World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

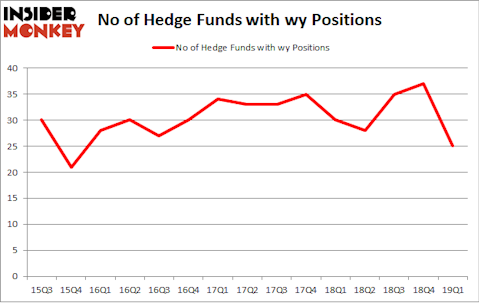

Weyerhaeuser Co. (NYSE:WY) investors should be aware of a decrease in hedge fund sentiment in recent months. Our calculations also showed that wy isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a look at the latest hedge fund action surrounding Weyerhaeuser Co. (NYSE:WY).

What have hedge funds been doing with Weyerhaeuser Co. (NYSE:WY)?

Heading into the second quarter of 2019, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -32% from the previous quarter. By comparison, 30 hedge funds held shares or bullish call options in WY a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Weyerhaeuser Co. (NYSE:WY) was held by Third Avenue Management, which reported holding $110.1 million worth of stock at the end of March. It was followed by D E Shaw with a $55.1 million position. Other investors bullish on the company included Point72 Asset Management, Two Sigma Advisors, and Adage Capital Management.

Due to the fact that Weyerhaeuser Co. (NYSE:WY) has experienced bearish sentiment from hedge fund managers, it’s safe to say that there was a specific group of funds that elected to cut their full holdings heading into Q3. At the top of the heap, Israel Englander’s Millennium Management cut the largest position of all the hedgies followed by Insider Monkey, totaling about $40.2 million in stock. Peter Rathjens, Bruce Clarke and John Campbell’s fund, Arrowstreet Capital, also said goodbye to its stock, about $29.2 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 12 funds heading into Q3.

Let’s now review hedge fund activity in other stocks similar to Weyerhaeuser Co. (NYSE:WY). We will take a look at Microchip Technology Incorporated (NASDAQ:MCHP), Chipotle Mexican Grill, Inc. (NYSE:CMG), The Kroger Co. (NYSE:KR), and KKR & Co Inc. (NYSE:KKR). This group of stocks’ market valuations are similar to WY’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MCHP | 32 | 585215 | 2 |

| CMG | 35 | 3506651 | -3 |

| KR | 22 | 504839 | -11 |

| KKR | 30 | 2526675 | 1 |

| Average | 29.75 | 1780845 | -2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.75 hedge funds with bullish positions and the average amount invested in these stocks was $1781 million. That figure was $375 million in WY’s case. Chipotle Mexican Grill, Inc. (NYSE:CMG) is the most popular stock in this table. On the other hand The Kroger Co. (NYSE:KR) is the least popular one with only 22 bullish hedge fund positions. Weyerhaeuser Co. (NYSE:WY) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately WY wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); WY investors were disappointed as the stock returned -14.5% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.