Last June, the CEO of JPMorgan Chase & Co. (NYSE:JPM) faced a Congressional hearing on losses caused by the hedging strategy led by Morgan’s “London Whale,” which has now resulted in losses of over $6 billion. What might have been an enlightening conversation on the role that hedge funds play in our economy and the relationship between the government and too-big-to-fail banks, turned into a disgusting spectacle of congressmen fawning over one of their biggest campaign contributors. Rather than being grilled on his bank’s failings, the bank CEO was given a forum to air his disagreements with elements of the Volker rule. As irritating as this episode was, from the standpoint of taxpayers and voters, what does it say about J.P. Morgan as an investment?

On the positive side, from an investor’s point-of-view, the Congressional hearing demonstrated again that, as Senator Richard Durbin put it, “Frankly, the banks own Congress.” As Senator Robert Menendez pointed out at the hearing, the moat around Dimon’s “fortress balance sheet” was dug by taxpayers. Uncle Sam supplies a put that limits downsize risk.

On the negative side, the whole London Whale experience showed that J.P. Morgan has not learned the lessons of 2008. Managers are still incentivized to take ridiculous risks in illiquid derivative plays that they do not fully understand. The London Whale was trapped, like a real whale in a shallow estuary when the tide runs out, because the market was not deep enough to let him exit his position. Recently, Morgan trotted out yet another formula, the third this year, to evaluate its derivatives risk. In response, J.P. Morgan’s retired former head of risk methodology Steve Allen had this to say, “It’s another example of the fact that banks are very opaque, they’ve always been opaque, they continue to be opaque, and running around spending a lot of time analyzing changes in the little bit of data that they give out is not really contributing very much to the knowledge base of the world.”

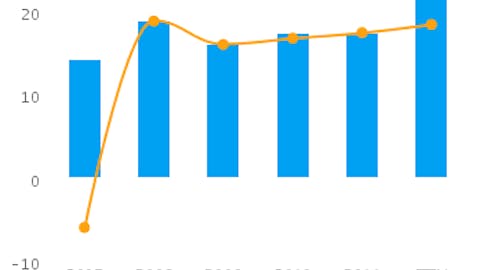

In the third quarter of this year, the U.S. banks generally did well with J.P. Morgan, Wells Fargo & Company (NYSE:WFC), and Citigroup Inc. (NYSE:C) all reporting strong earnings recently. The banks have been benefitting from the Fed’s efforts to keep interest rates down and the resulting recovery in the housing market. J.P. Morgan’s third quarter earnings were $1.40 per share last quarter versus $1.02 of the year earlier quarter. Despite the good news, the bank’s shares fell slightly on the announcement because the company’s net interest margin on loans shrank somewhat. On the other hand, the company had higher profits than normal from mortgage origination.

While admitting that the results for the latest quarter was better than they had anticipated, Standard and Poor’s Ratings Services added that, “Our rating outlook on JPM remains negative as we continue to assess possible further fallout from JPM’s risk management missteps. “ The real danger for Morgan is not small deviations in interest rate margins but from proprietary trading losses. Another potential hit to earnings is a recently announced lawsuit from the New York state attorney general relating to the company’s takeover of Bear Stearns.

Although I would never short J.P. Morgan, because you never know when they are going to book outsized trading profits, I would not buy its shares because of the trading risk.

If you really must buy shares in a huge bank, it is best to stick to the American variety, as European banks are mostly on life-support, Chinese banks carry opacity to a whole new inscrutable level, and Japanese banks have been dead money for decades. There is as yet no canonical list of too-big-to-fail banks, but if there were, J.P Morgan, Citigroup, Wells Fargo, Bank of America Corp (NYSE:BAC), and Goldman Sachs would certainly be on the list. With the exception of Goldman, these banks are, not surprisingly, among the top ten companies held by hedge funds.

Like J.P. Morgan, Goldman (aka the vampire squid) is addicted to trading, so large unexpected losses are always a risk. Plus the company is developing an unhealthy reputation for trading against its own clients. Bank of America, after Wells Fargo, is the largest real estate lender in the U.S., but has been plagued by litigation resulting from its ill-fated acquisition of Merrill Lynch as well as the robo-signing controversy. Citigroup makes unconscionable amounts of money charging usurious rates of interest to credit card holders. This eventually will be its Achilles heel as the middle class is crushed under a dual load of credit card debt and non-dischargeable student loans (the next credit crisis). The cleanest dirty shirt is probably Wells Fargo, which stands to benefit from the real estate recovery that finally seems to be taking hold. I will be examining all of these banks in separate articles to come.

Disclosure: This article is written by Steven Edwards.