The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Wynn Resorts, Limited (NASDAQ:WYNN).

One of the 10 Most Profitable Hotels in The World, Wynn Resorts, Limited (NASDAQ:WYNN) was owned by 43 hedge funds at the end of the third quarter, a slight decline from a quarter earlier. Wynn was not close to making the list of 30 Most Popular Stocks Among Hedge Funds, but has proven to be a lot more popular among billionaire money managers in particular, ranking in the top 10 of the 20 Dividend Stocks That Billionaires Are Piling On. Wynn has made a big bet on its dividend this year, raising it by 50%.

In the eyes of most stock holders, hedge funds are seen as slow, old investment vehicles of years past. While there are greater than 8,000 funds with their doors open at present, our researchers choose to focus on the elite of this group, about 700 funds. These hedge fund managers have their hands on most of the hedge fund industry’s total asset base, and by tracking their best picks, Insider Monkey has discovered many investment strategies that have historically exceeded Mr. Market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 26.1% since February 2017 even though the market was up nearly 19% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

What have hedge funds been doing with Wynn Resorts, Limited (NASDAQ:WYNN)?

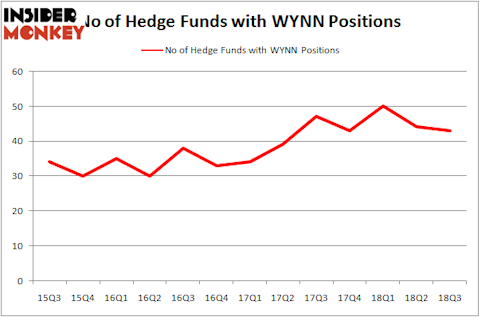

At Q3’s end, a total of 43 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 2% dip from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in WYNN over the last 13 quarters. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

Among these funds, Lone Pine Capital held the most valuable stake in Wynn Resorts, Limited (NASDAQ:WYNN), which was worth $756.7 million at the end of the third quarter. On the second spot was Egerton Capital Limited which amassed $377.2 million worth of shares. Moreover, Melvin Capital Management and Viking Global were also bullish on Wynn Resorts, Limited (NASDAQ:WYNN), allocating a large percentage of their portfolios to this stock.

Due to the fact that Wynn Resorts, Limited (NASDAQ:WYNN) has faced bearish sentiment from the entirety of the hedge funds we track, we can see that there exists a select few fund managers that elected to cut their entire stakes in the third quarter. Interestingly, Dan Loeb’s Third Point dumped the largest stake of all the hedgies followed by Insider Monkey, worth an estimated $255.2 million in stock. Christopher Lord’s fund, Criterion Capital, also dropped its stock, about $55.9 million worth. These moves are important to note, as aggregate hedge fund interest was cut by 1 funds in the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Wynn Resorts, Limited (NASDAQ:WYNN) but similarly valued. These stocks are Fortis Inc. (NYSE:FTS), Teck Resources Ltd (NYSE:TECK), Seagate Technology PLC (NASDAQ:STX), and WRKCo Inc. (NYSE:WRK). This group of stocks’ market caps are closest to WYNN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FTS | 14 | 230527 | 0 |

| TECK | 35 | 1102798 | 2 |

| STX | 27 | 1761695 | -2 |

| WRK | 33 | 618833 | 10 |

As you can see these stocks had an average of 27 hedge funds with bullish positions and the average amount invested in these stocks was $928 million. That figure was $2.48 billion in WYNN’s case. Teck Resources Ltd (NYSE:TECK) is the most popular stock in this table. On the other hand Fortis Inc. (NYSE:FTS) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Wynn Resorts, Limited (NASDAQ:WYNN) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.