You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

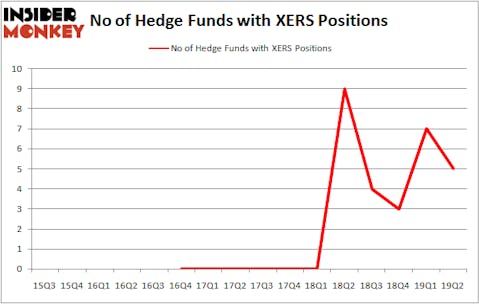

Is Xeris Pharmaceuticals, Inc. (NASDAQ:XERS) a buy, sell, or hold? The best stock pickers are in a pessimistic mood. The number of bullish hedge fund positions dropped by 2 recently. Our calculations also showed that XERS isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most stock holders, hedge funds are assumed to be slow, outdated investment tools of the past. While there are greater than 8000 funds in operation at the moment, Our experts hone in on the upper echelon of this club, approximately 750 funds. Most estimates calculate that this group of people have their hands on the lion’s share of the smart money’s total capital, and by following their first-class stock picks, Insider Monkey has unearthed a few investment strategies that have historically exceeded the S&P 500 index. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by around 5 percentage points per annum since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

In addition to following the biggest hedge funds for investment ideas, we also share stock pitches from conferences, investor letters and other sources like this one where the fund manager is talking about two under the radar 1000% return potential stocks: first one in internet infrastructure and the second in the heart of advertising market. We use hedge fund buy/sell signals to determine whether to conduct in-depth analysis of these stock ideas which take days. Let’s take a look at the new hedge fund action encompassing Xeris Pharmaceuticals, Inc. (NASDAQ:XERS).

How have hedgies been trading Xeris Pharmaceuticals, Inc. (NASDAQ:XERS)?

At the end of the second quarter, a total of 5 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -29% from the first quarter of 2019. On the other hand, there were a total of 9 hedge funds with a bullish position in XERS a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Jeremy Green’s Redmile Group has the number one position in Xeris Pharmaceuticals, Inc. (NASDAQ:XERS), worth close to $34.3 million, corresponding to 1% of its total 13F portfolio. On Redmile Group’s heels is Deerfield Management, led by James E. Flynn, holding a $27.2 million position; 1% of its 13F portfolio is allocated to the company. Other peers with similar optimism include Louis Bacon’s Moore Global Investments, Renaissance Technologies and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Due to the fact that Xeris Pharmaceuticals, Inc. (NASDAQ:XERS) has faced falling interest from the smart money, logic holds that there was a specific group of hedgies that decided to sell off their full holdings last quarter. Interestingly, Israel Englander’s Millennium Management dumped the biggest position of all the hedgies monitored by Insider Monkey, worth an estimated $1.2 million in stock, and Matthew Halbower’s Pentwater Capital Management was right behind this move, as the fund dropped about $0.4 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest fell by 2 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to Xeris Pharmaceuticals, Inc. (NASDAQ:XERS). We will take a look at Source Capital, Inc. (NYSE:SOR), Cumulus Media Inc (NASDAQ:CMLS), Legacy Housing Corporation (NASDAQ:LEGH), and Regional Management Corp (NYSE:RM). This group of stocks’ market valuations match XERS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SOR | 2 | 7237 | 0 |

| CMLS | 9 | 117968 | -4 |

| LEGH | 3 | 675 | -4 |

| RM | 11 | 68103 | -2 |

| Average | 6.25 | 48496 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.25 hedge funds with bullish positions and the average amount invested in these stocks was $48 million. That figure was $63 million in XERS’s case. Regional Management Corp (NYSE:RM) is the most popular stock in this table. On the other hand Source Capital, Inc. (NYSE:SOR) is the least popular one with only 2 bullish hedge fund positions. Xeris Pharmaceuticals, Inc. (NASDAQ:XERS) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately XERS wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); XERS investors were disappointed as the stock returned -14.1% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.