Is Worthington Industries, Inc. (NYSE:WOR) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

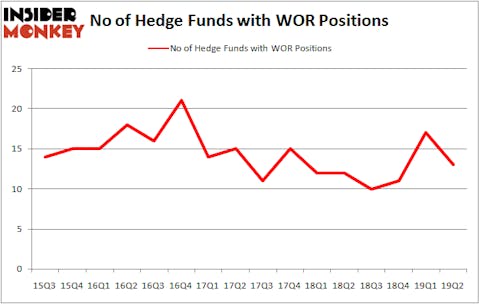

Is Worthington Industries, Inc. (NYSE:WOR) a bargain? Money managers are in a bearish mood. The number of long hedge fund bets fell by 4 in recent months. Our calculations also showed that WOR isn’t among the 30 most popular stocks among hedge funds (see the video below). WOR was in 13 hedge funds’ portfolios at the end of the second quarter of 2019. There were 17 hedge funds in our database with WOR holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to analyze the new hedge fund action encompassing Worthington Industries, Inc. (NYSE:WOR).

What does smart money think about Worthington Industries, Inc. (NYSE:WOR)?

At Q2’s end, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -24% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in WOR over the last 16 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Royce & Associates, managed by Chuck Royce, holds the largest position in Worthington Industries, Inc. (NYSE:WOR). Royce & Associates has a $19.3 million position in the stock, comprising 0.2% of its 13F portfolio. On Royce & Associates’s heels is Winton Capital Management, managed by David Harding, which holds a $16.1 million position; 0.3% of its 13F portfolio is allocated to the stock. Remaining professional money managers that hold long positions contain Ken Fisher’s Fisher Asset Management, Noam Gottesman’s GLG Partners and Cliff Asness’s AQR Capital Management.

Due to the fact that Worthington Industries, Inc. (NYSE:WOR) has experienced a decline in interest from hedge fund managers, it’s easy to see that there were a few hedge funds who were dropping their entire stakes heading into Q3. Intriguingly, D. E. Shaw’s D E Shaw said goodbye to the largest stake of the 750 funds watched by Insider Monkey, totaling an estimated $1.5 million in stock. Israel Englander’s fund, Millennium Management, also sold off its stock, about $0.9 million worth. These moves are interesting, as total hedge fund interest was cut by 4 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Worthington Industries, Inc. (NYSE:WOR) but similarly valued. We will take a look at Taylor Morrison Home Corp (NYSE:TMHC), Alliance Resource Partners, L.P. (NASDAQ:ARLP), Fanhua Inc. (NASDAQ:FANH), and Urban Outfitters, Inc. (NASDAQ:URBN). This group of stocks’ market values are similar to WOR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TMHC | 19 | 259749 | 7 |

| ARLP | 9 | 102943 | 1 |

| FANH | 9 | 28504 | -1 |

| URBN | 21 | 206534 | -4 |

| Average | 14.5 | 149433 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.5 hedge funds with bullish positions and the average amount invested in these stocks was $149 million. That figure was $62 million in WOR’s case. Urban Outfitters, Inc. (NASDAQ:URBN) is the most popular stock in this table. On the other hand Alliance Resource Partners, L.P. (NASDAQ:ARLP) is the least popular one with only 9 bullish hedge fund positions. Worthington Industries, Inc. (NYSE:WOR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately WOR wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); WOR investors were disappointed as the stock returned -9.9% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.