The 700+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the first quarter, which unveil their equity positions as of March 31. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Wynn Resorts, Limited (NASDAQ:WYNN).

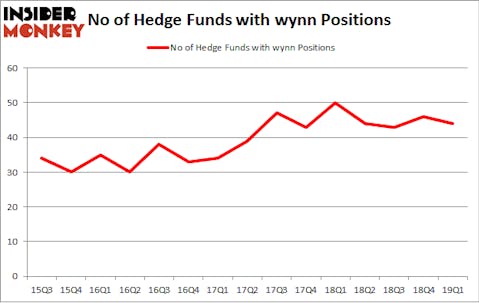

Wynn Resorts, Limited (NASDAQ:WYNN) shareholders have witnessed a decrease in activity from the world’s largest hedge funds of late. WYNN was in 44 hedge funds’ portfolios at the end of March. There were 46 hedge funds in our database with WYNN positions at the end of the previous quarter. Our calculations also showed that wynn isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s analyze the latest hedge fund action encompassing Wynn Resorts, Limited (NASDAQ:WYNN).

How have hedgies been trading Wynn Resorts, Limited (NASDAQ:WYNN)?

At Q1’s end, a total of 44 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -4% from one quarter earlier. By comparison, 50 hedge funds held shares or bullish call options in WYNN a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Lone Pine Capital was the largest shareholder of Wynn Resorts, Limited (NASDAQ:WYNN), with a stake worth $710.6 million reported as of the end of March. Trailing Lone Pine Capital was OZ Management, which amassed a stake valued at $277.8 million. Egerton Capital Limited, OZ Management, and D1 Capital Partners were also very fond of the stock, giving the stock large weights in their portfolios.

Since Wynn Resorts, Limited (NASDAQ:WYNN) has experienced bearish sentiment from hedge fund managers, it’s safe to say that there were a few fund managers that elected to cut their full holdings by the end of the third quarter. It’s worth mentioning that Alexander Mitchell’s Scopus Asset Management said goodbye to the biggest position of the 700 funds monitored by Insider Monkey, valued at about $29.7 million in stock, and Eduardo Costa’s Calixto Global Investors was right behind this move, as the fund dumped about $21.5 million worth. These bearish behaviors are interesting, as total hedge fund interest fell by 2 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Wynn Resorts, Limited (NASDAQ:WYNN). These stocks are Tiffany & Co. (NYSE:TIF), UDR, Inc. (NYSE:UDR), Invitation Homes Inc. (NYSE:INVH), and Centrais Elétricas Brasileiras S.A. – Eletrobras (NYSE:EBR). All of these stocks’ market caps are similar to WYNN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TIF | 30 | 1663436 | 0 |

| UDR | 18 | 682485 | -2 |

| INVH | 24 | 425523 | 8 |

| EBR | 8 | 22778 | 3 |

| Average | 20 | 698556 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $699 million. That figure was $2205 million in WYNN’s case. Tiffany & Co. (NYSE:TIF) is the most popular stock in this table. On the other hand Centrais Elétricas Brasileiras S.A. – Eletrobras (NYSE:EBR) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Wynn Resorts, Limited (NASDAQ:WYNN) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately WYNN wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on WYNN were disappointed as the stock returned -5.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.