hand, there were a total of 2 hedge funds with a bullish position in JHX a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in James Hardie Industries plc (NYSE:JHX) was held by Renaissance Technologies, which reported holding $5.9 million worth of stock at the end of September. It was followed by D E Shaw with a $1 million position.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s now review hedge fund activity in other stocks similar to James Hardie Industries plc (NYSE:JHX). We will take a look at BRF SA (NYSE:BRFS), Bio-Techne Corporation (NASDAQ:TECH), Peloton Interactive, Inc. (NASDAQ:PTON), and BeiGene, Ltd. (NASDAQ:BGNE). All of these stocks’ market caps are similar to JHX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BRFS | 14 | 116226 | 1 |

| TECH | 19 | 317814 | -5 |

| PTON | 27 | 450294 | 27 |

| BGNE | 9 | 2186184 | -3 |

| Average | 17.25 | 767630 | 5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $768 million. That figure was $7 million in JHX’s case. Peloton Interactive, Inc. (NASDAQ:PTON) is the most popular stock in this table. On the other hand BeiGene, Ltd. (NASDAQ:BGNE) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks James Hardie Industries plc (NYSE:JHX) is even less popular than BGNE. Hedge funds clearly dropped the ball on JHX as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. A small number of hedge funds were also right about betting on JHX as the stock returned 18.4% during the fourth quarter (through 11/22) and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.