We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article, we look at what those funds think of Wolverine World Wide, Inc. (NYSE:WWW) based on that data.

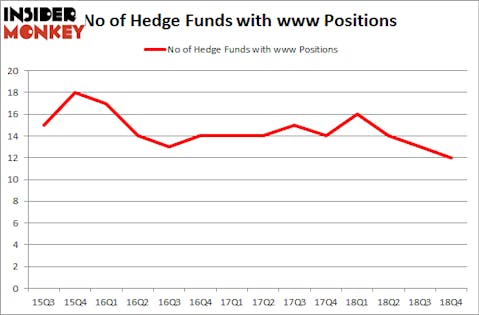

Wolverine World Wide, Inc. (NYSE:WWW) has seen a decrease in support from the world’s most elite money managers recently. WWW was in 12 hedge funds’ portfolios at the end of December. There were 13 hedge funds in our database with WWW positions at the end of the previous quarter. Our calculations also showed that www isn’t among the 30 most popular stocks among hedge funds.

At the moment there are a large number of signals stock market investors use to value their holdings. A pair of the most useful signals are hedge fund and insider trading moves. We have shown that, historically, those who follow the best picks of the top fund managers can outpace their index-focused peers by a healthy amount (see the details here).

Let’s take a look at the fresh hedge fund action surrounding Wolverine World Wide, Inc. (NYSE:WWW).

Hedge fund activity in Wolverine World Wide, Inc. (NYSE:WWW)

At Q4’s end, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -8% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in WWW over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Wolverine World Wide, Inc. (NYSE:WWW) was held by Royce & Associates, which reported holding $42.8 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $23 million position. Other investors bullish on the company included Two Sigma Advisors, GAMCO Investors, and GLG Partners.

Seeing as Wolverine World Wide, Inc. (NYSE:WWW) has faced a decline in interest from hedge fund managers, it’s safe to say that there is a sect of hedgies who sold off their full holdings heading into Q3. At the top of the heap, Paul Marshall and Ian Wace’s Marshall Wace LLP dumped the largest position of all the hedgies tracked by Insider Monkey, valued at about $17.7 million in stock. Joel Greenblatt’s fund, Gotham Asset Management, also sold off its stock, about $0.3 million worth. These moves are interesting, as total hedge fund interest was cut by 1 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to Wolverine World Wide, Inc. (NYSE:WWW). These stocks are Regal Beloit Corporation (NYSE:RBC), Companhia Siderurgica Nacional (NYSE:SID), Emergent Biosolutions Inc (NYSE:EBS), and Semtech Corporation (NASDAQ:SMTC). This group of stocks’ market values match WWW’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RBC | 17 | 85718 | 0 |

| SID | 7 | 4228 | 0 |

| EBS | 16 | 197098 | 0 |

| SMTC | 19 | 117355 | 6 |

| Average | 14.75 | 101100 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $101 million. That figure was $85 million in WWW’s case. Semtech Corporation (NASDAQ:SMTC) is the most popular stock in this table. On the other hand Companhia Siderurgica Nacional (NYSE:SID) is the least popular one with only 7 bullish hedge fund positions. Wolverine World Wide, Inc. (NYSE:WWW) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately WWW wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); WWW investors were disappointed as the stock returned 11.9% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.