Looking for high-potential stocks? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 7.6% in the 12 months ending November 21, with more than 51% of the stocks in the index failing to beat the benchmark. Therefore, the odds that one will pin down a winner by randomly picking a stock are less than the odds in a fair coin-tossing game. Conversely, best performing hedge funds’ 30 preferred mid-cap stocks generated a return of 18% during the same 12-month period. Coincidence? It might happen to be so, but it is unlikely. Our research covering a 17-year period indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like WPX Energy Inc (NYSE:WPX).

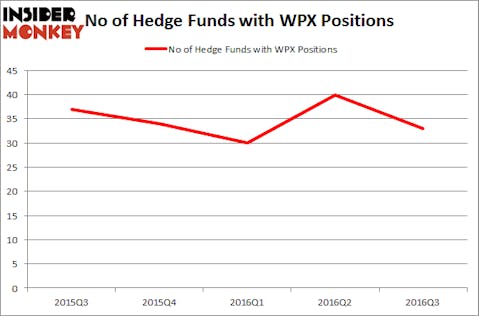

WPX Energy Inc (NYSE:WPX) investors should pay attention to a decrease in activity from the world’s largest hedge funds of late. WPX was in 33 hedge funds’ portfolios at the end of September. There were 40 hedge funds in our database with WPX holdings at the end of the previous quarter. At the end of this article we will also compare WPX to other stocks including Associated Banc Corp (NYSE:ASB), EnerSys (NYSE:ENS), and Masimo Corporation (NASDAQ:MASI) to get a better sense of its popularity.

Follow Wpx Energy Inc. (NYSE:WPX)

Follow Wpx Energy Inc. (NYSE:WPX)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

PLRANG ART/Shutterstock.com

Keeping this in mind, we’re going to take a peek at the new action encompassing WPX Energy Inc (NYSE:WPX).

How are hedge funds trading WPX Energy Inc (NYSE:WPX)?

At the end of the third quarter, a total of 33 of the hedge funds tracked by Insider Monkey were bullish on this stock, down 18% from the previous quarter. With hedge funds’ capital changing hands, there exists a few noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Clint Carlson’s Carlson Capital has the biggest position in WPX Energy Inc (NYSE:WPX), worth close to $84.9 million and amounting to 1.1% of its total 13F portfolio. The second most bullish fund manager is Millennium Management, managed by Israel Englander, which holds a $73.6 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other professional money managers with similar optimism consist of Rob Citrone’s Discovery Capital Management, Ken Griffin’s Citadel Investment Group and Mark McGoldrick and Jason Maynard’s Mount Kellett Capital Management.

Since WPX Energy Inc (NYSE:WPX) has experienced declining sentiment from the aggregate hedge fund industry, it’s safe to say that there is a sect of funds who sold off their entire stakes last quarter. Interestingly, Marc Lisker, Glenn Fuhrman and John Phelan’s MSDC Management dropped the largest stake of the “upper crust” of funds monitored by Insider Monkey, worth about $20.5 million in stock. Stuart J. Zimmer’s fund, Zimmer Partners, also dropped its stock, about $18.6 million worth of WPX shares. These moves are interesting, as total hedge fund interest was cut by 7 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to WPX Energy Inc (NYSE:WPX). We will take a look at Associated Banc Corp (NYSE:ASB), EnerSys (NYSE:ENS), Masimo Corporation (NASDAQ:MASI), and Janus Capital Group Inc (NYSE:JNS). This group of stocks’ market values are similar to WPX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ASB | 12 | 122108 | 1 |

| ENS | 21 | 58250 | -1 |

| MASI | 26 | 163915 | 0 |

| JNS | 20 | 306404 | 5 |

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $163 million. That figure was a whooping $676 million in WPX’s case. Masimo Corporation (NASDAQ:MASI) is the most popular stock in this table. On the other hand Associated Banc Corp (NYSE:ASB) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks WPX Energy Inc (NYSE:WPX) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: none.