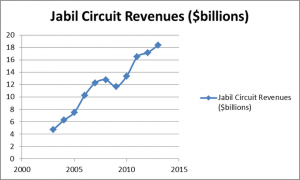

Jabil Circuit, Inc. (NYSE:JBL) is a leading provider of electronic manufacturing services around the world. With a plethora of A-list customers (more on that later), the company has done an outstanding job of increasing its revenues. However, shares have not quite kept pace with this. In fact, at around $18.50, shares are actually lower than they were 10 years ago. With the stock trading at the low end of its historical P/E range, is there more growth to be had, or should investors look elsewhere for lucrative tech investments?

Jabil Circuit has a lot of customers, however their five largest customers account for 47% of the company’s sales, so they are definitely worth talking about since the success of the company somewhat depends on its customers’ success.

The company’s largest customer is none other than BlackBerry, formerly Research In Motion, which accounts for 15% of the company’s sales. As BlackBerry is currently deploying a full-scale effort to revamp its brand, this situation is certainly worth keeping an eye on. If the upcoming sales numbers from the BlackBerry 10 are surprisingly positive, sure BlackBerry’s stock will skyrocket, however Jabil Circuit could be a sneaky way to play a BlackBerry turnaround.

As far as BlackBerry itself, I think the company will survive and that shares are undervalued right now at around $13. The company’s net assets are in the $6-7 range, meaning that if they called it quits right now and sold what they owned, the shareholders would theoretically get $6, meaning the market is valuing their business alone at under $7 per share, which is ludicrous! Having said that, BlackBerry’s turnaround is far from certain and this stock is a gamble. Hey, more risk means more potential reward, right?

Anyways, Jabil Circuit’s next largest customer is Cisco Systems, Inc. (NASDAQ:CSCO), which accounts for 13% of sales. Cisco is one of the big boys of tech and is completely dominant in their field, as I wrote about in detail in a recent post HERE. Cisco is on a short list of what I would call “5-star” stocks and is a rock solid company with plenty of growth ahead. In terms of Jabil Circuit, it simply adds a layer of safety when considering that a good chunk of the company’s earnings are linked to BlackBerry and other volatile companies.

The third largest is everyone’s favorite, Apple Inc. (NASDAQ:AAPL), which accounts for almost $2 billion of Jabil Circuit’s annual sales, or about 12%. Jabil Circuit manufactures casings and accessories for Apple, and iPhone 5 sales data that has been mediocre could be a large part of the reason Jabil hasn’t followed the market’s recent climb. However, according to UBS, the company saw lower margins in the early part of the iPhone 4 product cycle, particularly the first two quarters. If iPhone 5’s (or any Apple products) outpace expectations, Jabil will definitely be a beneficiary.

Apple is an irrational stock at the current time, to say the least. Apple trades at ridiculously low valuations, and even if it were trading at the peer average P/E ratio of 15 (and Apple has a growth rate above the peer average), the shares would be worth $662.25, and that’s not including all of the cash Apple is sitting on. That’s how the market goes, I suppose. If the behavior of every stock “made sense,” we’d all be rich!

Anyways, Jabil is a nice way to get exposure to potential growth stories like BlackBerry, which maintaining stability with a list of rock-solid customers such as Cisco, Apple, General Electric, IBM, and more. In the near term, I would expect the success (or failure) of the BlackBerry 10 to have a profound effect on the share price, but over the long run, the trend is still up as more and more electronic devices are produced.

The article A Less Obvious Play on the Big Boys Of Tech originally appeared on Fool.com and is written by Matthew Frankel.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.