Is White Mountains Insurance Group Ltd (NYSE:WTM) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

White Mountains Insurance Group Ltd (NYSE:WTM) has experienced an increase in hedge fund interest in recent months. Our calculations also showed that wtm isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a peek at the recent hedge fund action surrounding White Mountains Insurance Group Ltd (NYSE:WTM).

What have hedge funds been doing with White Mountains Insurance Group Ltd (NYSE:WTM)?

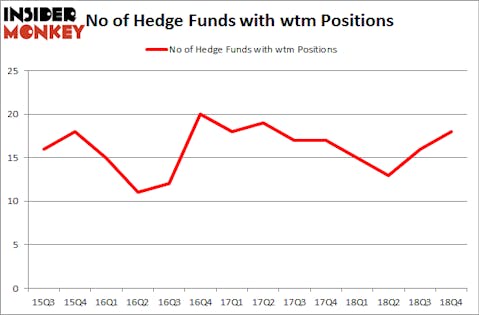

At Q4’s end, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 13% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in WTM over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Wallace Capital Management held the most valuable stake in White Mountains Insurance Group Ltd (NYSE:WTM), which was worth $71.2 million at the end of the third quarter. On the second spot was Elkhorn Partners which amassed $23.2 million worth of shares. Moreover, Impax Asset Management, Renaissance Technologies, and GLG Partners were also bullish on White Mountains Insurance Group Ltd (NYSE:WTM), allocating a large percentage of their portfolios to this stock.

Now, specific money managers have jumped into White Mountains Insurance Group Ltd (NYSE:WTM) headfirst. AQR Capital Management, managed by Cliff Asness, assembled the biggest position in White Mountains Insurance Group Ltd (NYSE:WTM). AQR Capital Management had $1.3 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also made a $0.9 million investment in the stock during the quarter. The other funds with new positions in the stock are Paul Tudor Jones’s Tudor Investment Corp, Ken Griffin’s Citadel Investment Group, and Hoon Kim’s Quantinno Capital.

Let’s check out hedge fund activity in other stocks similar to White Mountains Insurance Group Ltd (NYSE:WTM). These stocks are Fulton Financial Corp (NASDAQ:FULT), Cathay General Bancorp (NASDAQ:CATY), Immunomedics, Inc. (NASDAQ:IMMU), and J&J Snack Foods Corp. (NASDAQ:JJSF). This group of stocks’ market caps match WTM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FULT | 12 | 12203 | 0 |

| CATY | 14 | 47562 | 1 |

| IMMU | 28 | 680283 | -2 |

| JJSF | 10 | 81856 | 0 |

| Average | 16 | 205476 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $205 million. That figure was $151 million in WTM’s case. Immunomedics, Inc. (NASDAQ:IMMU) is the most popular stock in this table. On the other hand J&J Snack Foods Corp. (NASDAQ:JJSF) is the least popular one with only 10 bullish hedge fund positions. White Mountains Insurance Group Ltd (NYSE:WTM) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately WTM wasn’t nearly as popular as these 15 stock and hedge funds that were betting on WTM were disappointed as the stock returned 6.3% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.